Optical coatings are widely used in applications including architecture, consumer electronics, solar panels, automotive, medical, telecommunication, and military & defense.

Optical or photonic coatings are generally used to increase the reflection, transmission, or polarization properties of a component, e.g., prisms, polarizing films, color filters, mirrors, diffraction mosaics, and refractory lenses.

A glass component without optical coatings will reflect 4% of incident lights at each surface. On the contrary, a glass with an anti-reflection coating will significantly reduce reflection at each surface to less than 0.1%. A highly reflective dielectric coating can enhance reflectivity to more than 99.99%. Typically, optical coatings are composed of metals, oxides, and rare earth materials. The performance of these coatings is based on the number of layers of coating applied, and its refraction index.

Photonic crystals, also known as photonic band-gap materials, are optical nanostructures that have been developed to impact the motion of photons, similar to how a semiconductor crystal affects the motion of electrons. These crystals are important optical materials that are used to control the flow of light. Photonic crystals are widely used for the development of low and high reflection coatings for lenses and mirrors. They are also used to produce color-changing paints and inks.

Scientists from the University of California, Berkeley Lab, have developed a polymer heat-reflective photonic coating, which when applied onto windows can improve energy efficiency. This coating contains photonic crystals which can reflect light selectively at different wavelengths. The main advantage of using this coating is that it limits the use of heating systems and air-conditioners.

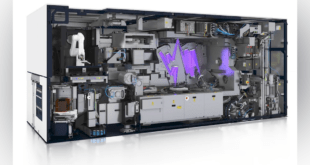

In the broadest terms, there are three basic technologies in use for producing the majority of optical thin films, namely: evaporation, sputtering and chemical vapor deposition. And, for each technology there are numerous vendor-specific variations. Each of these methods has its place, and there is no one approach that is best for every application.

Military Coating Requirements

Optics are employed in virtually every area of military operations, from vision systems and target designators used by troops on the ground, through guidance systems utilized in both manned and unmanned aircraft, to reconnaissance and surveillance packages carried by satellites in Earth orbit. These optics are often subjected to large variations in ambient temperature and humidity, as well as contact with abrasive or corrosive materials (such as sand or salt spray). Thin film coatings, which are almost universally required on military optics, must be able to physically withstand these stressors, as well as deliver their design performance in an environment where “failure is not an option.” But, increasingly, achieving these ends must also be balanced with cost.

Military applications often require high performance coatings that can withstand large environmental shifts, high laser power and exposure to contaminants. Virtually all optical components used in military applications, such as target designation, rangefinding and IR countermeasures, employ thin film coatings to somehow modify their transmission and reflection characteristics.

An optical thin film consists of one or more layers of coating material, with individual layer thicknesses typically ranging from a few nanometers to several microns. Achieving target performance requires tight control of deposition to produce the desired sequence, uniformity, material thicknesses and indices of refraction of these layers.

Higher coating density, or more precisely, lower porosity, also prevents water molecules from entering the film when it is exposed to high humidity. Moisture absorption changes layer refractive index, which shifts the coating performance curve to longer wavelengths. This so called “wet/dry shift” is generally not a problem in broadband coatings, such as antireflection (AR) and most high reflection coatings, but can have a serious impact on coatings intended for narrowband performance or those with a sharp band edge. Examples of these are bandpass filters, edge (short or long wave pass) filters and notch filters (which reflect a single laser wavelength and transmit everything else). These are all coatings widely employed in military systems, including target designators, multispectral imaging sensors, and countermeasures.

For most military applications, there are a few key parameters which are most critical to proper coating performance. The first of these is coating hardness. Hard coatings resist damage due to repeated cleaning or abrasion from particulates like sand. Here, there is a progression from evaporation, which produces the least dense and softest films, through to sputtering and LPCVD which both produce highly densified, hard coatings.

In the most general terms, coatings become more expensive to fabricate as the number of layers increases and/or the index and thickness tolerances on those layers become tighter. Obviously, the goal of the coating specifier is to ensure that the component meets its performance targets, but it’s important to make sure that specifications are framed in a way that doesn’t needlessly drive up cost.

Military coatings

Studies have shown that photonic coatings, which are capable of responding to the changes in the surrounding environment, are used profoundly as optical sensors, adaptive camouflage, and information encryption. Recently scientists have developed humidity sensing, color-changing photonic polymer coatings, based on hydrogen-bonded three-dimensional (3D) blue phase liquid crystal networks.

Additionally, the self-assembled character of 3D photonic nanostructures, along with the presence of the rigid covalent bonding between the polymers and substrate surfaces, plays an important role in exhibiting the color changes. This polymer photonic coating possesses vivid structural colors.

Researchers explained that the humidity-driven reversible color changes, across the visible spectrum of light, occur owing to the breaking of the hydrogen bonds and, subsequently, conversion into a hygroscopic polymer coating. This technology could be adapted for developing tailorable 3D photonic nanostructures, which could be used for sensing, display, anticounterfeiting, and biomimetic camouflage.

Market

The global optical coatings market size is estimated at USD 12.6 billion in 2021 and is projected to reach USD 19.0 billion by 2026, at a CAGR of 8.5%. The optical coatings market is witnessing high growth owing to the growing demand for optical coatings in industrial applications from emerging economies of APAC and Europe are the major drivers for the growth of the optical coatings market.

Optical coatings are mainly used in semiconductors, high-temperature lamp tubing, telecommunication and optics, and microelectronics industries. The optical coatings used in the electronics & semiconductor industry have to withstand the high-temperature gradients and high rates of heat transfer in rapid thermal processing, which are commonly applied to printed circuit board (PCB) coating, ICs, and wafers to modify their properties.

Optical coatings enable parts of a semiconductor to withstand extreme temperatures of wafer processing. In addition, the continuous development in the electronics & semiconductor industry has increased the use of new-generation wafers in semiconductors, which is expected to drive the demand for high purity optical coatings. Thus, it is the most preferred material to enhance the performance of products. This, in turn, would fuel the use of high purity optical coatings in the electronics & semiconductor industry.

The optical coating manufacturing process includes various raw materials, such as oxides (aluminum, zirconium, titanium, and selenium), fluorides (strontium, calcium, and magnesium), and metals (copper, gold, and silver). The raw material market for optical coatings is highly volatile, with a major impact on the price fluctuations of the metals and oxides, such as TiO2, indium, gold, copper, and silver. The availability and prices of raw materials, especially metals and oxides, fluctuate, and the rise in their prices can adversely affect the manufacturing cost. Indium is the key component used to manufacture transparent conductive coatings.

Segments

The optical coatings market is segmented on the basis of end-use industry into electronics & semiconductor, military & defense, transportation, telecom/optical communication, infrastructure, solar power, medical, and others.

The rapid growth of the solar PV market, driven by the increasing focus on clean energy generation, and rising demand for consumer electronics are also expected to fuel the market growth over the forecast period.

Electronics & semiconductor end-use industry segment holds major market share of the overall optical coating market owing to the increasing demand for highly resistant and high dielectric strength coating layers in photovoltaic (PV) cells, electronics assemblies, ICs, and other optoelectronic devices. These factors are fueling the growth of the optical coatings market in the electronics & semiconductor industry.

The demand for automotive electronics in the transportation end-use industry is increasing due to the rising income levels worldwide, increasing need for a safe and convenient drive, emergence of intelligent transport systems, and growing need to minimize environmental pollution. Optical coatings form an essential part of advanced automotive electronics systems and devices. The emergence of advanced driver assistance, along with the communication technology and entertainment system features, is also creating an opportunity for the optical coatings market.

AR Coatings is the largest type segment of the optical coatings market

The optical coatings market is segmented on the basis of type into AR coatings, high reflective coatings, transparent conductive coatings, filter coatings, beamsplitter coatings, EC coatings, and others. AR coatings type segment holds major market share of the overall optical coating market owing to its ability to provide high-quality coatings with high transmission power and low reflection power on components such as lenses, mirrors, and display screens used in various industrial and consumer applications. These factors are fueling the growth of AR coatings in the global optical coatings market.

Challenges: Maintaining the environmental durability of optical coatings

Coating characteristics and functionality requirements are defined by the optical system designers and are specified in the relevant drawing or coating specification. The coating specifications include optical mode (e.g., transmission or reflection), environmental durability requirements, laser-induced damage threshold (LIDT)/laser damage threshold (LDT), and the windscreen wiper test.

Environmental durability of the coating is defined and tested normally according to American military specifications and sometimes according to civilian standards [International Organization of Standardization (ISO) and American National Standards Institute (ANSI)]. These specifications or standards contain requirements and test conditions for the environmental durability of optical coatings. This factor poses a challenge to the manufacturers of optical coatings to adhere to environmental durability standards.

Vacuum deposition is the largest technology segment of the optical coatings market

The optical coatings market is segmented on the basis of technology into vacuum deposition, E-beam evaporation, sputtering process, and ion-assisted deposition (IAD). Vacuum Deposition holds the major market share of the overall optical coatings market owing to its ability to cure at room temperatures, improved reliability, and increased thermal and mechanical strength of electronic devices.

Geographical outlook

North America is the largest market for optical coatings during the forecast period. This growth can be attributed to the growing demand from the electronics & semiconductor industry and increasing contribution of government and major players for commercializing optical coatings in the region. Moreover, stringent environmental and government regulations, such as Architectural and Industrial Maintenance (AIM) Coatings for Volatile Organic Compounds (VOCs) content limits and the United States Munitions List (USML) that regulate optical technology along with coating exports under the International Traffic in Arms Regulations (ITAR) fuel the market growth for optical coatings in the region.

Dupont (US), PPG Industries Ohio, Inc. (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS International (Germany), Newport Corporation (US), Inrad Optics (US), Inc., Artemis Optical Limited (UK), Abrisa Technologies (US), Reynard Corporation (US), II-VI Aerospace & Defense (US) are the key players operating in the optical coatings market.

References and Resources also include:

https://www.marketsandmarkets.com/Market-Reports/optical-coating-market-128999548.html

https://www.techbriefs.com/component/content/article/tb/supplements/pit/features/applications/32876

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis