Additive manufacturing (AM), broadly known as 3D printing, is transforming how products are designed, produced, and serviced. AM enables on-demand production without dedicated equipment or tooling, unlocks digital design tools, and offers breakthrough performance and unparalleled flexibility across industries.

Metal 3D printing is considered the apex of all 3D printing. When it comes to strength and durability, there’s nothing quite like metal. Metal 3D printed parts have excellent mechanical properties and can be manufactured from a wide range of engineering materials, including metal superalloys.

Metal 3D printing is most suitable for complex, bespoke parts that are difficult or very costly to manufacture with traditional methods. Metal 3D printed parts can be topologically optimized to maximize their performance while minimizing their weight and the total number of components in an assembly. Topology optimization is essential for maximizing the added benefits of using metal printing.

The material and manufacturing costs connected with metal 3D printing is high, so these technologies are not suitable for parts that can be easily manufactured with traditional methods. The build size of the metal 3D printing systems is limited, as precise manufacturing conditions and process control are required. Already existing designs may not be suitable for metal 3D printing and may need to be altered. Minimizing the need for support structures will greatly reduce the cost of metal printing.

Metal printer types

Generally, metal 3D printers fall into one of these four categories: powder bed fusion, binder jetting, direct energy deposition, and material extrusion.

Metal Powder Bed Fusion (PBF)

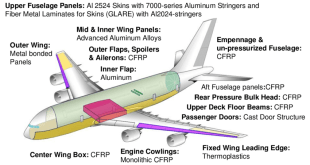

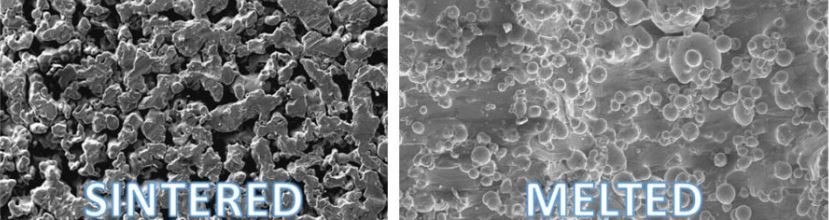

This category includes DMLS (direct metal laser sintering), SLM (selective laser melting), and EBM (electron beam melting) machines. Sintering uses a combination of heat and pressure to make particles stick together. Melting uses high enough temperatures to cause the particles to fully melt and join together. Sintered parts have high porosity and require heat treatments to be strengthened, though they’ll never be as strong as forged metal parts; melted parts are nearly fully solid and don’t require heat treatments. Another difference is that SLM works with a single metal at a time and DMLS works with metal alloys

Credit: http://www.additivalab.com/en/blog/laser-sintering-vs-laser-melting

Metal parts produced using PBF melting technology are free from residual stresses and internal imperfections, making them ideal for demanding applications found in the aerospace and automotive industries. The history and categorization of PBF metal 3D printers get a bit messy and it mostly relates to the difference between sintering and melting.

Metal PBF Pros

Nearly any geometry can be fabricated with high precision

Wide range of metals, including the lightest titanium alloys and the strongest nickel superalloys that are difficult to process with traditional manufacturing technologies

Mechanical properties are as good as (and sometimes better than) forged metals

Can be machined, coated, and treated like traditionally-fabricated metal parts

Metal PBF Cons

High cost of materials, machinery, and operation

Parts must be attached to the build plate with support structures (to prevent warping) that produce waste and require manual post-processing to remove

Limited build sizes (though they’re getting steadily larger)

Handling of metal powders can be dangerous and requires strict process controls

Metal Binder Jetting

Binder jetting, like laser sintering, can handle more than metal materials. Sand, ceramic, and full-color objects are also possible with the technology. Because metal binder jetting machines operate at room temperature, warping does not occur and supports are not necessary. As such, binder jetting machines can be much larger than powder bed fusion machines and objects can be stacked to use the entirety of the build chamber, so it’s a popular choice for small batch production runs and on-demand replacement parts.

Metal Binder Jetting Pros

Large build volume

Parts don’t need to be attached to a build plate so they can be nested to make use of all available build volume

Fewer restrictions on geometry because supports generally aren’t needed

Larger parts are possible because warping doesn’t occur

Very fast printing

Lower cost than powder bed fusion metal printing

Metal Binder Jetting Cons

Parts must go through a time-consuming debinding and furnace sintering process after printing

High cost of machines and materials

Higher porosity than powder bed fusion so mechanical properties are not as good

Small material selection

Direct Energy Deposition

DED 3D printing systems are also known as LENS (laser engineered net shaping) and DMD (direct metal deposition) machines. They can work with metal wire or metal powder and melting can be achieved with a plasma arc, laser, or electron beam. It’s very similar to welding so one of its primary applications is repairing and adding features to existing metal parts.

DED Pros

Metal wire is the most affordable form of metal 3D printing material

Some machines can work with two different metal powders to create alloys and material gradients

5- and 6-axis motion enables the production of overhangs without the use of support materials

It’s possible to repair broken metal parts and add new components to objects

Large build volume

Efficient material usage

Parts have high density and good mechanical properties

Fast printing

DED Cons

Printed parts have poor surface quality so machining and finishing is usually necessary

Small details are difficult or impossible to achieve

High cost of machinery and operation

Metal Material Extrusion

This technology was specifically created to make metal 3D printing cheaper and more accessible and it’s done just that. Small and medium businesses have rapidly adopted material extrusion with metal, largely because it’s so affordable. Design studios, machine shops, and small manufacturers use metal material extrusion machines to iterate designs, create jigs and fixtures, and complete small production runs. The latest development in this space is metal filaments that will work in most desktop FDM 3D printers, making metal 3D printing accessible to nearly everyone.

This is how material extrusion with metal works:

1) Either polymer filament or rods impregnated with small metallic particles are 3D printed layer-by-layer in the shape of your design.

2) The 3D printed part is then washed to remove some of the binder.

3) The part is then put in a sintering furnace which fuses the metallic particles into solid metal.

Metal Extrusion Pros

Most affordable method of 3D printing metals

Functional prototypes are possible

Easy and safe to operate

Metal Extrusion Cons

Parts must go through the same debinding and sintering process as binder jetting parts

More restrictions on geometry and supports are necessary to prevent warping

Parts have high porosity and don’t achieve the same mechanical properties of forged metals

Parts are not as dense as you would achieve with PBF or DED

Less accurate due to shrinkage in furnace

Other Metal Printing Types

Joule Printing

Joule Printing from Digital Alloys looks a lot like DED but the metal wire is melted by running a current through it rather than heating it with an arc or beam. This enables much faster printing as the company has demonstrated printing up to 2kg of titanium per hour.

Liquid Metal Additive Manufacturing

Vader Systems created Liquid Metal Additive Manufacturing where 1,200°C liquid metal droplets are deposited in a manner much like an inkjet printer.

Cold Spray Metal Printing

Cold Spray Metal Printing was originally used by NASA to build metal objects in space. Key feature is that it’s the fastest method of metal 3D printing in the world (think of 6kg of aluminum or copper per hour) downside is that it’s not that accurate. Australian companies Titomic and SPEE3D are frontrunners in this technology.

Belgian additive manufacturing start-up ValCUN has raised €1.5 million towards the development of a new prototype energy-saving metal 3D printer, reported in March 2021

Unlike many existing machines, which use a laser to fuse alloy powders into parts, the firm’s novel system is fitted with a unique heating input that’s capable of processing feedstocks more efficiently, and at a lower cost. Leveraging its newly-raised funding, ValCUN now aims to expedite the development of its economical technology, and market it to clients in the automotive, robotics and energy sectors.

Although ValCUN remains tight-lipped about the precise mechanics of its new process, the technology essentially revolves around a unique alternative to laser-based heat inputs. By replacing lasers with a more efficient energy source, the novel system potentially provides users with significant cost savings, while yielding environmental benefits as well.

ValCUN’s prototype heating process also eliminates any shape requirements for filler materials, meaning that it’s compatible with wire, granulate or even recycled feedstocks. Using such safe-to-handle materials could enable adopters to accelerate their product workflow, and allow the alloys from faulty parts to be re-used in future prints. Based on these efficiency benefits, the start-up believes that its system is capable of addressing the growing market for high volumes of medium-sized parts, such as manifolds and structural frames. Additionally, by making metal 3D printing more “accessible and economically competitive,” ValCUN eventually hopes to tempt manufacturers from more capital-intensive industries to invest in the technology.

Having successfully patented the technology towards the end of 2020, the company’s CEO and Co-founder Jonas Galle says that it’s now seeking to expand its operations, and take a step towards commercialization. “The COVID-19 pandemic made it challenging to raise capital,” said Galle, “but the approval for additional financing will allow us to further expand our activities.”

In particular, ValCUN believes that its technology is well-suited to producing near-net-shape objects and heat exchangers, essential elements of high-density batteries or IT data processing centers. As a result, the company is ambitiously targeting future clients like Google and Tesla, but in order to move onto this next stage of its expansion, it’s now seeking to attract engineers to its growing team

Royal Australian Navy installs metal 3D printing capability

The Fleet Support Unit (FSU) at HMAS Coonawarra Navy Port installed a large-format SPEE3D metal 3D printer, making the Royal Australian Navy the latest Australian defence service with the capability to print its own metal parts on demand. Sustainment, or the repair, maintenance and overhaul of equipment makes up a substantial proportion of the cost of all defence forces globally. The difficulty and expense of getting spare parts through regular supply chains has been exacerbated by the current pandemic.

SPEE3D’s metal printing technology was developed in Australia and is the world’s fastest and most economical metal 3D printing technology. It is also the only large format metal 3D printing technology that has been trialled and proven to be field-deployable by Australia’s defence forces. SPEE3D’s technology empowers the Navy to design and manufacture the parts they require, when and where they are needed, whether that be on base or at sea.

Many of the printing techniques that work for metals can also be applied to ceramics, with potential applications that include making dental crowns or orthopaedic implants. Moulds for these objects are already made by 3D printing, with the material cast in the conventional way. But 3D-printing the entire object could save time at the dentist or surgeon’s office.

However, it is harder to control the microstructure of 3D-printed ceramics, says Eduardo Saiz, a materials scientist and ceramicist at Imperial College London. And nearly all practical ceramic printing techniques involve extensive post-print sintering that can warp or deform the part. “In my opinion, ceramics is way behind polymers and metals in terms of practical applications,” he says.

3D Printing Metal Market

The global 3D printing metal market size was valued at USD 772.1 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 27.8% from 2020 to 2027. Increasing penetration of metal 3D printing owing to greater design flexibility, low waste, and cost effectiveness in the overall manufacturing landscape is estimated to be a key factor driving the market.

Since additive manufacturing (AM) can produce parts without the prerequisite of specific tools, the startup costs of all AM technologies are relatively lower. This makes AM an economically suitable alternative for low-run production, prototypes, and one-off custom parts. Today, a rising number of manufacturing and engineering firms are exploring the advantages offered by 3D printing technologies to design and produce unique parts. Some firms have even started serial production using AM technology.

Growing adoption of AM in the medical, automotive, and aerospace and defense sectors is projected to drive the U.S. market. For instance, in 2019, Lima Corporate, a U.S.-based company, has commercialized hip cup implants produced using additive manufacturing. The company announced that it will start an on-site AM facility at a hospital located in New York by 2020.

In the aerospace and defense segment, companies are rapidly making progress through various joint ventures and partnerships. In February 2019, Launcher, Orbex, and ArianeGroup revealed their progress on manufacturing rocket engines using AM process. In another deal, Relativity Space signed an agreement with NASA to start a robotic factory using additive manufacturing.

Early adoption of additive manufacturing technology, a growing number of startups, and an increasing number of patents are some of the key drivers of the U.S. market. U.S. is characterized by the presence of established players, such as Stratasys and 3D Systems, along with traditional manufacturing companies, such as HP and GE, who are showing keen interest in metal AM.

Powder form dominated the market in 2019 with a volume share of 92.6%. Powders used for additive manufacturing are characterized by high packing density and spherical morphology, which grant good flow properties. Carpenter Technology Corporation is a prominent supplier of powders for AM technology. In July 2018, the company signed a contract with GE Additive to supply metal powder to GE Additive, along with other materials.

Filaments are expected to register a CAGR of 25.8%, in terms of volume, from 2020 to 2027. The manufacturers have been investing in R&D to develop low-cost technologies for printing with filament as compared to selective laser melting with metal powders. This is likely to augment the segment growth over the coming years.

Titanium led the market and accounted for 65.3% share of the global revenue in 2019. The use of titanium by the aerospace industry to 3D print equipment prototypes is anticipated to be a major factor in facilitating product growth. The ability of the product to meet industry requirements in terms of weight, strength and corrosive properties is anticipated to lead to sustainable growth.

Aluminum is expected to expand at a significant CAGR of 26.0%, in terms of revenue, from 2020 to 2027. AM using aluminum often has a high success ratio compared to other conventional methods, such as casting and forging. In 3D printing, aluminum alloy-based materials are best suited for SLM (Selective Laser Melting) and DMLS (Direct Metal Laser Sintering) technologies.

Demand for nickel-based alloys is growing in additive manufacturing on account of excellent corrosion and thermal-fatigue properties possessed by these materials. Industries such as oil and gas, chemical, process equipment, marine, and aerospace are the key end users of nickel-based powders in the market. Arconic, a leading player in the additive manufacturing industry, is a supplier of products 3D printed from high-temperature nickel superalloys. In 2017, Arconic formed an agreement with Airbus to supply nickel-based parts made from AM technology for the A320 family of aircraft.

The aerospace and defense application segment accounted for the largest revenue share of 45.6% in 2019. Metal AM technology is considered to be the new industrial revolution within the global aerospace or aviation sector. Prominent aviation vendors such as Airbus and Boeing have made great progress over the recent years to successfully use 3D printed components for the purpose of prototyping and custom parts. The medical and dental application segment is projected to expand at a CAGR of 28.5%, in terms of volume, from 2020 to 2027. The ongoing COVID-19 pandemic in 2020 has underpinned the significance of additive manufacturing due to its supply chain advantages. For instance, in the first quarter of 2020, Italian metal AM industry played a crucial role in supplying components needed for medical devices.

The automotive application is witnessing a strong growth due to the capability of additive manufacturing to manufacture lighter and geometrically accurate parts. The problems of excess automotive inventory caused by uncertainties, such as COVID-19 pandemic, are likely to encourage manufacturers to adopt just-in-time manufacturing technologies, such as 3D printing, over the coming years.

Regional Insights

North America dominated the market and accounted for 34.1% share of global revenue in 2019. The State of California observed the highest demand for 3D printed metals in 2019 and accounted for a consumption share of nearly 22% in the U.S. The tech industry present in Los Angeles, Silicon Valley, and San Diego is projected to be a key driver for the market over the coming years

Asia Pacific is projected to expand at the highest CAGR of 31.6%, in terms of volume, from 2020 to 2027. Until 2016, Asia Pacific significantly lagged behind North America and Europe in terms of the adoption of additive manufacturing. However, supportive government policies and rising interest among the manufacturing companies of Asia Pacific since 2016 have helped in developing a sustainable market in the region.

Europe was the second largest regional market in 2019. Favorable government policies across Europe are expected to boost market growth over the coming years. In May 2016, Europe held a conference to adopt additive manufacturing across the region. Increased funding for the research & development and standardization of the technology is further anticipated to fuel the industry growth.

Key Companies & Market Share Insights

The global market is witnessing increased competition as more players are gaining entry into the market. The value chain of the additive manufacturing is currently characterized by a large number of 3D printer suppliers, while there is a shortage of raw material supply, such as powders.

As a result, powder manufacturers are expected to witness attractive growth opportunities as the demand is set to grow at a rapid rate at least until 2030. New product development through substantial investments in R&D is the major strategy adopted by industry players. For instance, 3D Systems introduced a new aluminum alloy material for the metal additive manufacturing of lightweight but strong parts.

Some of the prominent players in the global 3D printing metal market include: Arcam AB, ExOne GmbH, Carpenter Technology Corporation, Renishaw PLC, Materialise NV, 3D Systems Corporation, Voxeljet AG, Sandvik AB, Hoganas AB, GKN PLC

References and Resources also include:

https://3dprinting.com/metal/types-of-metal-3d-printing/

https://www.grandviewresearch.com/industry-analysis/3d-metal-printing-market

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis