Today, interconnecting electronics in increasingly complex systems is leading to complex designs, components, and systems. The advent of integrated electronics, such as a system-on-a-chip and multichip modules, has increased speed and reduced latency in electronics. The interconnections for these components have become equally diverse.

The function of a printed printed circuit board (PCB) is to mechanically support and electrically connects electrical or electronic components using conductive tracks, pads and other features etched from one or more sheet layers of copper laminated onto and/or between sheet layers of a non-conductive substrate. PCB connects a variety of active components (such as microchips and transistors) and passive components (such as capacitors and fuses) into an electronic assembly that controls a system. A typical printed circuit board consists of conductive “printed wires” attached to a rigid, insulating sheet of glass-fiber-reinforced polymer, or “board.” The insulating board is often called the substrate. An important characteristic of PrCBs is that they are usually product-unique. The form factor—meaning the size, configuration, or physical arrangement—of a PrCB can range from a system literally painted on to another component, to a structural element that supports the entire system.

Printed Circuit Boards (PCBs) are the backbone of electronic systems used in aerospace and military applications. They are the foundation on which complex electronic circuits are built. PCBs for aerospace and military applications require a higher level of quality, robustness, ruggedness, and EMI/EMC compliance than those used in commercial applications. This article will discuss the importance of these requirements and the challenges of manufacturing PCBs for aerospace and military applications.

It has been estimated that computers and electronics account for one-third of the entire defense department expenditure. With such a large budget, military equipment is held to much higher standards than consumer products. PCBs have became a fundamental tool for military operations including navigation, missiles, and surveillance along with communication equipment.

Although military PCBs are produced at lower volumes than commercial grade products, expectations for product performance is more complex. The typical expected lifetime for a commercial product is estimated to be between 2-5 years before the technology becomes obsolete. Military applications however take longer time to develop and have a much longer expected product lifetime of between 5-15 years.

PCBs are a complex and intricate part of many electronic devices. They are made up of a number of different layers of materials, including copper, fiberglass, and solder. This makes them a potential target for attackers who want to tamper with or counterfeit them.

In fact, since PCBs lie at the heart of an electronic system and integrate several components to achieve the desired functionality, it is increasingly important to guarantee a high level of trust and reliability at such an integration stage. The incident allegedly at Supermicro serves as an example.

PCB Construction

Nearly all PCBs are custom designed for their application. Whether simple single layered rigid boards, to highly complex multilayered flexible or rigid flex circuits, PCB’s are designed using special software called CAD for computer aided design. The designer uses this software to place all of the circuits and connection points, called vias, throughout the entire board. The software knows how each of the components need to interact with each other, and any specific requirements as well – such as how they need to be soldered to the PCB.

Components are generally soldered onto the PCB to both electrically connect and mechanically fasten them to it. PCBs require additional design effort to lay out the circuit, but manufacturing and assembly can be automated. Electronic computer-aided design software is available to do much of the work of layout. Mass-producing circuits with PCBs is cheaper and faster than with other wiring methods, as components are mounted and wired in one operation. Large numbers of PCBs can be fabricated at the same time, and the layout only has to be done once.

When the designer is done, the software exports two critical components, with which we will build their boards. The first is called gerber files, which are electronic artwork files that show every single circuit in the PCB, where exactly it goes, on every single layer of the board. The gerber files will also contain drill files, showing us where exactly to drill the holes to make all the via connections we discussed earlier. They will also contain soldermask and nomenclature files as well as a file that shows us exactly how to cut out the perimeter of their board.

Printed Circuit Board Fabrication

The construction and fabrication of PCBs include the following steps:

- Chemically imaging and etching the copper layers with pathways to connect electronic components

- Laminating the layers together, using an bonding material, that also acts as electrical insulation, to create the PCB

- Drilling and plating the holes in the PCB to connect all of the layers together electrically

- Imaging and plating the circuits on the outside layers of the board

- Coating both sides of the board with soldermask and printing the nomenclature markings on the PCB

- The boards are then machined to the dimensions that are in the designer’s perimeter gerber file

A basic PCB consists of a flat sheet of insulating material and a layer of copper foil, laminated to the substrate. Chemical etching divides the copper into separate conducting lines called tracks or circuit traces, pads for connections, vias to pass connections between layers of copper, and features such as solid conductive areas for electromagnetic shielding or other purposes. The tracks function as wires fixed in place, and are insulated from each other by air and the board substrate material. The surface of a PCB may have a coating that protects the copper from corrosion and reduces the chances of solder shorts between traces or undesired electrical contact with stray bare wires. For its function in helping to prevent solder shorts, the coating is called solder resist or solder mask.

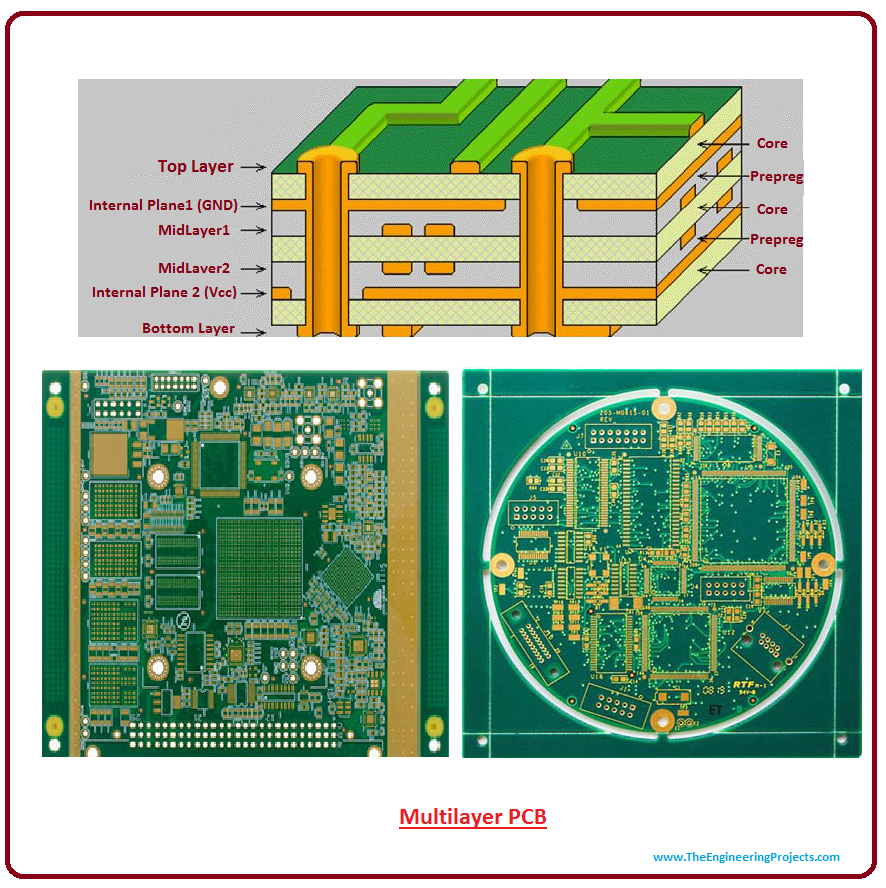

A printed circuit board can have multiple copper layers. A two-layer board has copper on both sides; multi layer boards sandwich additional copper layers between layers of insulating material. Conductors on different layers are connected with vias, which are copper-plated holes that function as electrical tunnels through the insulating substrate. Through-hole component leads sometimes also effectively function as vias. After two-layer PCBs, the next step up is usually four-layer. Often two layers are dedicated as power supply and ground planes, and the other two are used for signal wiring between components.

“Through hole” components are mounted by their wire leads passing through the board and soldered to traces on the other side. “Surface mount” components are attached by their leads to copper traces on the same side of the board. A board may use both methods for mounting components. PCBs with only through-hole mounted components are now uncommon. Surface mounting is used for transistors, diodes, IC chips, resistors and capacitors. Through-hole mounting may be used for some large components such as electrolytic capacitors and connectors.

The pattern to be etched into each copper layer of a PCB is called the “artwork”. The etching is usually done using photoresist which is coated onto the PCB, then exposed to light projected in the pattern of the artwork. The resist material protects the copper from dissolution into the etching solution. The etched board is then cleaned.

Once complete, the PCB board is ready for components to be assembled to it. Most commonly the components are attached to the PCB by soldering the components directly onto exposed traces – called pads – and holes in the PCB. Soldering can be done by hand, but more typically is accomplished in very high-speed automated assembly machines.

Two of the most common PCB assembly methods are surface-mount device (SMD) or thru-hole technology (THT). The use of either depends on the size of the components and the configuration of the PCB. SMD is useful for directly mounting small components on the exterior of the PCB, while THT is ideal for mounting large components through large pre-drilled holes in the board.

In multi-layer boards, the layers of material are laminated together in an alternating sandwich: copper, substrate, copper, substrate, copper, etc.; each plane of copper is etched, and any internal vias (that will not extend to both outer surfaces of the finished multilayer board) are plated-through, before the layers are laminated together. Only the outer layers need be coated; the inner copper layers are protected by the adjacent substrate layers. FR-4 glass epoxy is the most common insulating substrate. Another substrate material is cotton paper impregnated with phenolic resin, often tan or brown.

PCBs for Military use

PCB designs for military use need to be mindful of expectations including longer product lifecycles, extreme use cases, and temperatures. Military products are expected to be more reliable, robust, and rugged than consumer products which require more strict design constraints. Printed Circuit Boards (PCBs) used in aerospace and military applications demand high reliability due to their harsh operating conditions. Unlike the regular PCB, these circuit boards are exposed to extreme environmental conditions, chemicals, contaminants, etc.

Military grade PCBs must be built to withstand extreme conditions and high temperatures. A contract manufacturer able to tackle aerospace and military PCB assembly will have in-depth knowledge of different composites, materials, and substrates. Aluminum and copper are often use because they can withstand extreme heat. Anodized aluminum is also used at times in order to minimize the effects of heat induced oxidation

When designing PCBs that will be used in military systems, you must take steps to ensure component quality. This includes validating that components are authentic, meet performance criteria and pass testing regimens. Besides meeting these military-grade electronic components requirements, you need to ensure that your board’s manufacture and PCB assembly meet standards surpassing those for consumer products.

PCBs developed for military use must be populated with mil spec components with tighter tolerances of 1-2 percent instead of commercial grade components with grade tolerances of 5-10 percent. Often time’s engineers recommend PCB designers increase the current in military circuitry above and beyond that of commercial grade circuitry—adding an extra cushion of current to ensure the product will not fail under extreme circumstances. Extra cushion is also recommended for mechanical holes and other dimensions for an increase in efficiency and strength.

Counterfeiting can be a big problem is PCB assembly. It leads to product failures, as well as lost revenue for your company. It is critical that counterfeit parts are avoided at all costs when fulfilling an aerospace, military or government contract. This can be avoided when you work with a contract manufacturer that practices certified best processes and procedures, such as source assessment and fraudulent distribution avoidance. Your manufacturing partner should have a well-vetted and trusted chain of suppliers to guarantee only the bust parts go in to your PCBs.

Special surface finishes and coatings are required during PCB Assembly for military and aerospace applications. This is due to harsh environmental working conditions, including heat, humidity, water and vibration. Thermal compounds will insulate components, protect them from heat and reduce vibration that can crack solder. Boards are often coated with high quality acid or acrylic-based sprays. However, other surface finishes, including immersion silver, are also an option.

Some of the most common surface finishes are:

HASL Lead Free-HASL Sn/Pb – Normative reference IPC-6012: PCB is immersed in a bath of molten tin and then hit by high-pressure hot air jets that flatten the thickness and remove the excess from holes and pads. Thickness varies from 1 to 45 µm and is influenced by pad geometry, for this reason it is not particularly suggested for HDI PCB with VFP (Very Fine Pitch) and BGA (Ball Grid Array). This type of finishing is particularly suggested for multiple soldering cycles and for long storages since tin alloy is characterized by longer Shelf Life.

ENIG Normative reference IPC-4552: Chemical process which plates the exposed copper with Nickel and Gold.: This chemical finish, differently from HASL, is particularly suggested for HDI PCB with VFP and BGA, since coating planarity and homogeneity are granted.

HOT OIL REFLOW – Normative reference ECSS: Hot Oil Reflow is a finishing usually used for SPACE products; it is indeed the only ESA (European Space Agency) approved surface finishing. It consists in re-melting, with high-temperature oil bath, the Tin-Lead electrolytically deposited on surface.

OSP – Normative reference IPC-6012: OSP is an organic compound that selectively bonds with copper so to plate copper itself, providing an organic-metallic layer. Thickness, measured in A° (angstrom), protects it until soldering. OSP is the surface finishing most used in the world, particularly in white industry due to low costs and easy-to-use.

Durability, reliability and strength are major considerations that must be made during military and aerospace PCB assembly. Your contract manufacturer must be willing and able to minimize vibration when mounting components. This is why through-hole technology is the best method of mounting during PCB assembly. Boards manufactured with through-hole technology are extremely durable. This is because soldering from both the top and bottom of the board creates very strong physical bonds between the components and the board.

Aerospace and Military PCBs require stringent EMI/EMC compliance. Electromagnetic Compatibility (EMC) is really the controlling of radiated and conducted Electromagnetic Interference (EMI); and poor EMC is one of the main reasons for PCB re-designs. Indeed, an estimated 50% of first-run boards fail because they either emit unwanted EM and/or are susceptible to it. That failure rate, however, is not across all sectors. Mobile phone developers are well versed in minimizing the risk of unwanted radiations. Emerging IoT revolution is also causing EMI/EMC concerns. EMC issues are the designers of PCBs intended for white goods – such as toasters, fridges and washing machines – which are joining the plethora of internet-enabled devices connected wirelessly to the IoT. Also, because of the potentially high volumes involved, re-spinning PCBs can introduce product launch delays. Worse still, product recalls could be very damaging to the company’s reputation and finances.

Lastly, military products are expected to have superior use conditions to consumer products. Generally military products are brought into extreme climates and are required to maintain reliability. These products are expected to perform without failure in situations including a battlefield, extreme temperatures (both hot and cold), vibrations, impact as well as exposure to other elements including salt spray, dust, and solar radiation.

Due to these expectations, typical military grade PCB designs are required to meet IPC-A-610E Class 3 for High Performance and Electronic Products standards. These standards require products to display continued high-performance levels and performance on demand with zero tolerance for equipment failures. The class 3 standards requires electronic products to provide continual performance in uncommonly harsh environments without any downtime. Hence, military and aerospace PCBs require special considerations in terms of fabrication, design, and assembly.

Pre-layout simulations are also a critical process to developing military grade products as it is typically difficult to test applications in the real environments. Military standards also require more rigorous forms of testing prior to production. The standard testing process includes Design for Test (DFT), New Product Introduction (NPI), and Design for Manufacturability (DFM), along with x-ray testing. Although testing is extensive, such tests have a significant impact on thenumber of revisions required and ultimately result in a superior product. In addition to testing, product engineers for military grade equipment must diligently choose the best manufacturing process for the end use of the product. It is essential to avoid cutting corners and utilize the highest quality of chips to createthe best possible product.

Military prowess requires an embrace of lead-free electronics

Lead alloys have traditionally been used to attach electronic components to printed circuit boards. Lead alloys melt at low temperatures, making them easy to use without damaging electronic components during assembly. And manufacturers have prized lead’s well-known reliability, which is especially important in aerospace and defense because of the enormous cost to replace a faulty part. A satellite in space cannot simply be repaired, and aircraft and other defense technologies are expected to function without glitches for decades. But over the last 15 years, commercial electronics manufacturers have switched to lead-free technology, owing to lead’s harmful human health effects and environmental concerns.

While the commercial industry has made the switch, the U.S. defense community has resisted the change due to its reliability concerns. Specifically, the U.S. defense community’s continuing reliance on lead-based electronics puts the nation’s technological superiority and military readiness at risk. As electronics increase in sophistication and shrink in size, it is becoming increasingly difficult to rework these commercial electronics into leaded versions for use in defense systems. That leaves the military operating with less advanced systems — held onto at the mercy of the larger, lead-free commercial market or — at best — a potentially compromised lead-free component retrofitted into a lead-based environment.

Introducing lead into a lead-free manufacturing process complicates supply chains for many defense systems, undermining their ability to swiftly and reliably produce the equipment needed. Particularly at a time when supply chain risks are coming into focus for companies and countries, the extra step in manufacturing becomes a vulnerability and undermines the quality and innovation of new defense technology.

The reliance on lead also comes at a steep cost. The Pb-Free Electronics Risk Management Council — an industry group dedicated to lead-free risk mitigation — estimates that the rework necessary to convert commercial electronics into leaded electronic assemblies is costing the Department of Defense more than $100 million a year, and that doesn’t take into account the rising cost of lead as supplies shrink, nor all the related costs, including life-cycle management of lead-based assemblies.

Members of the House and Senate Appropriations committees are currently deciding whether to make a significant investment in lead-free electronics research in 2021. Should Congress falter, the DoD will soon find itself falling further behind in the adoption of advanced technologies such as microelectronics, artificial intelligence, 5G and the Internet of Things, all while paying more for weaker capabilities. This will compound existing vulnerabilities and create new ones. Like the proverbial frog in a pot of boiling water, this problem will sneak up on us until we realize we are cooked.

Qualifications

A contract manufacturer’s certifications will tell you a lot about its capability on handling your military or aerospace electronics project. Theses certifications show a CM’s commitment to quality.

Performance Standards for Military Grade Electronic Components

MIL-PRF-38534 (Hybrid Microcircuits, General Specification)

MIL-PRF-38535 (Integrated Circuits (Microcircuits) Manufacturing)

MIL-PRF-55342 (Resistor, Chip, Fixed, Film, Non-established Reliability, Established Reliability, Space Level, General Specification)

MIL-PRF-55681 (Capacitor, Chip, Multiple Layer, Fixed, Ceramic Dielectric, Established Reliability And Non-established Reliability)

MIL-PRF-123 (Capacitors, Fixed, Ceramic Dielectric, (Temperature Stable and General Purpose), High Reliability, General Specification)

Testing Standards for Military Grade Electronic Components

MIL-PRF-19500 (Test Methods For Semiconductor Devices, Discretes)

MIL-STD-883 (Test Methods Standards For Microcircuits)

MIL-STD-750-2 (Test Methods For Semiconductor Devices)

MIL-STD-202G (Test Methods For Standard Electronic and Electrical Component Parts)

Take the ITAR certification/qualification, for example. US DOD requires The International Traffic in Arms Regulation (ITAR) for military and aerospace PCB assembly. It is regulated by the Department of State and comes with regularly updated requirements to reflect changes in current technology, as well as political and security climates. ITAR restricts sensitive information relating to the design and production of military and intelligence devices, so you can trust that your drawings are being handled with required degree of security.

Market Growth

The global printed circuit board (PCB) market is expected to reach an estimated $107.7 billion by 2028 with a CAGR of 4.3% from 2023 to 2028. The major drivers for this market are increasing demand for PCB in the communication industry, growth in connected devices, and growth in automotive electronics.

The adoption of PCBs in connected vehicles has also accelerated the PCB market. These are vehicles that are fully equipped with both wired and wireless technologies, which make it possible for the vehicles to connect to computing devices like smartphones at ease. With such technology, drivers are able to unlock their vehicles, start climate control systems remotely, check their electric cars batteries status, and track their cars using smartphones.

Additionally, the demand for electronic devices, such as smartphones, smartwatches, and other devices, has also boosted the market’s growth. For instance, According to the US Consumer Technology Sales and Forecast study, which was conducted by the Consumer Technology Association (CTA), the revenue generated by smartphones was valued at USD 79.1 billion and USD 77.5 billion in 2018 and 2019, respectively.

3D printing has proved integral to one of the big PCB innovations lately. 3D-printed electronics, or 3D PEs, are expected to revolutionize the way electrical systems are designed in the future. These systems create 3D circuits by printing a substrate item layer by layer, then adding a liquid ink on top of it that contains electronic functionalities. Surface-mount technologies can then be added to create the final system. 3D PE can potentially provide immense technical and manufacturing benefits for both circuit manufacturing companies and their clients, especially compared to traditional 2D PCBs.

With the outbreak of COVID-19, the production of printed circuit boards were impacted by constraints and delays in Asia-Pacific region, especially in China, during the months of January and February. Companies have not made major changes to their production capacities but weak demand in China present some supply chain issues. The Semiconductor Industry Association (SIA) report, in February, indicated potential longer-term business impacts outside of China related to the COVID-19. The effect of diminished demand could be reflected in companies’ 2Q20 revenues.

- The usage of printed circuit boards (PCBs) is abundant in any electronic equipment, including calculators and remote control units, large circuit boards, and an increasing number of white goods, which is contributing to the market growth considerably.

- The increasing usage of mobile phones is further anticipated to drive the market for PCBs across the world. For instance, according to the Germany statistical office, at the beginning of 2019, nearly every household (97%) owned at least one mobile phone, compared to 94%, early in 2014. Mobile subscribers are also expected to grow from 5.1 billion in 2018 to 5.8 billion in 2025. (GSM 2019 Report). Due to the miniaturization trend of mobile devices such as smartphones, laptops and tablets for consumer convenience, there has been a rise in the manufacturing of the Printed Circuit Board (PCB).

- Moreover, owing to the increasing demand from the market segment, several market incumbents are specifically catering to the end-users’ needs, by offering PCBs in multiple batch sizes.

- For instance, AT&S produces printed circuit boards for smartphones and tablets, and it supplies to major companies, like Apple and Intel. Additionally, in 2020, Apple plans to launch two iPhone SE 2′ models in different sizes. The upcoming iPhone SE 2 models may use a 10-layer Substrate-like PCB (SLP) for its motherboard, which may be manufactured by AT&S.

- Additionally, vendors operating in the market are focusing on the geographical expansions, further driving the growth of PCBs in this segment. For instance, in February 2020, Apple Inc’s supplier, Wistron, will soon start assembling iPhone PCBs locally in India. Apple’s iPhone PCBs were earlier manufactured overseas and then imported to India. The new strategic move is expected to set off by the government, choosing to increase customs duty on PCB assembly.

North America Expected to Hold a Significant Market Share

- With exploding consumer electronics sector, the soaring popularity of IoT, and rising applications in the automotive industry are identified as the key factors that are likely contributing a positive impact on the sales of PCBs in the region. Quality performance and great packaging flexibility of PCBs will contribute to their success in the interconnectivity solutions in the future.

- In Dec 2019, TTM Technologies, Inc., a leading global printed circuit board products, radio frequency components, and engineered solutions manufacturer, announced the opening of a new Engineering Center in New York. Following the acquisition of manufacturing and intellectual property assets from i3 Electronics, Inc., the company has hired a number of engineering experts previously employed by i3 to strengthen its advanced PCB technology capabilities and extend its patent portfolio for emerging applications for the aerospace and defense and high-end commercial markets.

- Further, the vendors in the market are making strategic acquisitions to enhance their PC capabilities. For instance, Summit Interconnect, Inc. recently announced the combination of Summit Interconnect and Streamline Circuits. The acquisition of Streamline increases the Summit group to three California based operations. The Streamline operation significantly improves the company’s PCB capabilities when technology and time are critical.

- Number of television viewers are expected to grow in the region due to introduction of online TV platforms such as Netflix, Amazon Prime, Google Pay and Sky Go. This would encourage market adoption due to increased deployment of PCB in television sets.

- Increasing demand for small, flexible electronics will act as a critical trend for the market. The growing use of flex circuits in electronic wearables will have a positive impact on the market. Moreover, materializing interest in foldable or rollable smartphones will create a massive number of opportunities for key market players soon.

- Moreover, in May 2019 San Francisco Circuits announced upgradation of turnkey PCB assembly capabilities. The Full turnkey PCB assembly through SFC minimizes the customer’s responsibility to source components, manage the bill of materials (BOM), inventory, and logistics associated that can be encountered when working with a PCB assembly partner.

Competitive Landscape

The printed circuit board market is highly competitive due to the presence of few major players like Jabil Inc, Wurth elektronik group (Wurth group), TTM Technologies Inc., Becker & Mller Schaltungsdruck GmbH and Advanced Circuits Inc. These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

Recent Industry Developments

March 2020 – Zhen Ding Technology Holding Limited acquired Boardtek Electronics Corporation by Share-swap. After the share-swap, Boardtek would become the wholly-owned subsidiary of Zhen Ding. Boardtek engages in R&D, production, and sales of multilayer PCB which focuses on high-performance computing, high-frequency microwave, and higher efficiency of thermal dissipation.

February 2020 – TTM Technologies Inc. has announced the opening of the Advanced Technology Center in Chippewa Falls, Wisconsin. This revitalized 40,000 sq. ft. the facility, located at 850 Technology Way, offers a wide variety of some of the most advanced PCB manufacturing solutions offered in North America today, including the ability to manufacture substrate-like PCBs. TTM acquired the assets of i3 Electronics, Inc. (i3) in June, 2019, and shortly thereafter began work to quickly retool this facility which started production in January, 2020

References and Resources also include:

https://blog.levisonenterprises.com/5-factors-that-influence-military-and-aerospace-pcb-design

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis