Introduction:

In recent years, the field of space exploration has witnessed a significant surge in the deployment of microsatellite and nanosatellite constellations. These constellations, consisting of numerous small satellites working together, have become instrumental in driving innovation across multiple domains, including Space Internet, Navigation, Remote Sensing, and Security. In this article, we will explore how the growth of microsatellite and nanosatellite constellations is propelling innovation and transforming our capabilities in space-based applications.

Rise of Nanosatellites and microsatellites

Nanosatellite and microsatellite refer to miniaturized satellites in terms of size and weight. Microsatellites are artificial satellites, with a mass of 11–100 kg (including fuel mass) while nanosatellites are artificial satellites weighing between 1 and 10 kg, and measuring around 30 cm × 10 cm × 10 cm. ‘CubeSat’ is one of the most popular types of Nanosatellites with standard dimensions (“U” or Units) of 10 × 10 × 11. These satellites can be 1U, 2U, 3U, or 6U in size, and typically weigh less than 1.33 kg (3 lbs) per U.

The demand for these satellites has increased significantly over the last few years, owing to their lightweight attribute, shorter development cycle, high capability of performing complex computational tasks, and lower cost for development and launch. Compared with the traditional geostationary earth orbit (GEO) systems, LEO satellite constellation has the advantages of low propagation delay, small propagation loss and global coverage.

These are the fastest-growing segments in the satellite industry. One of the major advantages of nano and microsatellites is the low cost of building and operating these satellites. The growth in small satellites is driven by the miniaturization of electronics and sensors and the availability of high-performance commercial off-the-shelf components, significantly reducing the cost of hardware development.

The other rationale for miniaturizing satellites is to reduce the launch cost; heavier satellites require larger rockets with a greater thrust that also have a greater cost to finance. In contrast, smaller and lighter satellites require smaller and cheaper launch vehicles and can sometimes be launched in multiples.

The access to orbit and economy of these spacecraft is also improved through the availability of secondary launch payload opportunities, especially for small satellites which conform to standardized form factors. They can be launched ‘piggyback’, using excess capacity on larger launch vehicles. The introduction of reusable space launch vehicles, which could be used for multiple missions, is expected to further reduce the costs associated with small satellites. This is expected to result in an increase in the adoption of microsatellites and nanosatellites.

Satellite Constellations

Satellite constellations are groups of satellites that work together in a coordinated manner to achieve specific objectives. They have gained significant importance and are increasingly being deployed for a variety of reasons. Satellite constellations offer significant advantages in terms of global coverage, redundancy, reliability, increased capacity, and data rates.

A satellite constellation is a group of artificial satellites working together as a system. Satellites in Medium Earth orbit (MEO) and Low Earth orbit (LEO) are often deployed in satellite constellations, because the coverage area provided by a single satellite only covers a small area that moves as the satellite travels at the high angular velocity needed to maintain its orbit. Many MEO or LEO satellites are needed to maintain continuous coverage over an area. This contrasts with geostationary satellites, where a single satellite, at a much higher altitude and moving at the same angular velocity as the rotation of the Earth’s surface, provides permanent coverage over a large area.

Unlike a single satellite, a constellation can provide permanent global or near-global coverage, such that at any time everywhere on Earth at least one satellite is visible. Satellites are typically placed in sets of complementary orbital planes or formations and connect to globally distributed ground stations. They may also use inter-satellite communication. Satellite constellations ensure that signals, services, or observations can be provided to any location on Earth, even in remote or underserved areas. This global coverage is crucial for applications such as communication, navigation, and Earth observation.

Secondly, redundancy and reliability are essential factors in any satellite system. Satellite constellations provide redundancy by having multiple satellites performing similar functions. If one satellite within the constellation fails or encounters an issue, the other satellites can seamlessly take over its functions, ensuring uninterrupted services. This redundancy enhances the reliability of the system and reduces the risk of service disruptions or data loss. It is especially critical for applications where continuous availability is crucial, such as emergency communication or military operations.

Thirdly, satellite constellations offer increased capacity and data rates compared to individual satellites. By distributing the workload among multiple satellites, constellations can handle higher volumes of data and provide faster transmission rates. This increased capacity is particularly advantageous for applications that require large amounts of data to be transmitted, such as high-definition video streaming, Earth observation data, or real-time communication services.

Satellite constellations, particularly those in low Earth orbit (LEO), are poised to meet the increasing demand for bandwidth-intensive applications and emerging markets. Consumers now expect high-definition movie downloads, online gaming, and shopping experiences, all of which require substantial bandwidth. New segments like in-flight airline connectivity have also emerged, further driving the need for reliable and high-speed internet access. Additionally, the telecom backhaul market has expanded with the rise in mobile usage. Large LEO-constellation providers are striving to address this demand by offering price-competitive alternatives to terrestrial solutions. They achieve cost reduction through various means, including efficient manufacturing processes, streamlined launch operations, and user equipment optimization. This push to reduce costs makes satellite constellations a promising solution to fulfill the growing bandwidth requirements of diverse markets.

Moreover, satellite constellations enable improved system performance through the concept of “constellation synergy.” By coordinating the operations of multiple satellites, constellations can achieve enhanced capabilities that are not possible with individual satellites. For example, in navigation systems, constellation synergy enables better positioning accuracy, faster signal acquisition, and improved resistance to signal interference. In Earth observation, constellations provide frequent revisits to capture near-real-time imagery and monitor dynamic environmental changes. They provide opportunities to enable missions that a larger satellite could not accomplish, such as: Using formations to gather data from multiple points, In-orbit inspection of larger satellites.

In tandem with increased demand for connectivity, service expectations have risen. Both businesses and consumers seek high-bandwidth connections and, for many applications, low latency. Significantly, these expectations have spread beyond technologically sophisticated users to virtually all consumers in developed economies and many in emerging markets. Only people with limited connectivity options accept lower performance.

For some applications, in particular digital connectivity, the lower altitude of MEO and LEO satellite constellations provide advantages over a geostationary satellite, with lower path losses (reducing power requirements and costs) and latency. The propagation delay for a round-trip internet protocol transmission via a geostationary satellite can be over 600 ms, but as low as 125 ms for a MEO satellite or 30 ms for a LEO system.

Furthermore, satellite constellations offer scalability and flexibility. As the demand for satellite services continues to grow, constellations can be expanded by adding more satellites to the network. This scalability allows for the adaptation of the system to meet evolving needs and accommodate increased user demand. Additionally, constellations can be reconfigured or optimized for specific missions or applications, providing flexibility in their deployment and operation.

Large growth in Microsatellite and Nanosatellite constellations

Major and upcoming companies, such as Planet Labs, GomSpace, Sierra Nevada Corporation, among others, are launching constellations of micro and nanosatellites to offer near real-time remote sensing data.

It is expected that numbers of satellites in orbit are going to increase more than linearly with about 8000 spacecraft in orbit in 2024 due to constellations only. Over 2500 nanosats are estimated to be launched in 2021-2027.

Nanosatellites and microsatellites find application in scientific research, communication, navigation and mapping, power, reconnaissance, and others including Earth observation, biological experiments, and remote sensing.

Space Internet:

Connecting the Unconnected Space Internet, also known as satellite internet or global broadband coverage, has been a long-standing goal in the quest for global connectivity.

More than half of the world’s population does not have internet access today, and in some places it is still not cost effective to take the terrestrial and fibre optic network. To fill this gap many companies including Starlink, One Web, and Samsung have proposed the concept of using satellite constellations in Low Earth Orbit (LEO) for communication to provide efficient global coverage. Unlike traditional satellite internet, these plans involve the use of satellites in low Earth orbit, which can be operated cheaply and with lower latencies.

Microsatellite and nanosatellite constellations are playing a pivotal role in realizing this vision. By launching and maintaining large constellations of small satellites in low Earth orbit (LEO), these constellations create a mesh network that can deliver high-speed internet access to even the most remote and underserved regions of the world. The scalability, affordability, and flexibility of microsatellite and nanosatellite constellations make them ideal for establishing global broadband coverage and bridging the digital divide.

Navigation:

Pioneering Precision and Reliability The growth of microsatellite and nanosatellite constellations is revolutionizing space-based navigation systems. By deploying large constellations of small satellites, these systems offer improved precision, accuracy, and reliability in navigation applications. With the ability to provide continuous global coverage, microsatellite and nanosatellite constellations enhance the performance of GPS (Global Positioning System) and GNSS (Global Navigation Satellite System) by reducing signal interference and enabling faster position fixes. This advancement in navigation technology has far-reaching implications for autonomous vehicles, aviation, maritime operations, and precise positioning in various industries.

Remote Sensing:

Unveiling Earth’s Secrets Microsatellite and nanosatellite constellations have opened up new frontiers in remote sensing and Earth observation. Equipped with high-resolution cameras, multispectral imagers, and advanced sensors, these constellations capture a wealth of data about our planet. By leveraging the capability of coordinated small satellites, they enable frequent revisits, enhanced temporal resolution, and the ability to monitor dynamic environmental changes. This revolutionizes applications such as disaster management, weather forecasting, climate monitoring, agriculture, and land-use planning. The growth of microsatellite and nanosatellite constellations has democratized Earth observation, making it more accessible, cost-effective, and enabling global coverage.

Security:

Safeguarding Nations and Assets Microsatellite and nanosatellite constellations are playing an increasingly vital role in bolstering security and defense capabilities. These constellations provide crucial intelligence, surveillance, and reconnaissance (ISR) capabilities, facilitating real-time monitoring of borders, strategic assets, and potential threats. With their ability to rapidly deploy, operate in low Earth orbit, and work in synergy with existing surveillance systems, microsatellite and nanosatellite constellations offer enhanced situational awareness and enable timely response to security challenges. They are also instrumental in communication support for military operations in remote and inaccessible areas.

For in-depth understanding on Satellite Constellations technology and applications please visit: Orbiting Success: A Guide to Designing and Building Satellite Constellations for Earth and Space Exploration

Global Race to Satellite Constellations

Planet Labs:

Planet Labs is a company that operates a constellation of 218 microsatellites that are used to collect imagery of Earth. The company’s satellites are equipped with cameras that can take high-resolution images of Earth. Planet Labs uses its data to provide insights into a variety of topics, including agriculture, forestry, and urban planning.

Spire Global:

Spire Global is a company that operates a constellation of 112 nanosatellites that are used to collect weather data and other environmental data. The company’s satellites are equipped with sensors that can measure things like temperature, humidity, and pressure. Spire Global uses its data to provide insights into a variety of topics, including climate change, weather forecasting, and air quality.

Skybox Imaging:

Skybox Imaging was a company that operated a constellation of 12 microsatellites that were used to collect high-resolution imagery of Earth. The company’s satellites were acquired by Google in 2014. Google uses Skybox Imaging’s data for a variety of purposes, including mapping, navigation, and disaster response.

SpaceX:

SpaceX is a company that will complete its constellation of 4,425 microsatellites, that are designed to provide global broadband internet service. It will launch 610 satellites in 2023. The company’s satellites will be placed in low-Earth orbit, where they will be able to provide high-speed internet service to areas that are currently underserved.

Starlink satellites are designed to provide download speeds of up to 1 gigabit per second. This is much faster than the speeds that are currently available in many rural areas.

Latency: Starlink satellites are designed to have latency of under 20 milliseconds. This is important for applications like gaming and video conferencing. Starlink’s latency is significantly lower than HughesNet or Viasat, which means it will be easier for users to work or learn from home using Starlink.

OneWeb:

OneWeb is a company that is building a constellation of 648 nanosatellites that are designed to provide global broadband internet service. Each satellite weighing as little as 250 pounds to provide low-latency, high-speed internet access to rural areas through Wi-Fi, LTE, 3G or 2G connections.

The company’s satellites will be placed in low-Earth orbit, where they will be able to provide high-speed internet service to areas that are currently underserved. Additionally, the new satellite constellation will provide networks for global emergency and first responder access.

The satellites will each be able to deliver at least 8 gigabits per second of throughput. OneWeb has started to work on terminals that use antennas that combine mechanical steering and a phased-array antenna. They will provide internet access at 50 megabits per second. The company says it has developed Progressive Pitch technology in which satellites turn slightly so its low-orbit satellites won’t interfere with signals from existing Ku-band satellites in geostationary orbit.

As of March 8, 2023, OneWeb has 648 satellites in orbit. OneWeb has faced a number of challenges in developing its constellation, including financial difficulties and the grounding of its fleet of satellites due to a cyberattack in 2021. However, the company has made progress in recent months, and it is expected to begin commercial service in 2023.

Amazon’s Project Kuiper

Amazon is the latest in a string of companies with plans to use a network of thousands of satellites to offer broadband around the world. Amazon’s Project Kuiper will consist of satellites at three different altitudes: there will be 784 satellites at 367 miles, 1,296 satellites at 379 miles, and 1,156 satellites at 391 miles. Amazon’s constellation is designed to provide broadband internet coverage to most of the Earth.

These satellites will offer internet in areas ranging from 56 degrees north (roughly in line with the middle of Scotland) to 56 degrees south (below the southernmost tip of South America). This area, theoretically, covers over 95 percent of Earth’s population.

The satellites will be equipped with high-performance antennas and lasers to communicate with each other and with ground stations. The satellites will be powered by solar energy. The satellites will be designed to withstand the harsh environment of space. Amazon is working with a variety of partners to develop Project Kuiper, including satellite manufacturers, launch providers, and ground station operators. The project will also require a network of Earth stations for the satellites to communicate with. Amazon has already launched AWS Ground Station, a cloud computing service that will enable space-to-ground communications.

Amazon has launched 32 satellites as of March 8, 2023. The company plans to launch 3,236 satellites in total. The satellites will be deployed in three phases. The first phase will consist of 578 satellites, the second phase will consist of 1,296 satellites, and the third phase will consist of 1,362 satellites.

China’s programs

China has been making significant advancements in its space programs, particularly in the field of satellite constellations. The Hongyun project, led by CASIC, aims to establish a space-based communications network consisting of 156 small satellites in orbit. The project, set to be operational by 2022, aims to provide round-the-clock communication services worldwide, including in remote and underdeveloped areas, thus connecting people in these regions to the global telecommunications network.

Another Chinese company, Galaxy Space, plans to launch hundreds of satellites into low Earth orbit to provide global 5G coverage. Beijing-based China Head Aerospace Technology is developing the Skywalker constellation, which will consist of 48 satellites with applications in shipping, earthquake monitoring, and imagery. The company has partners in countries participating in China’s “Belt and Road Initiative,” including South Africa.

Samsung and Boeing are also joining the race to deploy internet satellites. Samsung plans to launch approximately 4,600 satellites to provide internet service to 5 billion users worldwide, while Boeing intends to deploy a constellation of 2,956 satellites for enhanced broadband connectivity. Iridium, in partnership with Orbital ATK, aims to offer safety services for cockpit Wi-Fi using its constellation.

Despite the progress, the affordability of these services remains a challenge. Space ventures require significant investments, and it may take time for the costs to decrease and become appealing to the mass market, especially in emerging markets. SpaceX, for example, initially charged $99 per month for its internet service, with additional fees for hardware, and cautioned about service limitations during the trial period. Cost considerations will play a crucial role in determining the success and adoption of these satellite constellation programs.

IoT Constellations

A myriad of new IoT satellite communication competitors (Eutelsat ELO, Kineis, Astrocast, Lacuna Space, Myriota, and many more), are presently growing to provide low cost IoT communication channels with worldwide coverage, encompassing the whole planet through low orbit satellite constellations. These organizations will contend with existing M2M Satcom vendors including Inmarsat, Thuraya, Globalstar, Orbcomm.

In many cases, IoT devices are distributed in remote areas (e.g., desert, ocean, and forest) in some special applications, they are placed in some extreme topography, where are unable to have direct terrestrial network accesses and can only be covered by satellite. Furthermore, revision of existing IoT protocol are necessary to enhance the compatibility of the LEO satellite constellation-based IoT with terrestrial IoT systems.

Eutelsat Communications revealed its ELO constellation project, targeting the Internet of Things (IoT) market. The 25 nanosatellite ELO constellation aims offer global IoT coverage enabling objects to transmit data, regardless of their location.

Internet of things satellite connectivity startup Myriota plans to provide low-cost, power efficient direct satellite connectivity for IoT uses, including industrial applications like equipment monitoring and measurement of environmental measures like groundwater levels. Myriota has four satellites on orbit already, with a plan to expand that to 25 by 2022. The Adelaide-based company has developed its own proprietary low-over iOT communications technology, that claims big advantages over existing solutions in terms of battery life, security, scalability and cost.

Radar microsatellite constellation

Satellite imagery has traditionally been produced via optical sensors. In recent years, however, satellite imaging increasingly relied on synthetic aperture radar (SAR). This technology boasts benefits over sensors, such as the ability to achieve clear imaging even in darkness and cloud conditions. It is critical for users to have access to uninterrupted, persistent situational awareness.

It also can gather data such as elevation and moisture levels. By leveraging small satellite developments, several companies have made strides toward providing high-quality SAR imaging at lower costs. In doing so, they are paving the way for widespread adoption of SAR while ensuring uninterrupted, on-demand visibility of life on earth.

Capella Space:

Capella Space has successfully launched two satellites (Sequoia 1 and Sequoia 2) in its constellation of 36 SAR microsatellites. The satellites are designed to provide high-resolution imagery of Earth’s surface, even in darkness and cloud cover. The microsatellite, named “Sequoia,” orbits at approximately 500 km while operating in the X-band.

Capella Space has received interest from military, intelligence, and government agencies for applications ranging from virtual reality (VR) software to missile defense and enhanced threat prediction capabilities.

ICEYE:

ICEYE has launched five SAR microsatellites as of March 8, 2023. The company has raised $87 million to continue to grow its operational constellation. ICEYE’s satellites are designed to provide high-resolution imagery of Earth’s surface, with a sub-meter resolution. Early achievements included 0.25-meter resolution for a small SAR satellite and quick turnaround time for capture data delivery (taking five minutes from when data begins its downlink connection to ground stations to when processed images are available for customers to use on their own systems). ICEYE’s customers include commercial businesses and government agencies.

Umbra:

Umbra is preparing to launch its first microsatellite in 2023. The company has agreements to deliver data to the United States government and commercial geospatial intelligence firms. Umbra’s satellites are designed to provide high-resolution imagery of Earth’s surface, with a resolution of better than 25 centimeters.

EOS Data Analytics:

EOS Data Analytics is developing its own synthetic aperture radar (SAR) sensors intended for deployment in a constellation of microsatellites. The company has already designed a radar prototype and is moving ahead with the development of a low-cost high-performance SAR payload for small satellites with ultra-high resolution down to 25 cm. EOS SAR satellites will operate in Stripmap and Spotlight modes (including interferometry) and will cover a wide range of applications. EOS is also considering dual-frequency SAR in X-band and S-band on a single satellite.

EOS is also considering dual-frequency SAR in X-band and S-band on a single satellite. Dual-band operation increases versatility for all weather imaging and improves object-ground contrast. A special configuration of the radar front end allows for imaging of selected areas in both bands in a single orbit.

These companies are advancing the field of SAR imaging through the use of microsatellite constellations, enabling cost-effective and widespread access to high-quality SAR data. With applications ranging from military and intelligence operations to environmental monitoring and disaster response, SAR constellations are poised to revolutionize Earth observation capabilities.

Disaster Monitoring Satellite Constellations

The European Space Agency (ESA) operates the Sentinel-2 mission, which consists of a constellation of two satellites designed for land monitoring purposes. These satellites provide high-resolution optical imagery and ensure continuity for previous missions like SPOT and Landsat. The mission offers global coverage of Earth’s land surface every 10 days with one satellite and every 5 days with both satellites in operation. This frequent imaging capability is highly valuable for ongoing studies and analysis. Equipped with advanced MSI (Multispectral Imager) instruments, the satellites deliver high-quality optical imagery.

The lower cost of platform development and the ability to launch a larger number of satellites have fueled the growth of small satellite constellations. These constellations have the capacity to perform simultaneous and distributed measurements or observations, enabling enhanced data collection. One notable advantage of multi-plane systems is the increased temporal resolution of the gathered data, as they provide shorter revisit times compared to single-plane systems. Moreover, the presence of multiple satellites in each orbital plane allows for a more graceful degradation of system performance in the event of individual satellite failures.

Several microsatellite-class constellations have achieved success in their respective missions. The Disaster Monitoring Constellation (DMC) and Rapid Eye Earth observation missions, as well as the ORBCOMM satellite communications system, are notable examples. In addition, there are larger multi-plane constellations composed of smaller satellites, such as Planet Labs’ Flock-1a (28 satellites) and Flock-1c (11 satellites), and Skybox Imaging with 24 satellites.

These satellite constellations demonstrate the effectiveness and efficiency of using multiple small satellites to achieve comprehensive and continuous monitoring and observation of Earth’s surface. They provide valuable data for disaster monitoring, environmental analysis, and various other applications, contributing to our understanding of the planet and enabling informed decision-making.

Microsatellite constellation geolocates RF signals

Microsatellite constellations, such as the HawkEye 360 Pathfinder, have been developed to detect and geolocate radio frequency (RF) signals. These microsatellites, weighing 15 kilograms and measuring 20 x 27 x 44 centimeters, are designed to detect RF signals emanating from various sources, including VHF radios, maritime radar systems, automatic identification system (AIS) beacons, VSAT communication systems, and emergency beacons.

The precise geolocation of these RF signals is made possible through the use of multiple microsatellites flying in formation. The relative positions of each satellite within the constellation are crucial for accurately determining the source of the transmissions. To achieve this, the microsatellites are equipped with space-qualified GPS receivers and high-performance attitude control systems, which ensure the stability and precise positioning of the satellites in orbit.

When a transmission originates from within the common footprint of two or more satellites in the constellation, they can receive the same signal. By comparing the different times of arrival and apparent center frequencies (Doppler) of the signal at each satellite, the microsatellites can calculate the transmitter’s position. This onboard comparison of time-of-arrival and frequency-of-arrival measurements enables accurate geolocation of the RF signal.

HawkEye 360 applies advanced RF analytics to the data to assess suspicious vessel activity, survey communication frequency interference and direct search-and-rescue. HawkEye 360 can help to locate people in distress, such as survivors of a shipwreck or a plane crash. The company has partnered with the U.S. Air Force to use its data to support search-and-rescue missions.

Precise formation flying is critical, as the relative position of each satellite must be known to accurately geolocate transmission sources. The onboard GPS receivers not only provide precise position and velocity estimates for the microsatellites themselves but also play a crucial role in synchronizing their clocks. This synchronization is essential for multilateration, which involves using the time differences between multiple satellites to calculate the position of the transmitter accurately. The GPS receivers also stabilize the phase-locked loops that govern the tuning frequency in the RF tuners of the microsatellites.

The HawkEye 360 Pathfinder microsatellites were built by Deep Space Industries and the University of Toronto, Institute for Aerospace Studies/Space Flight Laboratory. They were launched into low-Earth orbit in December 2018. By leveraging advanced RF analytics on the collected data, the HawkEye 360 constellation enables the assessment of suspicious vessel activity, the survey of communication frequency interference, and the facilitation of search-and-rescue operations.

Overall, microsatellite constellations like HawkEye 360 Pathfinder demonstrate the capabilities of small satellites in detecting and geolocating RF signals, providing valuable insights for various applications such as maritime security, communication interference analysis, and emergency response

Technical Challenges and Enabling Technologies

Satellite constellations are revolutionizing the space industry, but they also come with their fair share of technical challenges. However, advancements in technology are enabling solutions to overcome these challenges and ensure the success of satellite constellations.

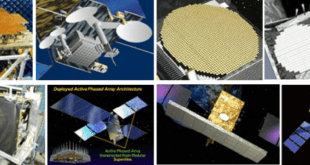

One of the primary challenges is to increase the throughput of individual satellites to meet the growing bandwidth demands of consumers. Advancements in active antennas and processing have allowed satellites to deploy more spot beams and deliver greater power through each beam. This not only enhances connectivity but also increases the overall throughput of the satellite constellation.

Intersatellite links (ISLs) play a crucial role in large constellations by improving connectivity and providing specific benefits such as enhanced throughput and network management. ISLs enable direct communication between satellites, reducing reliance on ground-based infrastructure and improving overall system performance.

Traditional parabolic-dish antennas are not suitable for low Earth orbit (LEO) constellations due to the rapid movement of multiple satellites across a ground receiver’s field of view. To address this challenge, electronically scanned apertures (ESAs), also known as electronically steerable antennas, have emerged. ESAs can shift beams, track and access a large number of satellites simultaneously without the need for physical movement. This enables better tracking capabilities and scalability.

Efficient data compression techniques are crucial to reducing bandwidth requirements without compromising communication quality. Improved data compression methods ensure optimal utilization of available bandwidth, maximizing the efficiency of satellite communications. This is particularly important as the demand for data throughput continues to increase.

Managing and monitoring a large number of satellites in orbit poses challenges for ground service providers. Investments in new ground segment infrastructure development are necessary to handle the increased volume of satellite data. Predictive analytics, network optimization techniques, and advancements in computing power and artificial intelligence algorithms can help effectively manage ground stations, reducing response times and operating costs.

Spectrum congestion is another challenge in satellite constellations. With the increasing demand for data throughput, the RF spectrum can become overcrowded. Innovative approaches and spectrum management techniques are required to ensure efficient spectrum utilization and prevent congestion.

The rise in space traffic and debris poses a significant concern for satellite constellations. Improved collision avoidance systems, space traffic management protocols, and debris mitigation strategies are essential to maintain the safe and successful operation of spacecraft.

While satellite constellations offer tremendous potential, it’s important to note that the initial costs of deploying and operating such systems can be high. However, as technology continues to evolve and economies of scale are realized, costs are expected to decrease over time.

In conclusion, advancements in technology and innovative solutions are addressing the technical challenges associated with satellite constellations. Through increased throughput, improved antenna systems, efficient data compression, and optimized ground segment infrastructure, satellite constellations are poised to transform the space industry and provide enhanced connectivity and services to users worldwide.

Conclusion:

The growth of microsatellite and nanosatellite constellations is propelling innovation across various domains, including Space Internet, Navigation, Remote Sensing, and Security. These constellations are revolutionizing global connectivity, navigation precision, Earth observation, and defense capabilities. As the technology continues to advance and more constellations are deployed, we can expect further breakthroughs and applications that will shape the future of space exploration and

References and Resources also include:

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis