In today’s rapidly evolving global landscape, the United States’ reliance on critical minerals has never been more pronounced. These non-fuel raw materials are essential for manufacturing products that are crucial to national security, ranging from the rare earth minerals in electric motors and generators to the carbon fiber used in airplanes. However, the increasing demand for these minerals, coupled with limited domestic supply and growing dependence on foreign imports, poses significant risks to the U.S. supply chain.

The Dual Role of Critical Minerals

The United States depends on a variety of raw, non-fuel materials dubbed “critical minerals” to manufacture products considered essential to national security. These products can range from rare earth minerals in electric motors and generators, to the carbon fiber used for airplanes. Increasing demand, coupled with limited domestic supply and increasing reliance on foreign companies to import these critical minerals, poses significant risks to the U.S. supply chain.

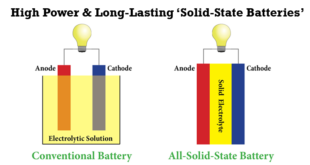

Minerals remain important for military power today. Iron is used in steel, which is necessary for military components like ship hulls and tank armor. Copper is commonly used in munitions such as bullets and artillery shells. And lithium and other minerals have gained further relevance due to their use in new energy technologies, like high-capacity batteries.

Critical minerals have become a focal point in discussions about the green energy transition. They are indispensable for technologies such as electric car batteries, solar panels, and wind turbines. From lithium to graphite, beryllium to cobalt, these minerals are essential for electric car batteries, solar panels, wind turbines, and other clean energy technologies.

But beyond their role in clean energy, these minerals are also vital for weapons production. For instance, silver is used in Apache helicopters, copper and nickel in body armor, and molybdenum in missiles. The significance of these minerals extends well beyond their immediate applications, underscoring their strategic importance

These nonfuel minerals and mineral materials are vital to countries’ defense industrial bases, enabling the production of military platforms like tanks as well as munitions and artillery shells. Therefore, mineral supplies can help sustain military power, while mineral shortages can severely undermine it.

NATO and Department of Defense’s Threat

Amid global supply chain risks and China’s growing control over critical mineral refinement and production, the US Department of Defense (DoD) is making these minerals a top priority.

Given their limited domestic mineral production, both the United States and Europe depend heavily on mineral imports, including from rival powers like China, which supplies minerals such as graphite, rare earth elements, and other battery minerals, and Russia, which provides aluminum, nickel, and titanium.

In June 2023, NATO Secretary General Jens Stoltenberg warned the alliance to avoid becoming overdependent on Chinese minerals, just as many NATO countries previously became overdependent on Russian gas. Additionally, the U.S. government holds limited mineral inventories in its National Defense Stockpile, while the European Union (EU) has walked back its plans to develop a centralized mineral stockpile.

Coupled with limited production and stockpiles, the U.S. and other NATO militaries face three serious risks that could lead to mineral shortages: foreign export controls; rising military demand amid great power competition, including the possibility of a U.S.-China conflict; and disrupted sea-lanes. The United States and other NATO countries must act now to address these supply chain risks.

Other NATO countries and partners have limited mineral production and stockpiles, too. The EU imports between 75 and 100 percent of most metals it consumes, and neither the union nor its member states have mineral stockpiles—though the EU is now facilitating the joint purchasing of minerals by interested firms and member-states. Canada also does not have such a stockpile, and the United Kingdom discontinued its facility in 1984. The risks of limited—or nonexistent—strategic stockpiles became apparent during the 2021 global energy crisis, when the United Kingdom had enough natural gas stored to last only four to five winter days. For NATO countries generally, the situation is no better for the minerals critical for their militaries.

The second risk stems from increased allied production of defense platforms and munitions that contain minerals. This increased production is largely to replenish stocks of depleted matériel sent to support Ukraine in the Russia-Ukraine war. A 2023 report from the Hague Centre for Strategic Studies found that European countries face high or very high supply risks for several critical minerals with military applications, including aluminum, beryllium, chromium, copper, and natural graphite for towed artillery, which Ukraine heavily relies on.

In a possible U.S.-China conflict, the United States and other NATO countries would face increased risks of mineral shortages, too. In war games simulating a U.S.-China conflict over Taiwan, the Center for Strategic and International Studies found that the U.S. military used 5,000 long-range missiles in the first three weeks of combat, which would increase demand for minerals used in missiles, such as steel alloys. While projecting mineral consumption in a U.S.-China conflict is difficult given limited open-source information on the material composition of defense platforms and munitions, the high rates of matériel attrition in the Russia-Ukraine war demonstrate how wartime demands often exceed expectations and available supply.

DOD Response

Recognizing the urgency of securing these minerals, the U.S. Department of Defense (DoD) has made them a top priority. On May 18, 2018, the Department of the Interior published a list of 35 mineral commodities considered critical to the economic and national security of the United States. These minerals are crucial due to their military and industrial applications. For example, the Essential Chemical Industry at the University of York, UK, reports that nearly half of the world’s titanium is used in aerospace projects, often alloyed with metals such as aluminum, molybdenum, and iron.

The Department of the Interior published on May 18, 2018, a list of 35 mineral commodities considered critical to the economic and national security of the United States. These minerals have been designated as critical to the US’s national interest in part because of their potential military and industrial applications. The Essential Chemical Industry at the University of York, UK, reported that nearly half of the world’s titanium goes to aerospace projects and that it is often used as an alloy with metals, such as aluminium, molybdenum and iron.

The full list of critical minerals includes the following:

The list includes aluminum—used in almost all sectors of the economy; the platinum group metals—used for catalytic agents; rare-earth elements—used in batteries and electronics; tin—used as protective coatings and alloys for steel; and titanium—overwhelmingly used as a white pigment or as a metal alloy. A full list of the 35 mineral commodities follows.

Scandium can be worked at high temperatures, making its role in jet engines ‘a very real future possibility’, according to NioCorp. Currently it is used to reinforce and strengthen aluminium. Niobium serves a similar purpose, making steel stronger, lighter and more corrosion-resistant, producing high-strength, low-alloy steels. Unlike the former metals, niobium is listed as both a critical and a strategic mineral, signifying its importance to the US, as well as its difficulty to produce.

Aluminum (bauxite) is used in almost all sectors of the economy. Antimony finds applications in batteries and flame retardants, while arsenic is utilized in lumber preservatives, pesticides, and semiconductors. Barite is important in the cement and petroleum industries, and beryllium serves as an alloying agent in aerospace and defense industries. Bismuth is used in medical and atomic research, and cesium plays a role in research and development. Chromium is primarily used in stainless steel and other alloys, and cobalt is essential for rechargeable batteries and superalloys. Fluorspar is involved in the manufacture of aluminum, gasoline, and uranium fuel.

Gallium is crucial for integrated circuits and optical devices like LEDs, while germanium is used in fiber optics and night vision applications. Graphite (natural) is utilized for lubricants, batteries, and fuel cells. Hafnium is important for nuclear control rods, alloys, and high-temperature ceramics. Helium is used in MRIs, as a lifting agent, and for research purposes. Indium is mostly used in LCD screens, and lithium is primarily for batteries. Magnesium is used in furnace linings for manufacturing steel and ceramics, and manganese is essential in steelmaking. Niobium is mostly used in steel alloys.

Platinum group metals are used for catalytic agents, and potash is primarily used as a fertilizer. The rare earth elements group is primarily used in batteries and electronics. Rhenium finds applications in lead-free gasoline and superalloys, and rubidium is used for research and development in electronics. Scandium is utilized for alloys and fuel cells, while strontium is used in pyrotechnics and ceramic magnets. Tantalum is essential in electronic components, mostly capacitors, and tellurium is used in steelmaking and solar cells. Tin is used as protective coatings and alloys for steel, and titanium is overwhelmingly used as a white pigment or metal alloys. Tungsten is primarily used to make wear-resistant metals.

Uranium is mostly used for nuclear fuel, and vanadium is primarily used for titanium alloys. Zirconium finds applications in high-temperature ceramics industries.

This list of critical minerals, while “final,” is not intended as a permanent designation of criticality, but will be a dynamic list updated periodically to represent current data on supply, demand, and concentration of production, as well as current policy priorities.

Under the Executive Order, these commodities qualify as “critical minerals” because each has been identified as a non-fuel mineral or mineral material that is essential to the economic and national security of the U.S. They have supply chains vulnerable to disruption and serve an essential function in the manufacturing of products, the absence of which would have significant consequences for the economy or national security.

In May this year, when Jeffery A. Green, the president of a bipartisan government-relations firm in Washington DC and a former US Air Force commander, wrote in Defense News that, “without access to such minerals, our precision-guided missiles will not hit their targets, our aircraft and submarines will sit unfinished in depots, and our war-fighters will be left without the equipment they need to complete their missions.”

Addressing Scarcity and Dependence

The scarcity of these minerals means that the U.S. imports the vast majority. Brazil, for instance, produces 92% of the world’s niobium, and China is the largest importer of scandium to the U.S. China also produced 47% of the world’s titanium in 2016. This reliance on foreign sources is a vulnerability that the U.S. is actively working to mitigate.

The list of critical minerals is dynamic, updated periodically to reflect current supply, demand, and production data, as well as policy priorities. This flexibility ensures that the U.S. can adapt to changing global circumstances and maintain its strategic edge.

Leveraging AI for Supply Chain Security

In response to these challenges, DARPA has introduced the ‘Open Price Exploration for National Security’ (OPEN) project, an AI-driven initiative designed to estimate the prices and availability of critical minerals. By predicting market disruptions caused by factors like labor strikes or foreign sanctions, OPEN aims to secure the critical mineral supply chain and, by extension, U.S. national security.

DARPA’s AI for Critical Mineral Assessment Competition, in collaboration with the U.S. Geological Survey (USGS), is another innovative effort. This competition seeks solutions to expedite critical mineral resource assessments using AI and machine learning. The goal is to automate key processes and significantly reduce the time required for these assessments.

The Pentagon has unveiled plans to develop a new AI-driven program, known as the ‘Open Price Exploration for National Security’ (OPEN) project, to estimate prices and availability of critical minerals. By pre-empting the market effects of disruptive factors such as labor strikes or foreign sanctions, OPEN aims to minimize the risk posed to critical mineral supply chains and, by extension, US national security.

DARPA has partnered with the U.S. Geological Survey (USGS) to explore the potential for machine learning and artificial intelligence tools and techniques to accelerate critical mineral assessments. The goal is to significantly speed up the assessment of the nation’s critical mineral resources by automating key steps in the process.

The Energy Act of 2020 called for the USGS to assess all critical mineral resources in the U.S. In addition, the Bipartisan Infrastructure Law called on the USGS to assess potential critical mineral resources in mine wastes. These assessments can quantify potential mineral sources from existing domestic mines – whether historical or active – and help identify opportunities for economically and environmentally viable resource development.

Here’s the challenge: The list of critical minerals currently includes 50 minerals and current assessments are labor intensive. Using traditional techniques, assessing all 50 critical minerals would proceed too slowly to address present-day supply chain needs.

“The USGS’s critical mineral resource assessments are at the heart of our domestic supply and production of critical minerals,” said Dr. Anne Fischer, deputy director of DARPA’s Defense Sciences Office. “We want to have a measurable, immediate impact on the USGS’s ability to reach some of its objectives, especially in ways that are critical to national security.”

As part of the exploratory study, DARPA, in collaboration with the USGS, MITRE and NASA’s Jet Propulsion Laboratory, launched the AI for Critical Mineral Assessment Competition. This competition solicits innovative solutions for automatically extracting and georeferencing features from scanned or raster maps.

The competition will include the following two, independent challenges:

Map Georeferencing Challenge: Automated map georeferencing is a difficult task as most USGS maps are not digitized, and may be in a multitude of historical coordinate projection systems. Furthermore, the quality of features on scanned maps, critical for the identification of control points for alignment, can vary greatly. Participants will receive a dataset of 1,000 or more maps of various types for training and validation. The goal of this challenge is to accurately geolocate a map of unknown location and coordinate system by fitting coordinate points that can be referenced to known locations in one or more base maps.

Map Feature Extraction Challenge: Automated map feature extraction is a difficult task because map features (polygons, points, lines, text) often overlap and are sometimes discontinuous. Not only do the features come in all shapes and sizes, but the same feature type can be depicted in different maps using different symbols or patterns. This makes it challenging to create a universal identifier for even a single feature such as a mine location or mineral resource tracts. Participants will be provided a training set consisting of maps with each legend item labeled and characterized (as point, line, or polygon) and a binary pixel map reflecting the feature’s coverage in the map. The goal of the challenge is to identify all features in a map that appear in the map’s legend.

Recently, DARPA officials announced the winners of its AI for Critical Mineral Assessment Competition, an initiative aimed at enhancing and securing the supply of critical minerals. In collaboration with the U.S. Geological Survey (USGS), the competition sought to crowdsource innovative solutions to expedite the assessment process of critical minerals using AI and machine learning.

Canada-based company Uncharted won top honors for their solution, while American company Jataware received second place. Team Ptolemy, which included members from the Massachusetts Institute of Technology, University of Arizona, and Pennsylvania State University, secured third place.

“Critical minerals are essential to the national security supply chain, and as such, the agency is approaching the need from multiple angles,” stated DARPA Director Stefanie Tompkins. “The USGS collaboration puts an emphasis on identifying existing domestic resources. Other DARPA programs are evaluating the feasibility of recovering rare earth elements from e-waste and bioengineering methods to purify rare earth elements.”

USGS Director David Applegate highlighted the value of the competition, saying, “It has already led to incredible time savings in how we prepare data in a machine-readable format. Furthermore, these machine-learning models have implications beyond mineral resources into other fields that use map data, including geologic mapping, ecological mapping of species diversity, and many other application areas.”

Sarah Ryker, associate director for energy and mineral resources at the USGS, added, “DARPA is known for fostering innovation by creating problem-focused research communities, and we’re excited to put the results of this competition to immediate use. The United States is under-mapped, and the Bipartisan Infrastructure Law provides a historic opportunity to catch up – if we can precisely target our investments in new mapping. We hope that new capabilities emerging from these challenges will enable us to do exactly that.”

Itronics Starts R&D to Recover Tin, a U.S. Critical Mineral, and Copper From Silver Bullion

In January 2019, Itronics Inc. announced the commencement of research and development to recover tin and copper from the silver bullion produced by its “Breakthrough Technology” Printed Circuit Board Refining Pilot Plant. Tin is one of the 35 minerals deemed critical to U.S. national security and the economy, according to the U.S. Department of the Interior.

Dr. John Whitney, President of Itronics, stated, “Our recovery of all the tin contained on the circuit boards positions the company to be a world leader in tin recovery from discarded printed circuit boards, a technology advancement of global importance. It also positions Itronics to be the first domestic printed circuit board refiner to recover tin and antimony, making Itronics an emerging domestic ‘critical minerals’ producer.”

Previously, Itronics had announced that its technology recovers all the copper, tin, silver, gold, and palladium (a Platinum Group Metal, PGM) from discarded circuit boards. The technology also recovers antimony, a fire-retardant mineral used to make circuit boards fireproof. These metals are contained in the company’s silver bullion, which is sold to a finish refiner for separation and sale.

Laboratory testing performed by Itronics indicates that the copper and tin may be separated from the other metals contained in the bullion. The company plans to further develop this new metal separation technology. The long-term goal is to become a producer of high-purity metals, including the strategic metals tin and antimony, using the company’s hydrometallurgy and pyrometallurgy technologies. Itronics would benefit if the U.S. provides incentives to increase domestic production of “critical minerals,” including tin, antimony, and palladium.

According to the U.S. Department of the Interior, there is no mine production of tin in the United States; all the tin required by the U.S. economy is imported. The primary foreign suppliers of tin to the United States are Indonesia, Peru, Malaysia, Bolivia, and Brazil.

The list of critical minerals was published in response to a White House Executive Order issued on December 20, 2017, aimed at reducing U.S. dependency on imports of critical minerals. Under the Executive Order, a “critical mineral” is defined as “a non-fuel mineral or mineral material that is essential to the economic and national security of the United States, that has a supply chain vulnerable to disruption, and that serves an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy or national security.”

Itronics is now operating its breakthrough printed circuit board refining technology on a pilot scale at its manufacturing plant in Reno, Nevada. The circuit boards are converted into energy used in the refining process, producing silver bullion and silver-bearing glass, which are sold, thereby eliminating waste from the environment.

Itronics has pioneered the development of “Zero Waste” material recovery technology that converts liquid photochemical waste into silver bullion and a “non-nutrient metal free” liquid ingredient used to manufacture the line of high-quality GOLD’n GRO liquid fertilizers. Dr. Whitney said, “Itronics is now pioneering and has achieved operational proof of concept for its second ‘Zero Waste’ material recovery technology, the breakthrough printed circuit board refining technology, which is now being operated at a pilot scale.”

Legislative Support and Future Prospects

The Energy Act of 2020 and the Bipartisan Infrastructure Law underscore the importance of comprehensive assessments of domestic critical mineral resources. Traditional assessment methods are too slow to meet current supply chain needs, making the integration of AI and machine learning essential. This collaboration between DARPA and USGS aims to enhance the USGS’s capabilities in critical mineral assessments, with broader implications for other fields that utilize map data, such as geological and ecological mapping.

Conclusion

The strategic importance of critical minerals cannot be overstated. Securing a stable supply chain for these materials is vital for both national security and economic stability. Through innovative programs like OPEN and collaborative efforts with the USGS, the U.S. is leveraging AI to strengthen its critical mineral supply chain. These efforts not only address current vulnerabilities but also pave the way for a more resilient and self-sufficient future.

As the global demand for critical minerals continues to rise, the U.S. must remain proactive in securing these essential resources. By harnessing the power of AI and fostering innovation, the U.S. is well-positioned to navigate the complexities of the modern supply chain and maintain its strategic advantage.

References and resources also include:

https://www.mining-technology.com/features/critical-minerals-scarcity-undo-america-first-mining/

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis