Quantum Security Revolution: Inside the $30 Billion Global QKD Boom

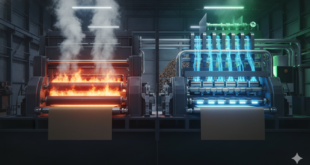

As the encryption race heats up, Quantum Key Distribution emerges as the frontline defense in a $30B cybersecurity revolution.

Market on Fire: Growth Metrics Defying Gravity

The quantum key distribution (QKD) market is in the midst of a remarkable expansion, driven by the impending threat of quantum computing attacks on classical encryption. Currently valued at $2.54 billion in 2025, the market is projected to skyrocket to $30 billion by 2035, representing a staggering compound annual growth rate (CAGR) of 28.32%.

This explosive trajectory is powered by several converging factors. One of the most pressing is the “harvest now, decrypt later” strategy. Nation-states and cybercriminals are hoarding encrypted data today in anticipation of quantum capabilities that can break them tomorrow. Over 60% of global financial institutions are now actively pursuing quantum-safe solutions. Simultaneously, government mandates are accelerating adoption—such as the UK’s National Cyber Security Centre requiring full migration to post-quantum cryptography (PQC) by 2035, and NIST’s recent standardization of ML-KEM, ML-DSA, and SLH-DSA algorithms in 2024. On another front, space-based breakthroughs are capturing imaginations and budgets alike, with the satellite QKD segment expected to grow from $500 million in 2025 to $1.1 billion by 2030. Initiatives like the European Space Agency’s EAGLE-1 and China’s Micius constellation are laying the foundations for secure orbital networks.

Across components and applications, software continues to dominate with over 62% market share, bolstered by artificial intelligence-enabled key management. Services follow closely behind, driven by demand for system deployment and upkeep. Government and defense remain the largest application segments, forecast to exceed $15 billion by 2035, while healthcare emerges as a hotbed of growth thanks to the sensitive nature of genomic and medical data. Large enterprises currently account for 70% of adoption, but small and medium enterprises are closing the gap, benefiting from flexible QKD-as-a-Service offerings and robust growth exceeding 28% CAGR.

Technology Leaps: Shattering Distance and Cost Barriers

Terrestrial Networks Go Hybrid

New hybrid architectures are overcoming one of QKD’s most persistent challenges—scalability. China Telecom has implemented a triple-layer security architecture that integrates QKD with post-quantum algorithms, making it possible to establish a secure 1,000-kilometer communication link between Beijing and Hefei. Deployed across 16 major cities, this setup ensures operational resilience—if one layer is compromised, others maintain data integrity.

Toshiba’s innovation in fiber multiplexing has further transformed the QKD deployment landscape. By simultaneously transmitting QKD keys alongside 33.4 terabits per second of classical data on a single fiber, the company has managed to cut infrastructure costs by more than half, making quantum security more economically viable.

Satellite QKD Goes Mainstream

In orbit, QKD is becoming increasingly feasible. China leads this race with an expanding Micius network, including the launch of multiple low-Earth orbit (LEO) satellites by 2025 and a new medium-Earth orbit (MEO) satellite featuring a powerful 600mm telescope by 2027. These platforms extend photon transmission time and network stability.

The global momentum is underscored by the BRICS Quantum Network initiative, which has already achieved operational QKD links spanning over 12,800 kilometers between China, South Africa, and Russia. Commercial entities are also entering the fray—SealSQ plans to deploy six dedicated QKD satellites in 2025, further democratizing access to space-based encryption.

Segment Analysis

Analysis by Type: Multiplexed vs Long-Distance Systems

The QKD market, when segmented by system type, falls into two key categories: multiplexed systems and long-distance systems—each addressing different infrastructure and security demands.

Multiplexed systems are designed to transmit multiple quantum signals simultaneously over a single optical fiber. This capability significantly boosts channel efficiency and reduces infrastructure costs, making it ideal for data-heavy sectors such as telecommunications and banking. These systems are becoming increasingly vital as enterprises push for higher bandwidth utilization without compromising quantum security.

In contrast, long-distance QKD systems focus on overcoming the inherent limitations of photon signal attenuation across vast distances. These systems are essential for cross-border communications in defense, banking, and international trade, where secure information exchange must extend far beyond metropolitan fiber networks.

In April 2024, a survey by leading industry analysts revealed a 50% surge in demand for long-distance QKD systems, largely driven by defense and financial institutions seeking to secure international data exchanges amid rising geopolitical tensions.

Analysis by Security: Application vs Network Security

By security function, the QKD market bifurcates into application-level security and network-level security, each tailored to specific threat vectors.

Application security involves integrating QKD into software platforms to protect sensitive data at the endpoint. This approach is critical in sectors such as banking, healthcare, and retail, where data breaches can result in legal liabilities and severe reputational damage. QKD enhances existing software protections by introducing unbreakable encryption keys, preventing future quantum attacks on stored data.

Network security, on the other hand, secures the communication infrastructure itself, protecting data in motion across fiber links, routers, and cloud systems. It is especially vital for governments, IT service providers, and critical transportation systems, where real-time data flows must remain shielded from interception or manipulation.

In March 2024, Toshiba Corporation successfully tested its QKD network security suite with several European financial institutions. The pilot program led to a 30% improvement in secure transaction speeds, highlighting QKD’s potential to reinforce high-frequency trading systems and interbank payment networks.

Analysis by Industry: Securing Critical Infrastructure

The QKD market is witnessing robust growth across multiple verticals, including banking and financial services (BFSI), government and defense, healthcare, transport, retail, IT and telecommunications, automotive, and aerospace.

The BFSI sector is adopting QKD to secure financial transactions, customer credentials, and interbank communications from post-quantum threats. Meanwhile, government and defense agencies are using QKD to safeguard national communications networks and sensitive intelligence channels.

In transport and automotive, QKD is emerging as a key enabler of secure vehicle-to-vehicle (V2V) communications and smart transportation systems, where data integrity is critical to public safety. The healthcare industry, increasingly reliant on telemedicine and digital patient records, is deploying QKD to protect sensitive genomic and diagnostic data from quantum-era cyber intrusions.

In September 2024, the Cybersecurity and Infrastructure Security Agency (CISA) reported a 45% increase in QKD adoption across BFSI and government sectors. This rise was attributed to intensifying cyber-espionage threats and the growing need for ultra-resilient networks that cannot be compromised by future quantum computers.

Geographical Hotspots: The Quantum Arms Race

Asia-Pacific: Dominance Through Deployment

The Asia-Pacific region commands the largest share of the QKD market, accounting for 38.5%. China is the cornerstone of this dominance, boasting a 4,600-kilometer fiber-based network that connects more than 700 ground stations and integrates with satellite links. Over 150 governmental and banking entities already rely on this infrastructure.

South Korea is carving its niche through international exports. SK Telecom recently finalized an $8.9 million agreement with U.S.-based QuantumXchange to supply QKD systems to Deutsche Telekom. Meanwhile, India is pushing forward with the National Mission on Quantum Technologies, investing $1 billion in platforms such as QNu Labs’ Armos system, which already offers a 100-kilometer operational range.

North America: Innovation Hub, Deployment Laggard

Despite holding a substantial 40% market share, North America lags behind in field deployment. Verizon has conducted promising trials in Washington, D.C., demonstrating the feasibility of simultaneous QKD and data transmission over a single fiber. However, such efforts remain limited in scale compared to Asia’s aggressive rollout.

Military innovation offers a silver lining. The U.S. Joint Service Labs are investing $45 million in quantum memory networks for battlefield communication, signaling a long-term commitment to secure infrastructure.

Europe’s Standardization Play

Europe is positioning itself as the custodian of global QKD standards. The European Space Agency’s EAGLE-1 mission will commence trials in 2025, testing satellite QKD alongside PQC integration. Germany’s Q.Link.X project is leading research into quantum repeaters, leveraging diamond color centers to overcome distance limitations. These efforts are aligned with the EU’s upcoming Ecodesign compliance requirements, due to take effect in 2027.

Key Players: From Giants to Specialized Upstarts

The global QKD market is shaped by a mix of established tech giants and specialized quantum startups, each playing a pivotal role in advancing secure quantum communications. ID Quantique (Switzerland) stands as a pioneer, having deployed the world’s first commercial QKD system and continuing to lead in quantum-safe cryptographic solutions. ID Quantique, a long-time pioneer, recently upgraded its offering with a quantum-safe VPN powered by Quantis quantum random number generators.

Toshiba Corporation (Japan) remains a dominant force in fiber-based QKD innovations, recently achieving breakthroughs in long-distance quantum transmission. Toshiba, commanding up to 16% of the market, continues to push boundaries with a successful 254-kilometer QKD transmission over commercial telecom fiber.

U.S.-based MagiQ Technologies and Qubitekk contribute to the defense and industrial sectors, offering ruggedized QKD systems tailored for battlefield and critical infrastructure security. Meanwhile, QuintessenceLabs in Australia has carved a niche with quantum random number generators and hybrid crypto gateways, integrating seamlessly into cloud environments.

Asia continues to gain strategic momentum with QuantumCTek (China) and SK Telecom (South Korea) spearheading national QKD networks and satellite deployments. QuantumCTek’s deep integration into China’s 4,600-km QKD backbone reinforces its leadership in domestic secure communications. In the U.K., Crypta Labs focuses on quantum-enhanced mobile security, while AUREA Technology (France) is making strides in compact, plug-and-play QKD modules. Niche innovators such as NuCrypt LLC are also advancing quantum-classical integration for metro-scale QKD systems. Collectively, these companies represent a global race not only to commercialize QKD but to set the foundational standards for post-quantum cryptographic infrastructure.

In China, QuantumCTek leads the domestic market, with over 500 government agencies connected via its 1,100-kilometer Hefei metro network. Australia’s QuintessenceLabs specializes in quantum random number generation for financial systems, while Singapore-based SpeQtral is emerging as a formidable force in space-based QKD, buoyed by government partnerships.

KEY INDUSTRY DEVELOPMENT

September 2024: Toshiba Corporation announced a collaboration with BT Group to create a quantum-secure network connecting important financial hubs in the U.K. This network is designed to improve transaction security for financial institutions by offering strong protection against future cyber assaults.

July 2024: ID Quantique worked with Swisscom to build a QKD-secured communication network for the Swiss government and defense applications. This demonstrates Switzerland’s strategic commitment to protecting sensitive national data with quantum technology

Source: https://www.fortunebusinessinsights.com/quantum-key-distribution-market-111470

Overcoming Adoption Hurdles

Despite rapid growth, the QKD market faces key obstacles. Trusted nodes—relay stations that temporarily store keys—remain a security concern, often requiring physical protection such as armed guards. Quantum repeaters, essential for truly end-to-end secure networks, are still in development and not expected to be viable before 2027.

Costs remain high, with a single node installation reaching $50,000, deterring smaller enterprises from adopting the technology. Compounding this is a widening skills gap: 44% of cybersecurity professionals report a lack of quantum literacy on their teams.

Emerging solutions aim to address these challenges. Cloud-based QKD platforms, such as Terra Quantum’s TQ42, offer scalable services without the need for physical infrastructure. Meanwhile, software-defined networking (SDN) integration trials—such as Telefónica’s successful QKD deployment in Madrid—are simplifying implementation and interoperability.

Lack of Standardization in QKD Protocols Hinders Large-Scale Implementation

While quantum key distribution (QKD) provides unsurpassed security benefits, the absence of defined protocols and legal frameworks creates a substantial obstacle to wider use. There are now several varieties of QKD protocols in use, including BB84, E91, and CV-QKD, each with its own set of requirements and operational procedures. This diversity makes integration into existing security infrastructures difficult, particularly for multinational enterprises and government agencies that rely on clear and unified standards to handle data security.

In May 2024, the International Telecommunication Union (ITU) published a paper warning that uneven quantum key distribution techniques might stymie large-scale adoption due to interoperability concerns that cause compatibility issues across different quantum networks. The ITU advocated developing a set of worldwide standards to facilitate QKD deployment and assure interoperability across businesses and nations. Until protocol standards are agreed upon, organizations may face increased expenses and operational issues, restricting quantum key distribution’s adoption in multi-stakeholder situations.

Future Outlook: The 2030 Inflection Point

By 2030, three major trends will likely define the trajectory of quantum security. First, quantum internet protocols will begin to take shape. China’s national vision includes global entanglement-based networks for applications such as secure voting and telemedicine. Second, the convergence of QKD with 5G and IoT systems is underway, with prototypes from SK Telecom showcasing secure smart factories. The growing need for encrypted data in IT and telecom sectors alone will drive demand at nearly 29% CAGR.

Lastly, the high costs of deploying space-based infrastructure will need to plummet. Today’s satellite launch price of over $50 million must fall below $5 million to make global QKD a reality. Commercial constellations launching toward the end of the decade are racing to achieve this target.

In the words of Yin Juan, lead scientist of the Micius satellite project, “Competition in quantum technology is a game of national comprehensive strength. China will dominate by controlling global quantum standards.”

Conclusion: The Encryption Paradigm Shift

Quantum key distribution has evolved from a theoretical novelty to a strategic asset in the fight against quantum-era cyber threats. Its applications are no longer confined to government or military networks but are extending rapidly into financial systems, healthcare, and beyond. China’s sprawling terrestrial-satellite hybrid deployments, Europe’s laser focus on regulatory standards, and commercial innovations from Toshiba and SealSQ are converging toward a singular truth: the encryption landscape is changing fundamentally.

By 2030, the world will see quantum-secured data flowing through smart cities, cross-border banking systems, and real-time military networks. In this new security economy, the question is no longer whether QKD will matter—but who will lead it. Delaying investment could mean falling behind in a race where the stakes are national security, digital sovereignty, and economic competitiveness.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis