The global IoT market is expected to reach a value of USD 1,386.06 billion by 2026 from USD 761.4 billion in 2020 at a CAGR of 10.53%, during the period 2021-2026. The internet of things technology helps in connecting various smart devices together to ease the operation and sharing of data amongst themselves. There are various smart devices, such as sensors, smartphones, and wearables, which collect necessary data from the devices which are further utilized to enhance customer’s experience. The increasing need for data analysis and integration of analytics is expected to propel the utilization of the Internet of Things market over the forecast period.

Besides the proliferation of connected devices, the continued adoption of machine-to-machine (M2M) technology will spur the development of a wide range of new consumer-centric services, or even facilitate new business models. In the age of the Internet of Things (IoT), people and things will be intelligently connected to one another, leading to innovations in business and Industry 4.0.

The growing adoption of IoT technology across end-user industries, such as manufacturing, automotive, and healthcare, is driving the market’s growth positively. With the traditional manufacturing sector amid a digital transformation, the IoT is fueling the next industrial revolution of intelligent connectivity. This is changing the way industries approach increasingly complex processes of systems and machines to improve efficiency and reduce downtime.

IoT is a network of internet-connected objects. These objects collect and exchange the data using sensors embedded within them. IoT has combined hardware and software with the internet to create a more technically-driven environment. The Internet of Things (IoT) can exist with conventional microcontrollers and SoCs, but issues such as low power requirements and wireless support have pushed development of platforms designed for IoT applications. One of the biggest challenges in building IoT solutions using legacy approaches is to connect millions of IoT devices to the cloud across different sensors, actuators, operating systems, compute power, and more, and it is widely agreed this has been slowing down IoT adoption.

IoT Module or IoT Chips

An IoT Module or IoT chip is a small electronic device embedded in objects, machines, and electronic devices. It connects to wireless networks and sends and receives data. Sometimes referred to as a “radio chip”, the IoT chip contains the same technology and data circuits found in mobile phones (but without a display or a keypad). Another key differentiator of IoT modules is that they provide always-on connectivity. This aspect is because IoT applications need to send data automatically, in real-time, without someone hitting a send button. Hardware security support is now a requirement. Specialized coprocessor support is also common from sensor integration and neural networks.

Many of the coprocessors found on IoT-oriented platforms are designed to do more, often targeted, processing using less power than using software alone on a conventional platform. One example is Intel’s Curie based around a 32-bit Quark SoC. It incorporates a 32-bit DSP for sensor fusion support as well as a 128-neuron pattern matching accelerator. The neural network is supported by General Vision’s CurieNeurons library. The module has Bluetooth Low Energy (BLE) support as well as a six-axis accelerometer and gyroscope.

IoT modules and IoT terminals use a variety of wireless technologies to stay seamlessly and securely connected. These range from : 5G, 4G, and 3G cellular solutions for high bandwidth applications like connected cars, to Low-Power, Wide-Area (LPWAN) solutions such as MTC (Machine Type Communication), Bluetooth and LoRa used for intelligent road systems, smart city applications, and enterprise applications.

They are engineered for extreme durability and longevity and need to operate continuously for a decade or more to justify the technology’s business case and cost. Unlike consumer devices typically carried by the end-user and used in controlled environments, IoT devices are often deployed in extreme environments and far-flung locations like shipping containers or under seawater in harbour management solutions. IoT environments can be tremendously demanding with extreme temperatures, vibration, and humidity. Besides, they’re often in remote, hard-to-reach locations, making it cost-prohibitive to send a technician out for repairs. IoT modules must be ruggedised to provide reliable connectivity without service interruption, regardless of location or wireless network.

IoT System on a chip (SoC)

A majority of these new IoT inventions will be implemented with a single system on a chip (SoC) to provide high levels of integration and it also allows the devices to operate with high power efficiency and security as it packs processors (MCU), RF transceivers, memory, power management, connectivity, and sensors in a single unit. A system on a chip or system on chip (SoC) is an integrated circuit (also known as a “chip”) that integrates all components of a computer or other electronic system on a single circuit die. As they are integrated on a single electronic substrate, SoCs consume much less power and take up much less area than multi-chip designs with equivalent functionality. Finally, SoCs are much cheaper to design and utilize when compared to multi-chip systems.

Nordic Semiconductor announced that Cloud of Things, a Tel Aviv, Israel-based Internet of Things (IoT) solutions company, selected its nRF52840 Bluetooth® 5.2/Bluetooth Low Energy (Bluetooth LE) advanced multiprotocol System-on-Chip (SoC) to provide the wireless connectivity for its DeviceTone Genie module. The DeviceTone Genie is a plug-and-play module designed for integration into any electronic product where the manufacturer wishes to introduce “production-grade” IoT capabilities and Microsoft Azure IoT Cloud support. For example, it can be used in lighting or utility metering applications to make luminaires or meters smart. The tiny 6 by 6cm module connects to a product via a UART, RS485, GPIO, or I2C interface, and comes pre-installed with a temperature sensor, GPS receiver, and Cloud of Things DeviceTone Nano firmware.

The Nordic nRF52840 SoC incorporates an Arm TrustZone CryptoCell™-310 cryptographic module and an AES 128-bit hardware accelerator. These features support a wide range of asymmetric, symmetric, and hashing cryptographic services offering end-to-end security for applications integrating the DeviceTone Genie module. In addition to best-in-class security, the nRF52840 SoC provides ample processing power and generous memory to handle the large volume of data generated by connected devices. The SoC combines a 64MHz, 32-bit Arm® Cortex® M4 processor with floating point unit (FPU), with a 2.4GHz multiprotocol radio (supporting Bluetooth 5.2, ANT™, Thread, Zigbee, IEEE 802.15.4, and proprietary 2.4GHz RF protocol software) with 1MB Flash memory and 256kB RAM.

IoT Chip Market

The IoT Chip Market was valued at USD 12133.8 million in 2020, and it is expected to reach a value of USD 25533 million by 2026, at a CAGR of 13.2% over 2021-2026. In the near future, 5G Network, artificial intelligence, machine learning, smart homes, smart cities, as well as an increase in the IoT connected devices in electronics and automotive segment are expected to drive market growth.

The key drivers for the growth of the IoT chip market are the development of internet connectivity in technologically advancing countries and the growth of low-cost smart wireless sensor networks. The growth of application-specific MCUs and flexible SoC-type designs, adoption of IPv6, which provides more IP address space, and technologies such as AI fueling IoT adoption are also expected to drive the IoT chip market. Concerns regarding the security and privacy of user data act as restraints for the market.

The IoT Chip Market is segmented by Product (Processor, Sensor, Connectivity IC, and Memory Device), End-user (Healthcare, Consumer Electronics, and Industrial), and Geography.

Logic devices, by hardware, is projected to be the fastest-growing segment in the IoT chip market

To implement IoT, the most common type of logic device used is a field-programmable gate array (FPGA). FPGA is an IC that is designed to be configured by a customer or designer even after manufacturing—therefore, the name “field-programmable.” FPGAs are programmed using hardware description languages, such as VHSIC Hardware Description Language (VHDL) or Verilog. FPGA offers advantages such as rapid prototyping, shorter time-to-market, ability to reprogram in the field for debugging, and long product life cycles. The significant increase in the shipment of logic devices can be attributed to the rising demand for wearables, e.g., smartwatches, especially in developing economies, such as China, India, and Brazil, as well as the increasing participation of domestic players in the wearables market.

Building automation, by end-use application, to hold the second-largest share in the IoT chip market

The demand for energy-efficient solutions, enhanced security, increased venture capital funding, and the constant need for improving the standards of living has led to the development of the building automation market. Building automation, which started with wired technology, has now entered the era of wireless technology with technologies such as ZigBee, Z-wave, EnOcean, Wi-Fi, and Bluetooth Smart revolutionizing the market. Moreover, the growing awareness of energy conservation, stringent legislation and building directives, promotion of numerous smart grid technologies, and the availability of a number of open protocols are driving the growth of the building automation market.

Consumer Electronics Segment is Expected to Expand With a Significant Rate

Currently, IoT is majorly adopted in home electronics, from entertainment to smart home control. Smart TV sets, washing machines, and home appliances are increasingly adopting IoT approaches and getting interconnected. Coupled with this, an increase in the demand for application-specific microcontroller units and flexible SoC type architecture are the major factors boosting the growth of IoT chips in the consumer electronics segment.

Moreover, wearable devices witnessed increased adoption in the market. These devices, in the beginning, caused inconveniences due to charging problems. In addition, the power provided by these batteries was also not sufficient to perform the standard computations and operate available features for the user throughout the day. These problems called for a huge demand for both hardware and software design improvements of the ultra-powered chips to cater to the communication requirements among the users as well as extend the battery life of the product.

Aerospace & defense, by end-use application, is projected to be the fastest-growing segment in the IoT chip market

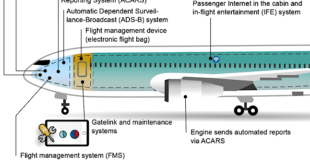

IoT provides connectivity and integration and equips the manufacturer with wide-ranging views of their operations in the aerospace & defense segment in the industrial application. The aerospace & defense end-use application uses sensors to capture comprehensive machine data. These sensors can be used on key equipment, machines, and vehicles. IoT offers numerous opportunities to airlines for the improvement of baggage handling and equipment monitoring.

Various airlines, such as Delta Air Lines (US) and British Airways (UK), have started adopting smart baggage tags to speed up the baggage and passenger check-ins and solve the problem of lost baggage. The switch of airlines from traditional barcodes to smart tags is changing the way people travel.

North America, by region, is expected to hold the largest share in the global IoT chip market

North America is expected to be a prominent market, owing to the growing role of IoT among the significant revenue-generating end-user industries of the region, driven by the deployment of connected cars, smart energy projects, home automation, and focus on smart manufacturing. Additionally, rapid digitalization across industry verticals and technological advancements have further fueled the growth of IoT in this region.

North America is a key market as it is home to some of the largest multinational corporations, such as Intel Corporation (US), IBM Corporation, Texas Instruments Incorporated (US), Dell (US), Microsoft Corporation, Google Inc, and Cisco Systems (US), in the IoT ecosystem.

Increased R&D in the field of IoT, in terms of new and improved technologies, and the increasing demand for improved lifestyles are the two crucial factors driving the growth of the North American IoT chip market. Increasing R&D, at both the academic and industry levels, is broadening the application areas of IoT in different industries, such as consumer electronics, retail, automotive and transportation, and healthcare, especially in the US. This is the main factor driving the growth of IoT applications in North America.

Competitive Landscape

The IoT chip market is highly competitive, with the presence of many big and small players in the market running their business in domestic as well as international boundaries. The market appears to be moderately concentrated with the major players adopting strategies, like product innovation and mergers and acquisitions.

Key Market Players

Intel Corporation (US), Texas Instruments Incorporated (US), Qualcomm Incorporated (US), NXP Semiconductors N.V. (Netherlands), MediaTek Inc. (Taiwan), Marvell Technology Group Ltd. (Bermuda), Microchip Technology Inc. (US), Cypress Semiconductor Corporation (US), Renesas Electronics Corporation (Japan), Huawei Technologies Co., Ltd. (China), NVIDIA Corporation (US), Samsung Electronics (South Korea), and Advanced Micro Devices (US) are a few major players in the global IoT chip market.

Intel Corporation (Intel) (US) ranked first in the global IoT chip market. Intel is a uniquely positioned company that powers the cloud and numerous smart and connected computing devices. Intel delivers computer, networking, and communication platforms to a broad set of customers, including OEMs, ODMs, cloud and communication service providers, and industrial, communications, and automotive equipment manufacturers. The company works through 6 operating segments—Client Computing Group (CCG), Data Center Group (DCG), Non-Volatile Memory Solutions Group (NVMS), Internet of Things Group (IoTG), Programmable Solutions, and Others. In the IoTG business segment, the company develops high-performance computing (HPC) solutions for targeted verticals and embedded markets. It specifically targets sectors such as retail, industrial, and smart cities/infrastructure.

Recent Developments

In March 2020, Marvell Technology Group launched the third generation ARM server processor ThunderX3 with 96 cores and 384 threads. Among the company’s server CPU products is the ThunderX line, whereas the first generation ThunderX2 was the first ARM server silicon that was deemed viable and competitive against Intel and AMD products.

April 2019 – IBM Corporation announced a collaboration with Sund & Bælt, which owns and operates some of the largest infrastructures in the world, to assist in IBM’s development of an AI-powered IoT solution designed to help prolong the lifespan of aging bridges, tunnels, highways, and railways.

In October 2019, NXP Semiconductors N.V. launched the i.MX RT1170 family of crossover MCUs that combine performance, reliability, and high levels of integration to propel IIoT, IoT, and automotive applications. The i.MX RT series addresses the growing performance needs of edge computing for IIoT, IoT, and automotive applications.

In November 2019, STMicroelectronics N.V. launched the ST8500 PLC wireless_IMAGEST8500 smart-meter chipset which integrates both radio frequency (RF) and powerline communication (PLC). Already widely used in smart electricity meters, STMicroelectronics’ ST8500 PLC chipset now enables smart meters to communicate through existing power cables or RF waves, combining the strengths of both types of connection. In addition, the built-in RF capability allows equipment designers to leverage the ST8500’s high feature integration and ease of use in other smart devices, such as gas and water smart meters, environmental monitors, lighting controllers, and industrial sensors.

In March 2020, Microchip expanded its silicon carbide (SiC) family of power electronics to provide system-level improvements in efficiency, size, and reliability. Microchip’s SiC family includes the commercially qualified Schottky Barrier Diode (SBD)-based power modules in 700, 1200, and 1700 V variants. The new power module family includes various topologies, including Dual Diode, Full Bridge, Phase Leg, Dual Common Cathode, and 3-Phase bridge, in addition to offering different current and package options.

March 2020 – Microsoft & Cisco Systems announced a partnership to enable seamless data orchestration from Cisco IoT Edge to Azure IoT Cloud. One of the outcomes of this collaboration would be to provide customers a pre-integrated IoT edge-to-cloud application solution.

January 2020 – Cisco introduced an IoT security architecture that provides enhanced visibility across both IT and IOT environments and protects processes. Cisco’s new solutions enable the collection and extraction of data from the IoT edge so organizations can increase efficiencies to make better business decisions and accelerate digitization projects.

References and Resources also include:

https://www.marketsandmarkets.com/Market-Reports/iot-chip-market-236473142.html

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis