Man-Portable Military Electronics: Transforming Soldiers into Networked Combat Nodes

How AI, advanced power systems, and next-generation wearable electronics are turning dismounted troops into intelligent nodes within the future combat cloud.

The landscape of man‑portable military electronics is undergoing a profound transformation. Once seen as simple radios or weapon sights, today’s systems are evolving into fully integrated, networked platforms that turn individual soldiers into intelligent nodes within a broader combat ecosystem. With global defense budgets surging and modern conflicts underscoring the need for rapid mobility, situational awareness, and survivability, these technologies are shaping the future of ground warfare.

Market Dynamics: Growth Fueled by Multi‑Domain Warfare

The market for man‑portable military electronics is expanding rapidly, with projections estimating US$ 10.9 billion in 2025, reflecting strong global demand for networked, mobile soldier systems. Growth is driven by the shift toward multi-domain operations, where dismounted forces operate in highly connected, contested, and unpredictable environments. Modern infantry units are now expected to act as “smart nodes,” integrating data from drones, sensors, and command systems to maintain information superiority and operational effectiveness.

The ongoing transformation emphasizes modularity, software-defined systems, and AI-enabled capabilities. Investments are being channeled not only into communications and optics but also into integrated platforms that combine navigation, targeting, and protection systems in compact, wearable form factors.

Technology at the Tactical Edge: From Radios to Augmented Reality

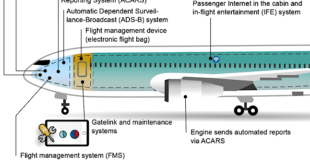

Communications continue to be the backbone of man‑portable systems. Software-defined radios (SDRs) are increasingly capable of operating across multiple bands, including satellite links, and dynamically adapt to interference, jamming, and bandwidth prioritization. AI-assisted waveforms allow real-time optimization, ensuring secure connectivity even in electronic warfare environments.

Surveillance and ISTAR capabilities are undergoing significant miniaturization. Micro-drones, now small enough to fit into a soldier’s pack, provide reconnaissance, persistent surveillance, and live targeting data. Advanced optics and augmented reality (AR) displays are enhancing situational awareness, overlaying contextual information, threat detection, and navigation cues directly into the soldier’s field of view.

Force protection technologies are also evolving. Lightweight wearable sensors can detect laser threats and enemy targeting, while integrated exoskeletons and structural battery innovations help manage load and increase endurance. Forward-looking systems aim to merge protection, mobility, and lethality without overwhelming the individual soldier.

Regional Trends: Investment and Modernization Across the Globe

North America remains a market leader, driven by continued soldier modernization programs and multi-domain operational concepts. The U.S. Army, for instance, continues to invest heavily in modular systems, augmented reality helmets, and AI-enabled tactical radios.

Europe is rapidly accelerating development of interoperable, next-generation soldier systems, partly in response to regional security dynamics and allied coordination requirements. Programs emphasize modularity, software-defined capabilities, and multinational standardization to ensure joint operational effectiveness.

Asia-Pacific is emerging as the fastest-growing region. Countries such as India, China, and Taiwan are heavily investing in dismounted soldier systems, balancing modernization with asymmetric warfare needs. Emphasis is being placed on compact, networked electronics, micro-drones, and advanced optics that can operate effectively in diverse terrains and high-threat environments.

Next-Generation Enablers: AI, Power, and Multi-Domain Integration

Artificial intelligence is increasingly being deployed directly on the battlefield. Edge computing enables AI algorithms to process data locally in real time, enhancing target recognition, threat assessment, and tactical decision-making without reliance on cloud connectivity. Autonomous drones and sensors integrated with soldier systems allow squads to extend situational awareness far beyond line of sight.

Power remains a critical enabler. Structural batteries and energy-harvesting technologies are reducing equipment weight, while fuel cells and next-generation high-density batteries are extending mission duration. These innovations are crucial as soldiers carry more sensors, communications gear, and computing devices than ever before.

Multi-domain integration ensures that the dismounted soldier is fully networked with aerial, ground, and space assets. Hybrid communication architectures combining mesh radios, cellular fallback, and satellite connectivity guarantee resilient operations, even in contested or denied environments. Biometric sensors and wearable electronics also allow commanders to monitor soldier health, cognitive load, and readiness in real time.

Leading Innovators and Emerging Players

Established defense firms continue to advance the state of the art. General Dynamics, Elbit Systems, Thales, and BAE Systems are delivering modular, software-upgradable soldier kits that combine communications, targeting, and navigation into compact systems.

At the same time, agile startups are introducing AI-native solutions, lightweight drones, and advanced power systems. Companies are exploring GPS-denied navigation, autonomous micro-drones, and edge AI processors that dramatically reduce latency and improve real-time decision-making at the squad level. This combination of established primes and innovative newcomers is accelerating the adoption of cutting-edge capabilities across armed forces worldwide.

Challenges: SWaP, Cybersecurity, and Interoperability

Despite rapid advancements, several challenges remain. The size, weight, and power (SWaP) trade-off continues to limit mobility and endurance, as integrated systems can weigh upwards of 50–60 lbs per soldier. Cybersecurity and electronic warfare threats also pose significant risks, as highly networked systems are increasingly targeted by adversaries. Ensuring resilience against jamming, interception, and hacking is a critical priority.

Interoperability across allied forces remains complex. Soldiers often rely on systems from multiple vendors or nations, and seamless integration of radios, sensors, and command platforms requires sophisticated gateway solutions. Addressing these challenges is essential for ensuring operational effectiveness and protecting personnel in multi-domain environments.

2025–2026 Forecast: Acceleration Toward the Combat Cloud

Over the next two years, the man-portable military electronics market will continue to accelerate. Soldiers will become increasingly integrated into a tactical combat cloud, with AI-assisted systems, autonomous drones, and modular electronics extending operational reach and awareness.

Edge AI will enable instantaneous target recognition and tactical decision support, while improved power solutions will reduce the burden of carrying advanced electronics. Interoperable systems will allow multinational forces to operate cohesively, sharing data securely and in real time. Human-machine teaming will mature, allowing squads to command autonomous systems and leverage unmanned assets in dynamic environments.

Forward-deployed 3D printing and additive manufacturing capabilities will begin to support on-site replacement of critical components, transforming logistics and sustainment. Biometric and cognitive monitoring will enhance force readiness and safety, allowing commanders to anticipate and respond to physical or cognitive fatigue.

Conclusion: Soldiers as Intelligent, Connected Nodes

The evolution of man-portable military electronics is fundamentally changing the battlefield. Soldiers are no longer just operators of weapons—they are integrated, intelligent nodes in a networked combat system. With AI, advanced power solutions, and multi-domain integration, the dismounted soldier of 2025–2026 will be smarter, more connected, and more resilient than ever before.

Victory in the future will favor forces that can seamlessly connect humans, machines, and sensors in a dynamic, adaptive, and intelligent mesh. The soldier of the future is not merely a combatant; they are the central node of a distributed, information-rich, and decisive battlefield network.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis