Beyond Moore’s Law: The Rise of Spin-Based Electronics

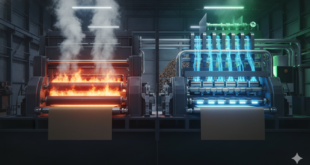

For decades, the semiconductor industry has been driven by Moore’s Law—the relentless pursuit of fitting ever more transistors onto ever smaller chips. Yet as silicon-based electronics near their physical limits, fundamental quantum effects begin to disrupt conventional operation, and escalating power dissipation threatens efficiency and reliability. These challenges have created the need for a new computing paradigm capable of sustaining progress beyond the constraints of traditional silicon technology.

Spintronics offers a compelling solution by leveraging the intrinsic quantum property of electrons known as spin, rather than relying solely on their charge. This approach enables devices that are denser, faster, and more energy-efficient, while providing non-volatile data storage that persists without power. By harnessing spin, researchers and engineers are opening doors to transformative applications—from ultra-efficient consumer electronics and next-generation memory solutions to powerful quantum computing architectures—heralding a new era in information processing.

From Niche Technology to Mainstream Revolution

The global spintronics market is poised for explosive growth, transforming from a $1.59 billion industry in 2024 to a projected $40.26 billion by 2034, representing an unprecedented 38 percent compound annual growth rate. This remarkable expansion underscores that spin-based electronics is transitioning from a laboratory curiosity to a commercial reality, fueled by the insatiable demand for energy-efficient, high-speed memory and processing technologies.

Spintronics leverages the quantum spin property of electrons rather than relying solely on their charge, offering non-volatility, ultra-low power consumption, and higher integration densities. As conventional semiconductor scaling approaches physical limits, spintronics emerges as the technology capable of extending Moore’s Law into the next decade.

Market Drivers and Key Segments

Asia Pacific currently leads the spintronics market, commanding 46 percent of the global share in 2024. This dominance is driven by semiconductor manufacturing hubs and large-scale consumer electronics production. North America is emerging as the fastest-growing region, fueled by government investments and quantum computing initiatives, while Europe maintains a strong position, particularly in automotive and industrial applications.

In terms of applications, Magnetic Random-Access Memory (MRAM) dominates memory devices with 42 percent of the market, gradually replacing traditional DRAM and Flash in premium applications. Spin-based logic gates are showing rapid growth as researchers develop spin-based processors, and spin qubits are emerging as a high-value segment in quantum computing research. Materials innovation also plays a central role, with ferromagnetic materials currently leading due to established manufacturing ecosystems. Graphene and other 2D materials are growing quickly, offering superior spin coherence properties, while semiconductor materials allow integration with conventional CMOS processes.

End-user adoption spans multiple sectors. Consumer electronics drive volume through smartphones, wearables, and laptops, while the automotive sector is growing fast, integrating spintronics for advanced driver-assistance systems (ADAS) and electric vehicles (EVs). Data centers increasingly adopt MRAM to reduce energy consumption and improve memory reliability, reflecting the broad versatility of spintronic technology.

Technological Breakthroughs Driving Adoption

MRAM has become mainstream, with major semiconductor manufacturers integrating it as a successor to traditional memory. Samsung has embedded MRAM in its 28nm FD-SOI process, TSMC offers 22nm MRAM for IoT applications, and Renesas launched AI microcontrollers with embedded MRAM in 2025. Spin logic devices, including Spin-FETs, demonstrate up to ten times lower power consumption than conventional transistors, while neuromorphic computing and quantum spin systems advance toward practical deployment.

Manufacturing innovations are further accelerating adoption. CMOS-compatible processes enable seamless integration with existing semiconductor infrastructure, while 3D stacking technologies allow unprecedented device densities. Advanced deposition techniques improve yield and performance consistency, paving the way for scalable, reliable spintronic devices.

Artificial intelligence is also playing a transformative role. Machine learning accelerates materials discovery by analyzing quantum properties to identify optimal spintronic compounds, reducing development cycles from years to months. AI-driven simulations predict device performance under various conditions, enabling virtual prototyping and minimizing expensive fabrication iterations. Computer vision enhances nanoscale fabrication, improving yield and consistency, while spintronic devices themselves naturally emulate neural behavior, making them ideal for AI hardware acceleration with superior energy efficiency.

Spintronics Market Segments

The spintronics market can be understood through several lenses, including application, material, device type, and end-use industry. Each segment highlights the diverse potential of spin-based technologies and the rapid adoption across multiple sectors.

Application Revolution: Memory Leads, Logic Follows

Memory devices dominate the spintronics landscape, with Magnetic Random-Access Memory (MRAM) accounting for roughly 42 percent of the market. MRAM is gradually replacing traditional DRAM and Flash in premium applications due to its non-volatility, energy efficiency, and high-speed performance. Among memory technologies, variants such as STT-MRAM and Toggle MRAM are gaining traction, providing versatile solutions for both consumer electronics and enterprise systems. Spin-based logic gates, meanwhile, are emerging as the fastest-growing segment, as researchers develop spintronic processors that promise ultra-low power consumption and compact device footprints. In parallel, spin-based quantum computing elements represent a premium innovation segment, offering unparalleled potential for high-performance computation and information security.

Materials Evolution

The materials used in spintronics are critical for device performance. Ferromagnetic materials, including cobalt, iron, nickel, and alloys such as permalloy, currently lead the market, supported by well-established manufacturing ecosystems. Graphene and other two-dimensional materials are experiencing rapid growth due to their superior spin coherence properties, which enhance signal stability and efficiency in spin-based devices. Semiconductor materials such as gallium arsenide, silicon, and indium arsenide facilitate integration with existing CMOS processes, while oxide materials and multiferroics are being explored for next-generation functionalities that combine magnetic, electronic, and optical properties.

Device Types

Spintronic devices can be broadly classified into metal-based and semiconductor-based technologies. Metal-based devices include Giant Magnetoresistance (GMR) and Tunnel Magnetoresistance (TMR) sensors, spin valves, and specialized devices such as spin-torque nano-oscillators. Semiconductor-based devices, on the other hand, include spin field-effect transistors (Spin-FETs), spin diodes, spin filters, and resonant tunneling diodes. These devices form the backbone of applications ranging from high-speed memory and logic systems to advanced sensors and optoelectronic components.

End-User Adoption

Spintronics is finding applications across a wide range of industries. Consumer electronics remain a major driver, with smartphones, wearables, and laptops leveraging MRAM and spin-based sensors to improve energy efficiency and performance. The automotive sector is experiencing rapid growth, using spintronic devices in advanced driver-assistance systems (ADAS), infotainment systems, and electric vehicle power management. Data centers increasingly adopt MRAM for high-density, low-power memory solutions, while industrial automation and robotics benefit from precision sensors. Healthcare applications, including biosensing and medical imaging, are expanding rapidly, and defense and aerospace sectors are exploring spintronics for secure communication, navigation, and advanced R&D initiatives.

Industry Applications and Use Cases

Spintronics is transforming data centers and cloud computing by replacing SRAM and DRAM in cache memory, cutting power consumption by up to 80 percent. Non-volatile MRAM enables instant-on operation and simplifies backup systems, while higher memory density allows more data to be stored per server rack.

The automotive sector benefits from spintronic TMR sensors that provide precise motor control in EVs, while MRAM integrated into ADAS delivers fault-tolerant memory for safety-critical systems. Radiation-hardened spintronic devices ensure reliability in harsh automotive environments. Consumer electronics, from smartphones to AR/VR devices, leverage spintronics for improved navigation, user interfaces, and battery efficiency, offering seamless high-speed performance.

Quantum computing is another emerging application, with spin qubits forming a promising architecture. Spin-based quantum memory enables secure information storage, while spintronic quantum sensors offer unprecedented measurement precision, further expanding the technology’s potential.

Geographical Outlook: Global Spintronics Expansion

The Asia Pacific region has emerged as the dominant force in the global spintronics market. In 2024, the market in this region was valued at USD 1.01 billion and is projected to reach approximately USD 18.72 billion by 2034, growing at a staggering CAGR of 38.32% from 2025 to 2034. Asia Pacific’s leadership stems from its high concentration of semiconductor manufacturing hubs, sophisticated electronics production facilities, and strong research and development capabilities. Large-scale investments from tech giants, robust government support for next-generation memory technologies, and a growing consumer electronics and automotive sector all contribute to this remarkable growth. The region’s skilled workforce and active academic-industry collaborations further position it as a global innovation leader in spintronic technologies.

North America, meanwhile, is the fastest-growing region in the spintronics market. Federal funding from organizations like DARPA, coupled with active private investment, has accelerated the development and commercialization of MRAM, spin logic devices, and other spintronic solutions. The presence of key players in aerospace, defense, and data center sectors, alongside leading universities conducting cutting-edge spin-based computing research, fuels rapid adoption. Additionally, early initiatives in quantum computing and AI hardware integration provide a strong foundation for future market expansion in the region.

Europe maintains a strong position, driven primarily by automotive, industrial, and high-performance computing applications. Countries such as Germany, France, and the Netherlands lead research in spin-based sensors, MRAM, and spintronic devices for industrial automation. European governments’ focus on energy-efficient electronics and support for next-generation semiconductor manufacturing further reinforce the market’s growth. Collaborative consortia and technology clusters, such as those in the EU’s Horizon research framework, enhance knowledge sharing and accelerate product development.

Emerging regions, including the Middle East, Latin America, and Africa, are gradually entering the spintronics landscape. While current adoption is limited due to infrastructure and investment gaps, growing demand for advanced memory solutions, energy-efficient electronics, and automotive technologies is expected to spur development. Strategic partnerships, technology transfers, and increasing access to global supply chains may enable these regions to become niche markets for specialized spintronic applications in the next decade.

Key Industry Players in Spintronics

The spintronics landscape is shaped by a mix of established semiconductor giants, specialized memory manufacturers, and innovative startups pushing the boundaries of spin-based technology. NVE Corporation and Spin Memory Inc. are at the forefront of research and development in spintronic devices, focusing on magnetic sensors and high-performance memory solutions. Everspin Technologies Inc. has emerged as a leading provider of MRAM products, offering non-volatile memory solutions for enterprise, automotive, and industrial applications.

Major semiconductor and technology corporations are also heavily invested in spintronics. Qualcomm Technologies Inc., Intel Corporation, and Samsung Electronics Co. Ltd. are exploring spintronic architectures for low-power, high-speed memory and logic applications, while Toshiba Corporation and IBM Corporation are integrating MRAM and other spin-based technologies into commercial products and experimental computing systems. Advanced Micro Devices (AMD), Infineon Technologies AG, and STMicroelectronics N.V. are leveraging spintronics to enhance automotive electronics, IoT devices, and industrial automation systems.

Several companies are applying spintronics to niche or emerging applications. Honeywell International Inc. and Applied Spintronics Technology, Inc. are developing spintronic sensors for aerospace, defense, and industrial environments. Memory manufacturers like SK hynix Inc., Micron Technology, Inc., and Renesas Electronics Corporation are focusing on MRAM integration for data centers, automotive, and IoT use cases. Meanwhile, technology conglomerates such as Hitachi Ltd., Canon Inc., and Fujitsu Ltd. are exploring spintronic applications for advanced imaging, computing, and industrial systems. Western Digital Technologies, Inc. continues to innovate in data storage, incorporating spintronic devices to increase density, reduce power consumption, and improve performance.

Collectively, these companies represent the diverse and rapidly evolving ecosystem of spintronics, from fundamental research and material development to commercial deployment in memory, logic, sensing, and next-generation computing technologies. Their combined efforts are driving the commercialization of spintronics and positioning it as a transformative force in electronics and computing over the next decade.

Challenges and Opportunities

Technical challenges remain, including maintaining spin coherence at room temperature, ensuring nanoscale manufacturing consistency, and integrating spintronic devices with conventional CMOS processes.

Despite its tremendous potential, spintronics faces several technical hurdles that must be overcome for widespread adoption. Maintaining spin coherence at room temperature remains a significant challenge, as environmental interactions can disrupt the delicate spin states critical for device operation. Achieving manufacturing consistency at the nanoscale also requires advanced process control and precision fabrication techniques, particularly for devices like spin transistors and MRAM. Additionally, integrating spintronic components with conventional CMOS technology introduces design complexity, as engineers must ensure seamless compatibility while preserving the unique advantages of spin-based operation.

On the market side, spintronics presents compelling opportunities across multiple sectors. The global memory replacement market alone is expected to exceed $20 billion as DRAM and Flash memory approach their physical scaling limits, creating strong demand for MRAM and other spin-based alternatives. Emerging Internet of Things (IoT) applications further drive the need for ultra-low-power solutions that only spintronic devices can deliver, from wearables to smart sensors. Moreover, the convergence of quantum technologies with spintronics is opening entirely new market categories, enabling innovative computing architectures, secure communications, and advanced sensing platforms that extend well beyond conventional electronics.

Taken together, these challenges and opportunities illustrate the dual nature of the spintronics landscape: while technical complexities remain, the market potential is vast. Companies that successfully navigate these hurdles stand to gain a competitive edge in a rapidly growing, high-impact field poised to redefine electronics and computing for the coming decades.

Yet the market opportunities are immense. Spintronics can capture a multi-billion-dollar memory replacement market as DRAM and Flash reach their scaling limits. Ultra-low-power solutions are increasingly needed for IoT devices, and the convergence with quantum technologies is creating entirely new categories beyond conventional computing.

Future Outlook: 2034 and Beyond

As we look toward 2034, spintronics is poised to transform both conventional and emerging technologies. Advancements in three-dimensional device architectures will allow unprecedented integration densities, while room-temperature quantum spintronics is expected to transition from experimental laboratories to commercial applications. Hybrid optical-spintronic systems, combining spin-based electronics with photonics, will unlock new possibilities in ultra-fast communication, high-speed computing, and advanced sensing, creating platforms that were previously impossible with traditional electronics.

Beyond computing, spintronic technologies are expected to penetrate sectors such as healthcare, energy, and aerospace. Biosensors leveraging spin-based detection will enable rapid, non-invasive diagnostics, while spin phenomena will support innovative energy harvesting solutions. In space and defense applications, spintronic devices will offer radiation-hardened performance, high reliability, and ultra-low power operation—qualities critical for satellites, spacecraft, and mission-critical systems. These developments signal that spintronics will not only enhance existing technologies but also enable entirely new classes of applications.

The competitive landscape is set to evolve alongside these technological advances. Traditional semiconductor companies are likely to continue acquiring spintronics startups to expand their portfolios, while Asian manufacturers are expected to dominate high-volume production. At the same time, specialized firms focusing on spintronic intellectual property and niche applications will emerge, driving innovation and shaping the market ecosystem. Collectively, these trends indicate that spintronics will become a foundational technology, influencing industries ranging from consumer electronics to quantum computing and defense systems.

Conclusion: The Spin Revolution Accelerates

The trajectory of the spintronics market—from $1.59 billion in 2024 to over $40 billion by 2034—represents one of the most dramatic transitions in semiconductor history. Its growth is underpinned by fundamental advantages in power efficiency, performance, and scalability. As research breakthroughs continue to remove technical limitations and companies integrate spintronic solutions into mainstream products, spintronics is set to evolve from enabling technology to foundational technology across computing, memory, AI, and quantum applications.

The age of spin-based electronics has arrived, and it is moving at quantum speed.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis