The semiconductor industry is the aggregate of companies engaged in the design and fabrication of semiconductors and semiconductor devices, such as transistors and integrated circuits. The semiconductor industry is in turn the driving force behind the wider electronics industry.

The amazing development of electronics in the past decades, from early radio, telephone, TV enabled by the vacuum tubes to the personal computers, cell phones, the Internet, and GPS provided by microcircuit revolution, has transformed almost every aspect of our lives including communication, work, transport, health and entertainment.

The revolution is still continuing, every computing device including smartphone, tablets, or PCs are transitioning to their smaller, lighter, and portable versions with higher DPI screens and multimedia capability; the traditional user interfaces are becoming transformed to those based on touch and gesture recognition. Smart phones are leading the revolution of convergence of communication, computation, gaming, and entertainment. The Internet, has transformed our whole world into a single global village. In the future the electronics is well poised to make intelligent decisions and perform creative thinking on our behalf.

Electronics has been a critical enabler in all the major wars; Sonar technology and Airborne Reconnaissance in World War 1; Radars, SIGINT, ballistic computers and transportable radio communications in World War II; Night vision devices, GPS/INS Navigation, Satellite early warning and Smart bombs In Gulf War; Network Centric Warfare, language translation and advanced radios in IRAQ War and digital radios, MALE/HALE UAVs and satellite imagery in AFGANISTAN Wars. The breakthroughs in electronics have resulted in significant enhancement of military capability in many areas like intelligence, surveillance and reconnaissance, target acquisition; command, control, and communications; electronic warfare, directed energy weapons, missiles and missile defence.

Microelectronics and solid state components have been the backbone of the military systems. Microelectronics has been steadily growing in performance and complexity after the invention of the transistor in 1948 at Bell Laboratories and the Integrated Circuit in 1959 at Texas Instruments.

The most widely used semiconductor device is the metal-oxide-semiconductor field-effect transistor (MOSFET). The MOSFET, which accounts for more than 99% of all transistors, is the driving force behind the semiconductor industry and the most widely manufactured device in history.

The Silicon Integrated Circuits, Very High Speed Integrated Circuits (VHSICs) and Microwave/Millimeter Wave Monolithic Integrated Circuits (MIMIC) were main contributors in advancement of radar, communication and electronic warfare systems. RF Technology and Integrated Circuits have also been key driving force behind the revolution in the personal communications & networking.

In modern warfare, decisions are driven by information coming from, for example, thousands of sensors providing ISR (intelligence, surveillance, and reconnaissance) data, logistics/supply-chain data, and personnel performance measurements. “Utilization of this data relies on computational algorithms running at huge scale.” Next-generation intelligent systems supporting Department of Defense (DoD) applications in artificial intelligence, autonomous vehicles, shared spectrum communication, electronic warfare, and radar will require processing efficiency orders of magnitude better than what is offered by current commercial electronics. Reaching the performance levels required by our Nation’s needs will require development of highly complex SoC platforms leveraging the most advanced integrated circuit technologies.

Moore’s Law which stated that the number of transistors on a chip will double approximately every two years has been the driver of semiconductor industry in boosting the complexity, computational performance and energy efficiency while reducing cost. These trends are driving forces of technological developments and progress that have led to greatest commercial benefits and the greatest gains in defense capabilities.

Unfortunately, as the complexity of chips has rapidly increased in line with Moore’s law predictions, recent years have seen an explosion in the cost and time required to design advanced SoCs, PCBs, and SiPs. Moore’s Law still applies, but the design work and fabrication now required to keep on pace is becoming ever more difficult and expensive. “The current trajectory is straining commercial and defense developments,” said Chappell. We’ve got underlying trends where the physics is already hard and getting harder. And that’s expressing itself in the cost across the board, whether that’s design, manufacturing, or even writing the software on top of a system-on-chip. Most aspects of electronics are getting more expensive, and larger design teams are needed to manage the underlying complexity. That has consequences across commercial industry and across the defense industry.

The manufacturing chain for any given semiconductor is extraordinarily complex and relies on as many as 300 different inputs, including raw wafers, commodity chemicals, specialty chemicals, and bulk gases; all are processed and analyzed by upwards of 50 different types of processing and testing tools. Those tools and materials are sourced from around the world, and are typically highly engineered. Further, most of the equipment used in semiconductor manufacturing, such as lithography and metrology machines, rely on complex supply chains that are also highly optimized, and incorporate hundreds of different companies delivering modules, lasers, mechatronics, control chips, optics, power supplies, and more. The “installed base” within a semiconductor factory today represents the cumulation of hundreds of thousands of person-years of R&D development. The manufacturing process that integrates them into a single manufacturing chain could represent hundreds of thousands more.

The types of products for which these manufacturing processes are designed are nearly as varied as the manufacturing inputs themselves. There are at least 20 major semiconductor product categories (from optical sensors to battery management modules to CPUs) and each category usually contains hundreds of different stock keeping units—distinct items for sale—for specialized applications. This complexity leads to a large market filled with myriad niches, in which specialized world-class companies have built defensible market positions through decades of targeted research and development.

Complexity also makes semiconductors a winner-take-all industry. The top one or two players in any given niche—whether a small one, such as furnaces, or a giant one, such as server CPUs—earn all the economic profits in that niche due to scale, learning efficiencies, and high switching costs for customers. It is rare to see newcomers break into these oligopoly positions. For instance, the market leader in graphics processing units (GPUs), Nvidia, invented the segment in 1999 and never relinquished its lead. While China has early-stage startups in the GPU segment, its market share is essentially zero. TSMC, based in Taiwan, was the first dedicated competitor in the foundry segment and has not relinquished its lead in its 33-year history. Indeed, SMIC, China’s leading competitor in the foundry segment, remains four or five years behind TSMC in technology, despite almost two decades of investment.

In June 2017,DARPA announced the Electronics Resurgence Initiative (ERI) as a bold response to several technical and economic trends in the microelectronics sector. Among these trends, the rapid increase in the cost and complexity of advanced microelectronics design and manufacture is challenging a half-century of progress under Moore’s Law, prompting a need for alternative approaches to traditional transistor scaling. Meanwhile, non-market foreign forces are working to shift the electronics innovation engine overseas and cost-driven foundry consolidation has limited Department of Defense (DoD) access to leading-edge electronics, challenging U.S. economic and security advantages. Moreover, highly publicized challenges to the nation’s digital backbone are fostering a new appreciation for electronics security—a longtime defense concern.

Market Growth

In 2021, the sales of semiconductors reached a record $555.9 billion, up 26.2 percent with sales in China reaching $192.5 billion, according to the Semiconductor Industry Association. A record 1.15 trillion semiconductor units were shipped in the calendar year. The semiconductors is projected to reach $ 726.73 billion by 2027.

Data reflects that the market is driven by rising demand for consumer electronics, the growing automotive semiconductor market, the emerging internet of things (IoT) market and investments into New Product Development and R&D. Consumer electronics are primarily fueling the market due to demand for products such as tablets, smartphones, laptops and wearable devices.

Additionally, the emergence of Articial Intelligence (AI), Growth in cloud computing, Internet of Things (IoT), and machine learning (ML) technologies is providing new opportunities to the market development. These technologies aid memory chips to process large data in less amount of time. Moreover, the increasing demand for faster and advanced memory chips in industrial applications will drive the market growth over the forecast timeline.

For 2022, IDC sees continued resilience in semiconductor sales worldwide with the cloud, network infrastructure, and automotive markets maintaining secular growth and semiconductor content per system increases as volumes moderate through the second half of the year. Long-term agreements put into place by foundries and fabless and IDM suppliers during the semiconductor shortages of 2021 will support ASPs and bring demand visibility for semiconductor vendors this year, supporting capacity expansions, particularly in more mature process lines. In the memory market, IDC forecasts DRAM and flash growth of 18% and 26% respectively in 2022 despite price attrition expected later this year. Challenges that will create headwinds for the global economy include inflation and the fiscal policies to address it, as well as the shutdowns in China and the impact of the Ukraine-Russia war. With Shanghai beginning to relax restrictions and open at the end of June coupled with stimulus policies to restart the economies in cities under lockdown, the China economy could moderately recover in 2H 2022.

Driving factors

Rising Consumption of Consumer Electronics Goods to Aid Growth

Rising household disposable income levels, coupled with the rapidly growing population and increasing urbanization, is creating massive demand for regular and advanced consumer electronics devices. IC (Integrated Circuit) chips are integrated in several electronics devices,

including smartphones, washing machines , TVs, and refrigerators for their efficient and appropriate functioning. Several leading consumer electronics brands, including Samsung, Apple, and Huawei, are making large investments in introducing new devices to cater to the increasing consumer demand for advanced devices, supporting the semiconductor industry growth.

These 5G phones will support a peak download rate of 1Gbps, which can support multiple streams of 8K video. There will be the need for very high performance processing and very low power consumption. While high performance was the key driver for the adoption of new-generation semiconductors in the past, low power consumption combined with low cost will be the key driver in the future.

China is emerging to be one of global leader in the 5G protocol, which includes infrastructures such as base stations, networking and transmission equipment, and smartphones. The result is that the demand for advanced semiconductors will grow rapidly in China in the 2020 to 2025 time frame. The semiconductor products consumed within the 5G ecosystem will need to be leadership in performance and power consumption on a global basis, which can be supported by 10/7nm.

Increasing Demand for Integrated Circuits in Developing Economies to Boost Market Growth

China is expected to witness strong demand for mobile chips, due to establishment of manufacturing and assembling plants of several well-known smartphone manufacturers such as Apple and Oneplus. Moreover, Taiwan’s industry depicts significant growth, reflected through the

huge number of Taiwanese personal computer manufacturers and their increasing investments in the research an development.

Restraining factors

COVID-19

Since the onset of COVID-19 in early 2020, the industry has been facing several challenges to maintain stable growth. The entire technology industry is trying to recover from the US-China trade war and 2019’s down cycle. The International Data Corporation (IDC) estimates revenue contraction of approximately 6% in 2020 (with 54% of probability) for the global semiconductor industry over the forecast period.

The sudden outbreak of COVID-19 in Wuhan, China, which is also known as the “motor city”, has severely impacted automotive production in Asia, as it is the home to auto plants of General Motors, Honda, Nissan, Peugeot Group (PSA), Renault, and Toyota.

The United Nations Conference on Trade and Development (UNCTAD) has estimated that 2% reduction in the export of parts from China to other automotive manufacturers in the European Union (EU), the U.S., South Korea, Japan, and many more could lead to automotive export reduction worth USD 7 billion from these economies to the rest of the world. However, the rising need to work from home has drastically surged the networking & communication and data processing applications all over the world, which will lead to moderate growth of this market in the long-term.

Tari Disruption and Shift in Global Trade to Hamper Growth

U.S. trade sanctions have dealt a serious blow to China’s goal of becoming self-sufficient in semiconductor manufacturing in the next 10 years. But the U.S.-China trade war also has rattled global semiconductor stocks. The U.S. late last year imposed restrictions on trade between U.S. companies and China’s telecom giant Huawei Technologies. In September, the U.S. raised the bar to include Semiconductor Manufacturing International Corp., or SMIC.

The industry is enormously dependent on the United States as the country has been a prominent region, holding a dominant share in the market. With changes in the country’s leadership, the U.S. has started to impose trade restrictions with China from 2018 and if the restrictions continue, the country is expected to suffer a ~16% decrease in their market share.

Therefore, increasing tension with China is expected to diminish the dominance of the U.S. market and the focus is expected to shift to Asia Pacific in the coming years. Furthermore, tarifs are applied to practically all the industrial goods and materials, which are customary for the chips. These tarifs are impacting import and export of components, which will directly affect the manufacturing cost of the chips.

Semiconductor Technology Trends

The most widely used semiconductor device is the MOSFET (metal-oxide-semiconductor field-effect transistor, or MOS transistor), which was invented by Mohamed M. Atalla and Dawon Kahng at Bell Labs in 1959. MOSFET scaling and miniaturization has been the primary factor behind the rapid exponential growth of semiconductor technology since the 1960s. The MOSFET, which accounts for 99.9% of all transistors, is the driving force behind the semiconductor industry and the most widely manufactured device in history,

The logic CMOS is predicted to encounter its downsizing limit around the gate length of 5 nm, presumably due to the huge off-leakage current in the entire chip. Two types of FET’s, the Si-nanowire FET and the alternative channel (such as GaAs and Ge) FET, have shown promise to replace current planer bulk CMOS. Si-nanowire FETs would have edge for adoption and more promising due to its compatibility with current Si CMOS process technologies. The Si-nanowire FET has higher on-current conduction due to their quantum nature and also because of their adoptability for high-density integration including that of 3 dimensional stacked layer structure

New device structures will be in initial volume production in 2020 to 2025, with nanowires being a potential option for the next generation of structure after FinFETs. The reality is that it can take 10 years between high volume products and the initial demonstration of a viable product. Furthermore, no device structure has demonstrated a high probability of production volume for microprocessors to date. As a result, FinFET structures are expected to be the mainstream approach for advanced feature technology through 2025. Another expectation is that there will be continued enhancements to 3-D structures, and the 7nm design structures of IBM have some significant technology enhancements. IBM, however, is unlikely ahead of Intel in 3-D structures, especially in the ability to support high volume manufacturing.

The Microelectronics and solid state devices, enabling technologies for radars, communications and EW is also advancing. The Si/CMOS/SiGe technologies are being employed for affordability, GaN for power and linearity, InP HEMT for speed and low noise, MEMS for low loss switching, chip stacking and 3D integration technologies for compactization.

In Microelectronics area, wide bandgap semiconductors, namely Gallium Nitride High Electron Mobility transistors (GaN-HEMT) technology has resulted in development of highly efficient amplifiers which has wide applications for mobile wireless communications, satellite communications and radars. In future GaN technology shall enable millimeter wave communications. The limitations of silicon power device are being alleviated with development of SiC, a wide-bandgap semiconductor. SiC shall enable increased power density, high temperature operation and high breakdown strength operation of power devices. Low noise and power transistors shall require development of the following materials and device technologies: GaAs PHEMT, SiGe, GaAs MHEMT, InP HEMT, GaN HEMT and InP HBT. The compound semiconductor materials (GaSb, InAs, and AlSb) materials enable extremely low noise mm-wave receivers and sub-one-volt mixed signal logic as a result of their extremely high mobility and saturated electron velocity.

Memory supply and consumption will also primarily be in Asia, with modules that include memory chips and controller functionality. In addition, memory component vendors will become memory solution vendors, where there will be the need for supporting software in the various types of application being addressed, such as cloud computing. The result is that the composition of the semiconductor market will be significantly different in 2020 to 2025 than is the case at the present time.

The “More than Moore” domain encompasses the engineering of complex systems through heterogeneous integration (in SOC or SIP) of various technologies. The “More-than-Moore” approach allows for the non-digital functionalities to migrate from the system board-level into the package (SIP) or onto the chip (SOC). These More than Moore technologies shall support development of wearable and implantable systems, ultra-low power sensor nodes, reprogrammable, multifunction digital RF components and intelligent microsystems

Advancements in AI, IoT , and wireless connected devices is creating a huge demand across the globe. For instance, Micron Technology, Inc. is offering high capacity memory and multi-chip packages powered with AI training that are utilized in embedded or cloud in edge devices and mobile. The key semiconductors in IoT applications include controllers, wireless connectivity, and embedded nonvolatile memory. A critical requirement in the IoT semiconductor market is ultra-low power (ULP), which can require using specialty wafer processes. TSMC is addressing these opportunities with its ULP wafer processes, and Globalfoundries is supporting FD SOI technology.

A majority of these new inventions are equipped with a single system on a chip (SoC) to offer high levels of integration. Additionally, SoC also allows the devices to operate with high power efficiency and enhanced security, as it integrates processors, memory, RF transceivers, sensors, power management, and connectivity in a single unit.

As semiconductor technology begins to advance, new segments are swiftly being integrated into the market, such as Machine Learning. The global machine learning sector is expected to grow from USD 1.41 Billion in 2017 to USD 8.81 Billion in 2022 while registering a CAGR of 44.1% during the forecast period. The segment is rapidly growing due to many businesses adopting machine learning to gather intelligence for security and consumer interaction benefits, which can help eliminate human errors. However, machine learning is also being integrated into modern day technology, such as the automotive industry, to build autonomous vehicles.

Segmentation

By Components Analysis

Memory Devices Segment to Depict the Highest CAGR with Wider Range of Applications Memory devices are expected to drive the overall market owing to the ongoing technological advancements such as virtual reality and cloud computing and their integration in end-user

devices. High average selling price for NAND ash chips and DRAM play a major role in

Similarly, logic devices, which are used for special purpose application-specific signal processors (ASSP) and application-specific integrated circuits (ASIC), are projected to display the highest growth rate over the forecast period. MPU (microprocessors) and MCU (microcontroller) segments depict stagnant growth owing to frail shipments and investments for notebook PCs, computers, and standard desktops. In the

current market scenario, the increasing popularity of IoT-based electronics is stoking the demand for powerful processors and controllers. Hybrid MPU and MCU offer real-time embedded processing and controlling for topmost IoT-based applications, thus leading to substantial market growth.

Analog ICs are anticipated to portray progressive growth with limited demand from the networking and communication industry. Few emerging trends for the growing demand of analog integrated circuits include signal conversion, automotive-specific analog applications and power management, hence enabling the rising demand for discrete power devices.

Comparatively, sensors are projected to witness moderate growth owing to the changing requirement of hybrid and mix technologies in the communication and automotive industries. The others segment consists of DSP (digital signal processing) that is likely to show decent

growth, owing to low demand in this industry

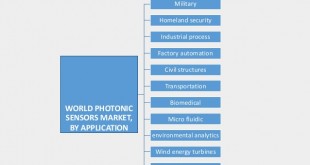

By Application Analysis

The networking and communications segment is projected to grow at a significant CAGR with increasing demand for smartphones and smart devices around the world. The necessity of working from home is notably rising across the developed and developing economies, thus

enhancing the demand across this application segment.

The data processing application segment holds considerable market share owing to the strong need and sales of smartphones and other connected devices, accelerating the demand for memory and storage devices. Consumer electronics such as gaming consoles , wearable

devices, and other electronic devices play an important role in this market, enabling the usage of electronic gaming across various countries.

The automotive application segment is estimated to witness moderate growth rate due to limited penetration rate of hybrid and electric vehicles. However, the market potential may get enhanced with promising advancements in autonomous driving. Automotive electronics is going through some major changes with advanced driver assistance systems (ADAS) having good growth potential. In the future, many of the buying decisions on automobiles will be made based on the electronics content and the services that can be supported. Approximately 90M automobiles are produced annually, with the expectation for a higher volume of automobiles manufactured worldwide as well as increased content of semiconductors per automobile.

The industrial application segment is estimated to grow steadily on account of inadequate manufacturing in industrial machines. The government application segment will display stagnant growth owing to limited government investments and projects in communications technologies.

Semiconductors is playing an important role in the growth and innovation of automotive technologies used for connected cars and electric vehicles. The rapidly-evolving automotive market presents a glowing opportunity for automotive semiconductors to support increased connectivity, battery performance in EVs, enhanced sensors, and other technologies.

Similarly, the semiconductor industry is also benefitting from ongoing deployment of 5G technology. Additionally, an increase in the adoption of augmented reality/virtual reality in industrial and gaming companies is creating significant growth opportunities for semiconductor companies.

With IoT being one of the top growth drivers of the semiconductor industry, security concerns around connected devices pose a major threat to semiconductor companies. These include home automation systems, wearable devices, and industrial automation products. Semiconductor products, especially those used in medical electronics and industrial automation, will, therefore, need to place more focus on developing secure chips.

The shift towards smaller nodes will provide semiconductor companies with a competitive advantage by offering increased power and performance. However, the move presents significant challenges, in terms of costs and resources, which the semiconductor industry will need to address.

As with any industry in the technology value chain, the semiconductor industry will need to constantly innovate products to meet newer technology demands. In 2018 and beyond, there will be a major focus on smaller chips that consume less power and provide better support for wireless connectivity.

Overall demand for semiconductor devices was robust throughout the year, driven by the growing adoption of electronics components across all applications, with particular strength in the mobile and data centre markets.

Regional Insights

Asia Pacific holds the largest market share and is projected to exhibit highest growth in this market across the globe. The increasing adoption of high-end technology devices coupled with the minimum electronics prices is leading to an upswing in the consumption of consumer

electronics. Additionally, technological advancements such as IoT and LTE are supporting the adoption of electronics products, allowing the region to dominate the semiconductor market share. The U.S. and Europe drive the consumption pattern for IoT in the short term, but China will be the large market in 2020 to 2025.

The cost of participation in advanced technology is rapidly increasing, and only a small number of companies globally will be able to support these investment levels. The role of China will, consequently, become important within the wafer supply ecosystem because of the large market potential in China and the ability to obtain large funding sources.

China’s semiconductor market is the largest in the world. Annually, China consumes more than 50 percent of all semiconductors, both for internal use and eventual export. As such, the rapid growth of Chinese demand lifted the entire industry worldwide. However, domestic Chinese manufacturers are still only capable of meeting approximately 30 percent of their own demand. Therefore, to rebalance China’s reliance on external semiconductor demand, the Chinese government has urged its national champions and leading digital businesses to improve their domestic semiconductor manufacturing capabilities.

The North America market is estimated to exhibit dynamic growth that is driven by the increasing investments in R&D activities. According to the Semiconductor Industry Association (SIA), the U.S. industry expenditures in R&D increased at a compound annual growth rate of about 6.6 percent from 1999 to 2019. Expenditures in R&D activities by the U.S. companies tend to be consistently high, regardless of cycles in annual semiconductor sales, which reflects the importance of investing in R&D production. In 2019, the R&D investments in the U.S. totaled at 39.8 billion US dollars.

The market in Europe will witness substantial growth backed by the telecom as well as the automotive industry. Companies across the region are making investments in innovating new technologies and increasing their production capacity to cater to the surging demand for

advanced devices and components in the semiconductor industry. Moreover, the increasing consumption of consumer goods across the UK, France, and Germany will support the growth of this industry in Europe over the forecast timeline.

Furthermore, the Latin American semiconductor market will witness healthy growth owing to the increasing consumption of smartphones, TVs, and laptops across Brazil and Mexico. Consumers across the region are making investments in purchasing high-end electronic devices owing to their steadily rising disposable income levels.

The availability of skilled labor forces coupled with rapid innovations in technologies will drive the industry growth in the Middle East & Africa. Increasing demand for advanced industrial electronics and high-end computing technologies is further expected to propel the regional market growth over the forecast timeline

Semiconductor Industry

The global semiconductor industry is dominated by companies from the United States, Taiwan, South Korea, Japan and Netherlands.

Unique features of the industry include continuous growth but in a cyclical pattern with high volatility. While the current 20 year annual average growth of the semiconductor industry is on the order of 13%, this has been accompanied by equally above-average market volatility, which can lead to significant if not dramatic cyclical swings. This has required the need for high degrees of flexibility and innovation in order to constantly adjust to the rapid pace of change in the market as many products embedding semiconductor devices often have a very short life cycle.

At the same time, the rate of constant price-performance improvement in the semiconductor industry is staggering. As a consequence, changes in the semiconductor market not only occur extremely rapidly but also anticipate changes in industries evolving at a slower pace. The semiconductor industry is widely recognized as a key driver and technology enabler for the whole electronics value chain

Samsung took the top semiconductor spot from Intel as memory sales grew considerably faster in 2021, reaching $75.8 billion compared to $57.7 billion in 2020 in semiconductor company revenues, a 31.1% year-over-year increase. The top 5 companies also included SK Hynix, Qualcomm, and Micron. In 2021, the top 10 companies held 58% of the total semiconductor market while the top 20 companies held 76% of the market, up from 57% and 75% respectively in 2020, showing the continued growth of the market share leaders. IDC tracks about 200 suppliers in our coverage and over 120 companies experienced a growth rate above 20% in 2021.

Memory IC companies — Samsung Electronics, SK Hynix, Micron Technologies and Toshiba — continued to dominate the top ten semiconductor companies. Micron achieved the highest growth rate in the top ten, recording 9.8 percent growth in the first quarter, compared to the previous quarter. Qualcomm revenue fell 13.6 percent, which was the largest sequential drop, due to the weakness in the wireless communication market. Qualcomm and nVidia were the only two fabless companies remaining in the top ten.

“New Chinese suppliers threaten the current market balance, and emerging memory technologies are poised to cannibalise huge chunks of DRAM demand while the demand drivers of the past, including PCs and smartphones lose steam and no longer push industry demand,” commented Mike Howards, VP of DRAM & Memory research within the Semiconductor & Software division at Yole.

Through 2025, the semiconductor industry is set to benefit from the ongoing innovation and development of connectivity, data centers, communications, automotive, and advanced software. Increasing consumption of electronic components used in the safety, infotainment, and navigation of automobiles will further contribute to the growth in the industry.

The rising demand for AI-based applications across different industries will create new growth opportunities for semiconductor manufacturers and suppliers. AI will also bring improvements in semiconductor manufacturing, by speeding up the process, increasing chip performance, reducing production costs, and increasing output

Key Industry Players

Broadcom, Intel and Qualcomm to Focus on Developing Innovative Products to Strengthen Its Offerings Broadcom Inc. announced the availability of 3*3 Wi-Fi 6 chip named BCM6710, specially designed for WLAN applications and set-up boxes. This is a highly optimized chip integrated with RF power amplifiers that paves the way for high bandwidth, low-latency applications including 4K UHD video streaming, augmented reality (AR) , and many more. In the current scenario, Broadcom Inc. hinges on the strategy to combine best-of-breed technology to deliver comprehensive technology-based products to the major business and government customers. Similarly, in July 2020, Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated introduced ‘Qualcomm QCS410’ and ‘Qualcomm QCS610’ system-on-chips (SoCs). These chips are designed for premium camera technology including, powerful machine learning and artificial intelligence features.

Some of the key players are Broadcom, Inc. (California, United States), Intel Corporation (California, United States), Qualcomm (California, United States), Samsung Electronics (Suwon-si, South Korea), SK hynix (Gyeonggi, South Korea), Taiwan Semiconductors (Hsinchu, Taiwan), Texas Instruments (Texas, United States), Toshiba Corporation (Tokyo, Japan), Maxim Integrated Products, Inc. (California, United States), Micron Technology (Idaho, United States), NVIDIA Corporation (California, United States), and NXP Semiconductors N.V. (Eindhoven, The Netherlands)

Key Industry developments

February 2020: Toshiba Electronic Devices and Storage Corporation launched “TC78H670FTG,” the latest addition to its micro-stepping integrated circuit portfolio. This new IC is likely to drive a 128 micro-stepping motor within the power range of 2.5V to 16V.

November 2019: Samsung announced the production of its 12GB LPDDR4X uMCP and 24GB LPDDR4X uMCP chips, oering high quality memory and data transfer rates of up to 4,266 Mbps in smartphones.

References and Resources also include

https://www.fortunebusinessinsights.com/semiconductor-market-102365

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis