A communications satellite is an artificial satellite that relays and amplifies radio telecommunications signals via a transponder; it creates a communication channel between a source transmitter and a receiver at different locations on Earth. The benefit of a satellite communications network lies in its ability to link users to voice, video and data information where other forms of terrestrial networks may not be feasible. Military communications networks provide for the exchange of voice, video and data between geographically dispersed elements of a battle force.

For more information on Satellite Communication Systems and technologies, Please visit

The advantages and disadvantages of this form of communication are highly dependent on the satellite and network configuration. Satellite communications networks consist of user terminals, satellites and a ground network that provides control and interface functions. Today, satellite networks are providing affordable high-speed broadband services to millions of users around the globe. Users are connected over satellite channels directly utilizing very small aperture terminals (VSATs), or by hybrid architecture, whereby VSATs provide a satellite backhaul of terrestrial wireless services delivered over cellular/WiFi devices.

Trends driving spending on the military communications sector will be underpinned by software defined radio, satellite connectivity and network-centric IP-based communications. Communications are no longer confined to voice transmission, but are focused on IP-centric delivery of data in a wide range of formats including video, imagery, messaging with the delivery of voice now also moving into the IP-based domain. Requirements for higher data rates with a focus on IP-centric communications that encompass video and data as well as voice will push demand for military satellite terminal systems. Communicating securely faster over multiple channels and wider spectrum in an increasingly complex spectrum environment will underpin the current and future trends for system design architectures which will dictate the underlying changes in component technology demand.

Military satellite communications have typically focused on C-band and X-band operations, but as use of satellite terminals has increased, so these bands have become increasingly capacity constrained and increasingly expensive. Bandwidth demand over the years has increased driven in part by continued growth in intelligence requirements and the expansion of UAS platform usage to incorporate BLOS (beyond line of sight) operations. This has led to the use of systems operating at higher frequencies such as Ku-band and Ka-band.

Today, a single 28 GHz band satellite can serve 1/3 of the Earth. The wide coverage provides all communities within a satellite’s footprint access to service. Coupled with easy to deploy user terminals, this means that consumers and businesses have near-instant access to fast, affordable broadband, anywhere. People can stream their favorite videos at home, walking around town, and even on an airplane. 28 GHz satellite-powered Wi-Fi now connects millions living in urban and rural centres and villages — many for the first time. For example, in Brazil, Hughes has implemented such a combined satellite plus terrestrial network, to bring high-speed connectivity to community centres and schools in remote villages across the Amazon region.

Both the commercial and military satellite communication industry is evolving, as evidenced by numerous trends that one can expect to see on the horizon over the coming 18 months and beyond. The increase in small satellites, the use of high-throughput satellites and low-Earth orbiting (LEO) satellites, launches on reusable rocket launch vehicles, satellites with all-electric propulsion and new use cases for 5G and the Internet of Things (IoT) are some of the are among the game-changing innovations enabling a range of solutions from digital financial services to better health care to smarter cities.

Because of the global coverage of different satellite constellations, geostationary and non-geostationary based, the future ubiquitous presence of a satellite infrastructure will allow journalists, and any other professional operators, from security services to civil protection teams, to send back to base multimedia content, in real time

Wideband communications satellites provide DoD with fast and reliable voice, video, and data communications to support critical military operations around the globe. Wideband satellites operate in different radio frequency spectrum bands. DoD typically relies on C, X, Ku, and Ka-bands to provide wideband connectivity, depending on where and how users are operating.

Each of these frequency bands has advantages and disadvantages for various applications. Satellite transponders operating at the lower C-band frequencies are more robust, especially when it rains (water degrades some RF signals.) Under US law, X-band usage is limited to the US government and NATO. The Ku-band can communicate with smaller antennas and is useful for mobile operations. Ka-band satellites can transmit more data, including high-speed video, than satellites using the other frequencies, but their signals are more susceptible to rain and fog.

Of course, there would be limitations — such terminals could be more costly than mobile Internet terminals, and the satellite links may be subjected to rain fading in some regions. But having the terminals able to operate in multiple bands (i.e. C-band and K-band) will minimize the limitations that rain fades might cause.

The C-band would be less sensitive to rain fading. Using HTS for a C-band service would improve the overall performance in extreme weather conditions, and spread-spectrum techniques could be used to limit interference to adjacent satellites or any terrestrial services using C-band. Such systems could lower the “cost per megabit” and guarantee good service availability from locations where transmission could be impaired by rain, says ITU. The systems would also make use of the more advanced radio frequency (RF) modulation systems now possible, and fully digital aerial array terminals. The results would be sets of compact and light self-pointing systems that could be operated by the journalist alone, without special help.

Satellite Terminals

A satellite terminal can be broken down into a number of constituents, as shown by a representative breakdown of the Norsat GLOBETrekker 2.0 Flyaway Satellite Terminal. It consists of an antenna subsystem, with an associated tracking system, a transmitting section and a receiving section. It also includes equipment to interface with the terrestrial network together with various monitoring and electricity supply installations. The antenna is generally common to transmission and reception for reasons of cost and bulk. Separation of transmission and reception is achieved by means of a diplexer. The tracking system keeps the antenna pointing in the direction of the satellite in spite of the relative movement of the satellite and the station

The radio-frequency subsystem contains on the receiving side, low noise amplifying equipment and equipment for routing the received carriers to the demodulating channels; On the transmitting side, equipment for coupling the transmitted carriers and power amplifiers. RF power amplifier provides the power amplification of the signal.

In each direction, frequency converters form the interface with the telecommunications subsystem which operates at intermediate frequency. A BUC (block upconverter) converts a band of frequencies from a lower frequency to a higher frequency and is used in the uplink. The LNB (low-noise block downconverter) is used in the receive path of a transmission, and typically combines a LNA (low-noise amplifier), as well as other components to that enable the received signal to be down converted for the modem.

Satellite Terminal trends

Satellite communications systems are becoming smaller, lighter, covering more bands including higher frequency bands such as Ka band. “Thirty years ago satellite communications was limited to high-ranking officers at command centers,” noted Tony Jannetta, CTO, L-3 Global Communications Solutions (GCS). “Over time, satellite communications has migrated through the military echelons and is now to the point where man-portable systems have been designed.

Communications are no longer confined to voice transmission, but are focused on IP-centric delivery of data in a wide range of formats including video, imagery, messaging with the delivery of voice now also moving into the IP-based domain. This increasing use of data translates into ever-larger chunks of bandwidth being consumed at faster and faster rates. As spectrum becomes an increasingly sparse resource, dealing with this data tsunami across military communications is tightening up the requirements for better spectrum management. Optimizing spectrum use will require use of more complex modulation while the use of AESA-based architectures will also migrate into satellite terminals longer term.

Very small aperture terminal (VSAT) systems; low capacity data transmission (uni- or bidirectional), television or digital sound programme broadcasting. VSATs are equipped with antennas of 0.6–1.2min diameter. The introduction of Ka band will allow even smaller antennas (USAT, Ultra Small Aperture Terminals) to provide even larger capacity for data transmission, allowing multimedia interactivity, data-intensive business applications, residential and commercial Internet connections, two-way videoconferencing, distance learning and telemedecine.

Advances in satellite manufacturing and directional earth-station technology, particularly the development of multi-axis stabilized earth-station antennas capable of maintaining a high degree of pointing accuracy, while stationary or on rapidly moving platforms, have made earth stations with very stable pointing characteristics both available and practical.

The advantages and disadvantages of this form of communication are highly dependent on the satellite and network configuration. Trends driving spending on the military communications sector will be underpinned by software defined radio, satellite connectivity and network-centric IP-based communications.

This increasing use of data translates into ever larger chunks of bandwidth being consumed at faster and faster rates. As spectrum becomes an increasingly sparse resource, the requirements for better spectrum management is becoming important. Optimizing spectrum use will require use of more complex modulation while the use of AESA-based architectures will also migrate into satellite terminals longer term.

Some satellite communication terminals that the military uses in forward-deployed locations are highly vulnerable to a pervasive flaw, according to researchers with cybersecurity company IOActive. Company officials say they are already working with the Defense Department and the vendors that produce the buggy equipment.

At the RF front-end, satellite terminals will take increasingly take advantage high power wideband RF technologies that can bridge the traditional gap that has existed between solid-state and vacuum tube technologies. Similarly, the receive side will be underpinned by wideband receive capabilities, coupled with bringing the signal into the digital domain using faster ADCs and DACs to enable faster digital processing.

Army’s Ground terminal requirements for multi domain operations

To leverage LEO and MEO capability in support of multi domain operations, the Army needs ground satellite terminals that are easy to deploy and set up by Soldiers in austere environments, with antenna that will be able to automatically re-acquire satellites as they pass by overhead. MEO constellations will typically be comprised of tens of satellites orbiting the Earth, with LEO constellations made up of hundreds and even thousands of smaller satellites. Having so many satellites aides in network resiliency, combating enemy satellite jamming or even destruction, and adding multipath diversity. However, unlike GEO satellites that appear stationary from a point on the Earth’s surface, LEO and MEO move across the sky and require additional tracking and handover capability between satellites.

Compared to current legacy GEO solutions, LEO mega-constellations could provide a 100 times increase in bandwidth and a 10 times reduction in latency, while providing network communications services to a larger density of users. Bandwidth increases for MEO solutions will be slightly less, but significantly more than current GEO capability provides. These improvements will enable more data to be sent at faster rates to a larger number of users, while improving the network performance.

“Leveraging emerging satellite technologies in multiple orbits will give us that needed resiliency, huge bandwidth increase and lower latency to enable multi-domain operations in congested and contested environments against increasingly powerful adversaries,” said Richard Greel, technical management division future systems-of-systems engineering lead at the Program Executive Office for Command, Control and Communication-Tactical (PEO C3T). “Being able to securely access both military and commercial satellite capabilities in multiple orbits would provide alternate SATCOM paths for greater network resiliency, and options for commanders to enhance their communications PACE [primary, alternate, contingency, emergency] plans.”

“Each new system has its own strengths and weaknesses, and there will not be a one-size-fits-all solution,” Greel said. “Early experimentation with emerging commercial LEO and MEO capability shows that it can be easily integrated into Army tactical networks and, when fully mature, could serve as additional tools in the Warfighters’ communication tool belt.”

The Army’s multi-constellation strategy will require different ground terminals and eventually integrated scalable multi-functional ground terminals. Today, each GEO, MEO, and LEO solution requires its own dedicated antenna, which increases size, weight, and power requirements. The Army is exploring integrated terminals that support military and commercial multi-orbits and frequency bands, while leveraging the anticipated significant component cost reduction that comes as a result of the commercial deployments. Initially, for potential CS 23 support, the Army envisions using a single frequency-band ground terminal leveraging one specific constellation. Integrated terminals capable of supporting multiple bands and constellations in multiple orbits are being developed for future capability sets.

Get SAT deploys Dual Sat terminal solution with Inmarsat Global Xpress service

Get SAT and Inmarsat announced a demonstration and deployment of a unique Dual SAT terminal solution for U.S. government agencies. The solution employs Get SAT’s lightweight micronized Milli SAT LM terminals using Inmarsat’s worldwide Global Xpress Ka-band network.

Dual Sat provides an antenna diversity solution for mobility platforms where obstructions such as ship’s superstructures would cause blockage for a single antenna system. A fully automated software switching system that requires no external components, Dual SAT’s two terminals operate redundantly as a single system to ensure complete high-speed connectivity. When the primary antenna is blocked, the alternate antenna is switched seamlessly to provide services. This solution is ideal for the roll on, roll off requirements of Special Operations and Executive Staff onboard Afloat Forward Staging Bases (AFSB).

Based on the micronized, ruggedized and portable Milli SAT terminal replacing large and bulky alternatives consisting of multi-modem and control units, the solution leverages Get SAT’s highly efficient flat panel antenna technologies to enable fully autonomous operation for high bandwidth data rates. Following certification, the roll on, roll off solution is truly a one-person operation.

According to Get SAT CEO Kfir Benjamin, “Get SAT’s Dual Sat solution proves that there is no obstacle that can hold back any SATCOM-on-the-move application. Our miniaturized package enables true, un-blocked, constant, crisp communications. Our solution drastically cuts back on installation time and costs while easily integrating with pre-existing on-board systems.”

Get SAT’s micronized communications terminals are based on the company’s patented fully-interlaced InterFLAT panel technology that transmits and receives signals on the same panel. Meeting the demanding requirements of full-time usage in harsh environments, these rugged satellite on the move (SOTM) terminals offer significant savings in size, weight, and power usage.

Modular terminals

DoD currently maintains 17,000 terminals with “approximately 135 different designs,” GAO said. Those terminals operate across diverse platforms—such as ships, backpacks, vehicles — all with differing system requirements. DoD lacks a coherent strategy for acquiring satcom terminals necessary to access even its own military satellites, as the Government Accountability Office (GAO) reported in its Dec. 19 review of the Pentagon’s June 2018 analysis of alternatives (AoA) for optimizing wideband satellite communications.

“The sheer number and types of wideband terminals DOD currently uses presents a very large challenge for changing how DoD acquires wideband SATCOM capabilities,” GAO’s Cristina Chaplain told me. “Additionally, DoD faces questions on how to govern terminal acquisitions, which currently take place in many programs spread across the services.”

The larger message from the study is that “commercial is really hard, and you have to follow the terminals,” Cowen-Hirsch told SpaceNews. “Terminals are a critical component to access the space capability,” she said. The industry has made huge investments in modular terminals to replace vertically integrated systems, she added. “This drives to an integrated architecture,” which is what the industry hopes the Pentagon will have one day. Because most military terminals are highly customized and difficult to upgrade, their operating costs are high, accounting for 70 percent of what the military spends on satellite communications, according to an industry source. By comparison, terminals make up about 10 percent of the cost of buying commercial services.

It can take up to five years to upgrade a military aircraft’s satcom terminals, he said. “We need more software defined radios that can be upgraded without pulling them out the plane or the ship. We need flexibility on the user equipment side.” A case in point are the Air Force Reaper drones that operate the Ku band. “If somebody offers a Ka service because you’re being jammed in Ku, I can’t use it. We need terminals that can respond.”

SDR Hardware — a game-changer in satellite communications

In satellite Communications, upper protocol stack layers set up and manage data connections to be used by an application. Using the services provided by the physical layer, a data link is established for one- or two-way transmission of data packets. This includes flow control and retransmission to compensate for the loss of data on the physical link. To secure a stable radio link, the upper protocol stack layers manage radio resource allocation, position reporting, handover, etc — i.e. all functions needed to secure a connection for terminals potentially moving while in use. As technology leaps forward, the physical layer can soon be implemented as software or firmware enabling the same satellite terminals to access different satellite systems.

A Software-Defined Radio (SDR) is a radio communications system where components, which traditionally have been implemented in hardware, are instead installed as software. This could, for example, be mixers, filters, modulators/demodulators, detectors, etc. A basic SDR system consists of one or more General Purpose Processors (GPP), Digital Signaling Processors (DSP), Field Programmable Gate Arrays (FPGA), analogue hardware, and antenna. When put together, such a design produces a satellite terminal that can access different satellite systems based solely on the software or waveform used.

Waveform is a piece of software that can be downloaded to a hardware platform, which ultimately defines the specific protocol for a given radio communication system. By downloading waveforms and implementing the protocols, end users are able to reuse the same hardware for many different satellite systems resulting in a higher degree of flexibility than with traditional satellite terminals most use today. In the end, this will lead to improved flexibility and user experience of satellite terminals, thus improve conditions for end users.

SATCOM systems with AI/ML boost

Hughes Network Systems has won an R&D contract worth $11.8 million from the U.S. Army to improve resiliency and interoperability among satellite communications systems used by the military. Under the terms of the contract, Hughes will demonstrate its new end-to-end narrowband SATCOM architecture (NBSA) that contains machine learning (ML) and artificial intelligence (AI) features designed to improve several critical areas – network management, automated control, and system interoperability – for the U.S. Army Combat Capabilities Development Command (CCDC), C5ISR Center, Space and Terrestrial Communications Directorate.

Nuclear-hardened terminals

Military satellite communications (SATCOM) experts at the Raytheon Co. will switch SATCOM terminals aboard the U.S. Air Force B-52 strategic bomber and RC-135 reconnaissance aircraft to the latest Advanced Extremely High Frequency (AEHF) satellite under terms of a contract worth nearly a half-billion dollars. Raytheon will design radiation-hardened SATCOM terminals to switch the two aircraft from the Military Strategic Tactical Relay (MILSTAR) to the AEHF satellite constellations. Flight testing aboard the two aircraft is part of this contract.

Solid-state technologies

To meet these challenges, military satellite terminals will see increasing use of solid state technologies. These solutions were initially based around GaAs technology and offered potential advantages over vacuum tube based solutions in terms of cost and size with power outputs reaching 100 to 200 W. As GaN technology has matured, so SSPAs based on GaAs are being displaced by GaN solutions that can offer higher power and greater linearity enabled in smaller form factors.

The simultaneous combination of high frequency, wide bandwidth, high power capabilities and high temperature operation make GaN a natural fit for military applications. GaN-based SSPB/BUC products enable higher power, wider bandwidth and higher frequency performance while also allowing terminal sizes to shrink. GaN on silicon (Si) has been successfully deployed in military communications.

The trend towards solid state solution based offerings is being reflected in the offerings from major suppliers of BUCs and SSPAs supporting the satellite terminal market.

- Advantech Wireless offers a complete line of GaN-based SSPA, Solid State Power Block (SSPB) and block upconverters. At X-band, for example, the company’s SapphireBlu™ series of GaN-based products offer power levels reaching up to 600 W. Advantech Wireless, has released Gallium Nitride (GaN) Technology based 50 Watt X-Band Solid State Power Block/Block UpConverter (SSPB/BUC) for Tactical Mobile Military Applications. The new 50W BUC will allow higher output power, and higher data rates for mission critical, bandwidth hungry operations in challenging mobile military environment. “These units are designed for extreme low weight Satcom on the Move (SOTM), man packs, and flyaway applications, where weight and energy efficiency is the driving factor,” mentioned Cristi Damian, VP Business Development at Advantech Wireless.

- Communications & Power Industries (CPI) has offered solid state amplifiers for over four decades, and has been increasingly focusing solutions on GaN technology to replace the company’s GaAs-based offerings. For example, the company’s C-band 100W GaN-based Model 4710H offers over 35% reduction in weight over the GaAs-based 7720H 100W C-band GaAs BUC, as well as offering reduction in volume and an increase in efficiency. The company has detailed even better performance metrics when comparing Ku-band solutions whilst using GaN for Ka-band has yielded the Model B5KO which offers four times the output power of the previous generation of GaAs amplifier.

- Norsat is also developing solutions based on GaN with its Atom series of Ku- and Ka-band series of products citing several benefits that include reduced production price, low conductance losses due to low resistance, quicker devices yielding fewer switching losses, lower power requirements and smaller devices. Furthermore, Norsat’s comparison of Ka-band GaAs-based versus GaN-based offerings, find GaN offering advantages in other parameters such as ACPR (spectral regrowth) and TTIM (two-tone intermodulation)

Market Growth

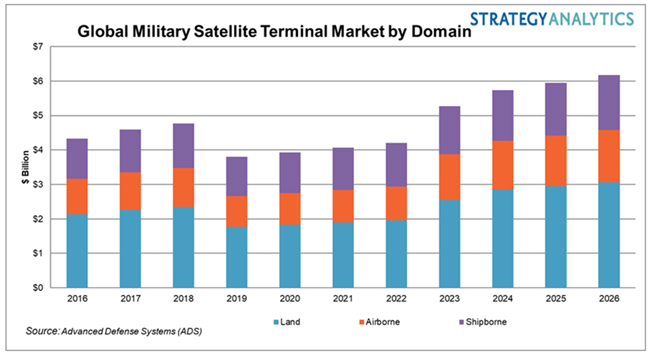

Strategy Analytics forecasts spending on global military communications systems and services will grow to over $36.7 billion in 2026, representing a CAGR of 3.5%. Satellite communications will account for 37.2% of this opportunity. These trends will support the continued use of military satellite communications (milsatcoms) as key enablers in completing the C4ISR jigsaw and acting as critical nodes in the net-centric communications environment. This is reflected by the broad range of terminal solutions available, targeting requirements across the land, air and naval domains.

Land-based satellite terminals will continue to represent the largest market both in dollar as well as shipment terms, with the segment forecast to account for 49.7% of the total satellite terminal communications spend and 77.0% of total shipments in 2026. The market for airborne satellite terminals is forecast to grow the fastest, from $1.0 billion in 2016 to $1.5 billion in 2026, at a CAGR of 4.0%. Shipborne military satellite terminal communications system demand will grow at a CAGR of 3.1% to be worth $1.6 billion in 2026.

While the traditional frequencies including C-band and X-band will remain a staple component of satellite communications, bandwidth constraints and a push towards higher data rates focused on IP-centric communications that encompass video and data as well as voice will push demand for military satellite terminal systems operating at higher Ku- and Ka-bands with the subsequent market for systems operating at these frequencies forecast to grow at a CAGR of almost 5% through 2026. This will be coupled with the emergence of multi-band/wideband capable systems to enable true global roaming capabilities

Strategy Analytics forecasts demand for high power RF and related semiconductor components and technologies through to the digital backend from the military satellite terminal market will grow at CAGR of 1.7% from $175 million in 2016 to reach $206 million in 2026, and the increasing use of solid-state technologies will translate to the penetration of GaN technology growing by over 500% through to 2026.

Strategy Analytics forecasts the penetration of GaN technology will grow by over 500% through to 2026. This represents a growing opportunity for GaN semiconductor technology suppliers including Northrop Grumman, Qorvo, Wolfspeed, a Cree Company, UMS and Win Semiconductor. Companies that succeed in this market will need to combine the linearity, power and efficiency offered by GaN into MMIC-based solutions offered in cost effect packaging that enables the continuing requirements for smaller sized and lower weight satellite terminals.

The Milsatcom Terminal Suppliers

Key players involved in the Satellite terminal Market are: L3Harris, Viasat, General Dynamics Mission Systems, Thales Group, Raytheon Technologies, Cobham Limited, Honeywell, Ball Corporation, DataPath, SpaceX, The 54th Research Institute of CETC, Chengdu M&S Electronics Technology Co.,Ltd., Hytera Communications Corporation Limited, Hwa Create Corporation Ltd., Shanghai Basewin Intelligent Technology Co.,ltd., SATPRO M&C TECH CO.,LTD, KEYIDEA, Nanjing Panda Electronics Company Limited, Chengdu T-RAY technology Co., Ltd, Jiangsu LeZone Technology Corp., Ltd & Datang Telecom Technology & Industry Group

Some of the companies that are active in supplying military satellite terminals to the defense sector.

Land-based systems can be categorized based on size and mission (strategic vs. tactical) and incorporate fixed and transportable systems, mobile/vehicular-based systems and portable and dismounted form factors.

- Elta Systems ELTA’s ELK-1895 is a full duplex lightweight transportable tactical SATCOM terminal that is designed to be transported and operated by a single soldier.

- The Low Cost Terminal (LCT) is an industry-funded terminal which takes advantage of Northrop Grumman and Lockheed Martin system knowledge alongside Comtech TCS to provide Protected Communications on the Move (P-COTM) and Protected SIPR/NIPR Access Point (P-SNAP) communications at the halt capabilities with a focus on supporting communications over the AEHF (Advanced Extremely High Frequency) satellite network.

Airborne military satellite terminals are used across a broad range of platforms including combat aircraft, special mission platforms, helicopters and UAS.

- Viasat offers a broad range of terminals designed to cover the full complement of airborne missions. The Ku/Ka-band VMT-1220HM airborne satellite terminal is designed for COTM on C-130 platforms, and the company also offers terminals for light aircraft as well as helicopter platforms.

- Airbus offers the AirPatrol satcom terminal which is designed to be installed on fixed wing, rotary wing or UAS platforms and can be configured for operation across X, Ku or Ka frequency bands

Military satellite terminals in the naval domain span the full spectrum of platforms both surface and subsea, including aircraft carriers, destroyers, corvette, frigate platforms as well as the emerging demand from USVs (unmanned surface vehicles).

- Raytheon’s NMT (Navy Multiband Terminal) is expected to be installed in approximately 300 U.S. Navy ships, submarines and shore stations, replacing several existing SATCOM systems. NMT variants offer X-, Ka- and Q-band, enabling communications across current and legacy US military satellite communications networks including AEHF, Milstar, Ultra High Frequency Follow-on (UFO/E/EE), Interim Polar, Enhanced Polar System (EPS), Defense Satellite Communications System (DSCS) and Wideband Global SATCOM System (WGS).

- Indra offers the TNX-100 terminal which is designed to operate at X-band through through a range of satellites including SPAINSAT, SKYNET, SYRACUSE, SYCRAL and XTAR.

- UK-based Paradigm Communication Systems has made satcom simple by designing and manufacturing Paradigm interface module (PIM). Using the device requires no particular expertise or specialist training. PIM is modem- and terminal-agnostic, and as such, integrable to all major modems allowing a great choice of network flexibility. Operators can follow onboard visual and optional audio cues to set up and operate the terminal. The device consists of a single, ruggedised unit that incorporates all parts that operators need to power and uses the satellite terminal. Three years ago, Paradigm introduced the PIM950, an advanced version of the module. Farmer says it was created in response to the increasing demand from military end-users needing to switch between different network options. “The idea behind the PIM950 was to take what we did with the PIM which basically is to create something that is terminal- and modem-agnostic. So, it frees up that sort of flexibility for the military end-user and applies it to the networks, so on the field you can switch between Global Xpress, velocity or evolution networks literally with a simple click of a button drop-down menu,” Farmer says

References and Resources also include:

https://www.satellitetoday.com/mobility/2019/01/17/will-sdr-hardware-change-the-satellite-industry/

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis