In a world where sustainability and environmental consciousness have taken center stage, industries are actively seeking innovative solutions to reduce their carbon footprint. The maritime sector, which has historically been associated with significant greenhouse gas emissions, is no exception to this trend. Enter the realm of marine hybrid propulsion – a cutting-edge technology that promises to revolutionize the way ships and vessels operate, enabling a greener and more efficient future for the industry.

Need for Marine Hybrid Propulsion

Marine transport is the backbone of international trade. As per the data revealed by the International Chamber of Shipping based in United Kingdom, nearly 90% of the total volume of merchandise trade occurs via sea route owing to its low cost compared to other mode of transports such as rail and road.

Moreover, nearly 2 billion tons of crude oil, 1 billion tons of iron ore, 350 million tons of grains, and 11 billion tons of goods are transported by ship each year and about 90% of the world trade is carried by the shipping industry. Thus, the surge in international trade boosts the number of cargo vessels and ships fleet and which in turn, drives the market for marine hybrid propulsion.

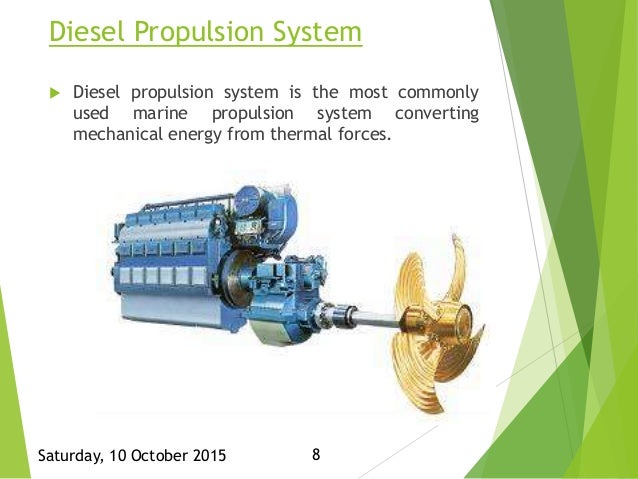

Marine propulsion is the mechanism or system used to generate thrust to move a a naval vessel across water. At present, 90% of the sea-going naval ship are diesel-powered. Still, ship operators are giving a preference to cut their fuel bills and reduce the environmental eect of their naval operations.

There are numerous benefits to electric motor propulsion including that it’s quieter, more efficient at lower speeds and less smelly. It’s also expected to lower overall costs of ownership by reducing or eliminating the needs for oil and transmission fluid changes, filter and impeller replacements and starter problems. There’s less to winterize too. Additionally, unlike diesel or gas engines, electric motors provide full torque instantly so boats get up on plane faster. Aftermarket conversions (which currently make up the lion’s share of the market) can use existing drive shafts and components so there is a cost-savings when re-powering.

Marine Propulsion Systems: Navigating the Seas of Innovation

A hybrid marine propulsion system is any combination of a combustion engine and an electric motor. Electricity can be produced by one or a combination of the following: a combustion engine generator, a wind generator, a towed water generator or solar panels. A purely electric solution with solar panels is enviable due to its zero carbon footprint and low operating costs and various takes on theses systems have been gaining traction on alternative energy vessels. Advances in both energy storage and solar panel technology have reduced costs and physical footprint making solar power propulsion systems more feasible for use on boats.

Hybrid propulsion improves the fuel efficiency of vessels with variable power demand such as tug boats, fishing vessels, and others. The main propulsion types of marine hybrid propulsion are diesel-electric, parallel hybrid, serial hybrid, full electric, gas turbine, and fuel cell.A diesel-electric propulsion system can employ a single engine to drive several propellers or several engines to power one or more propellers.

Hybrid and pure electric propulsion systems have proliferated within the automotive industry, hybrid or electric boats are beginning to gain steam. Still, the marine world is a relatively small niche market that tends to follow rather than lead other industries in terms of innovation. Currently only less than 2 percent of boats today are integrating electric or hybrid propulsion. This slow adaption is partly due to the unique issues of boating. Boats have a different frequency and variance of use than cars and the market has many segments (ferries, sailboats, small high speed planers, large distance cruising yachts, etc.) where boats are used differently, making it hard to build one solution to fit all applications. However, a few companies are trying to change all that.

Power and auxiliary sailboats are typically propelled by inboard or outboard engines using diesel or gasoline fuel. A growing appeal has been placed on electric motors for these purposes – i.e. pure electric engines powered by large battery banks. As with any new technology, there’s an adoption curve. The early adopters are the technologists, visionaries and tinkerers and they make up only about 15% of the market. In marine, these are distance sailors that need efficient sustainability and autonomy but they’re also ferries and water taxis that operate on bodies of water where combustion engines aren’t allowed. Then come the trailerable towboats, tenders and fishing boats as well as charter boats to fill the boating sweet spot of the 25-75 foot midrange power market.

Because e-propulsion is in its infancy in the marine market, available solutions are few and they’re expensive. So far, most electric boats have been slow and small and had very restricted range but that is changing. There’s also the problem of infrastructure, which is the same for automotive: What is the range of these new vessels and where do they recharge? Just like a Tesla that you’d probably not take on a cross-country road trip, a boat may need charging stations close together to “fuel” quickly.

The marine hybrid propulsion is a combination of a battery-powered propulsion system along with alternate fuel such as diesel and liqueed natural gas (LNG) utilized during propulsion of the naval vessels. Marine hybrid propulsion systems are gradually emerging as one of the most preferred clean propulsion systems globally and are being used in several vessel categories. One of the major advantages of using hybrid propulsion systems is their clean and efficient mechanism, which significantly lowers emissions as compared to conventional propulsion systems. Features such as silent maneuvering, emission-free operations, and lower degrees of fuel consumption have prompted vessel and towage operators to invest in this technology.

The main applications of marine hybrid propulsion market are in offshore vessels and navy applications. Offshore patrol ships are good examples of ships that are equipped with the hybrid propulsion system. Patrol ships can be operated at low speeds by the electric motor and at a high power demand by the main engine. Moreover, Anchor Handling Tug Supply vessels are good examples of offshore ships with highly flexible power demand and per consequence, different operation modes, and sailing speeds.

The current trend in Navies is moving to electric hybrid gas turbine propulsion plants, again improving efficiency and reducing the need to refuel, while increasing operational availability and performance. The electric propulsion ship by using electric motor is drawing considerable attention because of great advantages such as high efficiency, silent operation, controllability and low life-cycle cost. Especially interior permanent magnet (IPM) motor are considered motor attractive option for wide range operation ability and high torque density.

Hybrid Propulsion Technology: Revolutionizing Maritime Propulsion Systems

In the quest for greener and more efficient transportation solutions, hybrid propulsion technology has emerged as a game-changer in the maritime industry. This innovation combines traditional fuel-powered sources, like diesel engines, with stored energy sources, such as batteries and electric motors. The result is a propulsion system that offers multiple benefits, including reduced emissions, improved fuel efficiency, and enhanced operational flexibility. This article dives into the nuances of marine hybrid propulsion technology, highlighting its key features, industry trends, and various application approaches.

Parallel Hybrid Propulsion Systems

Hybrid propulsion systems can be classified based on their configurations. In a parallel hybrid system, diesel engines and electric motors work in parallel to drive the propeller. The electric propulsion setup typically comprises prime movers like diesel or turbine generators that generate mechanical energy, which is then converted into electric power for propulsion motors. These motors can be DC or AC driven, and they efficiently power the vessel while emitting fewer pollutants compared to conventional marine systems.

Serial Hybrid Propulsion Systems

Serial hybrid systems involve a range-extending generator. In this setup, the engine drives a generator, which powers an electric motor connected to the driveshaft. Notably, there’s no mechanical connection between the engine and the driveshaft. A variant of this system integrates a parallel approach, where both the engine and an additional electric motor contribute to propulsion through a common shaft.

Fully Electric Marine Propulsion Systems

Companies like Torqeedo have taken the concept of electric propulsion further by introducing fully integrated inboard electric propulsion systems. These systems, such as the Deep Blue 100i motor, cater to vessels of varying sizes and uses. The focus remains on safety, and the technology has expanded the possibilities for electric propulsion in terms of speed, size, and vessel application.

Advancements in Battery Technology

Lithium-ion batteries have revolutionized marine electric systems. They are lighter, longer-lasting, and more stable than traditional lead-acid batteries. Companies like Torqeedo and BMW have joined forces to “marinize” automotive batteries, making them suitable for marine applications. These advanced batteries offer higher energy density, longer life spans, and improved stability.

Challenges and Future Prospects

While the benefits of hybrid propulsion technology are compelling, challenges remain. Initial investment costs can be high, and retrofitting existing vessels might be complex. The complexity of combining different voltage systems for various functions within a vessel adds to the challenge.

Manufacturers’ Responses

Companies like Katsa and Reintjes are actively developing solutions to meet the demands of hybrid propulsion systems. Katsa’s hybrid power-take-off (PTO) gearbox, for instance, combines diesel and electric motors for efficient power transmission. Reintjes has introduced electrically driven hybrid solutions that ensure smooth running, reduced noise, and lower energy consumption.

Global Marine Hybrid Propulsion Market

The global Marine Hybrid Propulsion market size was valued at USD 5014.61 million in 2022 and is expected to grow at a CAGR of 5.8% from 2023 to 2028, reaching a value of $10.8 billion by 2028. This growth is being driven by a number of factors, including the increasing demand for energy-efficient and environmentally friendly ships, the need to reduce emissions, and the development of new technologies for hybrid propulsion systems.

Market Drivers

The increasing demand for energy-efficient and environmentally friendly ships is one of the key drivers of the growth of the global marine hybrid propulsion market. The shipping industry is a major contributor to greenhouse gas emissions, and there is a growing pressure on the industry to reduce its environmental impact. Hybrid propulsion systems offer a way to improve the energy efficiency of ships and reduce their emissions.

Other factors that include prominently rising global population, rapid industrialization particularly in the Asia Pacific region, and liberalization of economies have significantly spurred the rate of trade activities between countries across the globe. The aforementioned factors are likely to further propel international trade at a rapid rate during the forthcoming years. Hence, the demand for cargo ships and containers that are required for international as well as regional transportation of raw materials and goods are likely to rise during the forecast timeframe. Further, the rising need for fuel-efficient and dependent ships are anticipated to prosper the market growth for marine propulsion engines in the upcoming years.

Increasing trade of resources such as coal, crude oil, iron, and steel is done through large vessels. These large vessels containing high-volume resources are driven through the marine hybrid propulsion market. In addition, continuous development in the marine industry along with growing ship owner preferences for high fuel-efficient features are boosting the growth of the marine hybrid propulsion market. Furthermore, marine hybrid propulsion not only offers improved fuel efficiency but also adhere to stringent environmental regulations.

The need to reduce emissions is another key driver of the growth of the global marine hybrid propulsion market. The International Maritime Organization (IMO) has set ambitious targets for reducing greenhouse gas emissions from ships. Hybrid propulsion systems can help shipowners to meet these targets.

The development of new technologies for hybrid propulsion systems is also contributing to the growth of the market. New technologies, such as battery and fuel cell technologies, are making hybrid propulsion systems more efficient and cost-effective.

Market Trends

There are a number of trends that are shaping the global marine hybrid propulsion market. One trend is the increasing use of battery-powered hybrid systems. Battery-powered hybrid systems offer a number of advantages, such as their low emissions and their ability to be recharged at ports.

Another trend is the increasing use of fuel cell-powered hybrid systems. Fuel cell-powered hybrid systems offer a number of advantages, such as their high efficiency and their ability to operate on a variety of fuels.

The growing popularity of LNG-powered ships is also a trend that is shaping the market. LNG-powered ships are more efficient than traditional diesel-powered ships, and they also emit lower emissions.

Increasing Operational Performance of Naval Vessels is Propelling Growth

Shipyard management and vessel owners are continuously investing in marine hybrid systems to improve the operational performance of naval vessels. The hybrid system is minimizing the power consumption of marine engines. The fuel-driven marine engines are able to handle a static load of around 65-80% of the overall capacity of a naval vessel. The reduction in the operational performance of the diesel-based marine engine is due to the interruption of wind and tidal sea waves. Moreover, introducing a battery-powered storage system act as a backup unit of the propulsion system. This battery-powered storage system is used to emulate the external load of the marine engines and help to reduce fuel consumption.

Restraining Factors

High Development Cost of Hybrid Propulsion Restrict Market Growth

High development cost associated with the building of hybrid propulsion system is a prime factor ha mpering the growth of the market. Additionally, high maintenance cost of the hybrid propulsion system will also restrain the market. Dependence on heavy fuel as the primary fuel and high adoption rate of diesel-based propulsion system is likely to hinder the market in the forecast period.

Market Segmentation

The global marine hybrid propulsion market is segmented by propulsion type, ship type, and region.

On the basis of transport, the global marine hybrid propulsion market is categorized into inland waterways, coastal/cross-border waterways, fishing vessels, ferries, tugboats, cruise, cargo ships, and defense vessels. On the basis of end user the global marine hybrid propulsion market is categorized into cruise ships, defense vessels, ferries, offshore support vessels, tugboats, and a yacht. On the basis of application, the global marine hybrid propulsion market is categorized into commercial, logistics, offshore drilling and naval.

The different types of ships include anchor handling tug supply vessels, platform supply vessels, yachts, motor ferry, cruise liner, and other ship types and operates in various power ranges such as 0-300 KW, 301-500KW, and 501KW-800KW. It is used in commercial, logistics, offshore drilling and naval, and other applications.

By propulsion type, the market is segmented into diesel-electric hybrid, battery-electric hybrid, and fuel cell hybrid. The diesel-electric hybrid segment is the largest segment, accounting for the majority of the market share. However, the battery-electric hybrid segment is growing at the fastest rate.

On the basis of power rating, the global marine hybrid propulsion market is categorized into 0-300 kW, 301-500 kW, and 501-800 kW. Based on the deadweight, it is classified into 5K DWT, 5K-10K DWT, and more than 10K DWT. By the ship type, it is divided into anchor handling tug supply vessels, platform supply vessels, yachts, motor ferry, cruise liner, small cargo ships, naval ships, submarines, ROVs, UUVs, and AUVs. Lastly, by installation, it is bifurcated into line fit and retrofit.

By ship type, the market is segmented into container ships, cruise ships, and ferries. The container ships segment is the largest segment, accounting for the majority of the market share. However, the cruise ships segment is growing at the fastest rate.

By region, the market is segmented into North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific is the largest market for marine hybrid propulsion systems, followed by Europe and North America.

By Operation Analysis

Parallel Hybrid Propulsion Segment to Exhibit Impressive Growth On the basis of operation, the market is classied into a parallel hybrid propulsion system and serial hybrid propulsion system. The parallel hybrid propulsion system segment held the largest share the forecast period. This dominance is due to the increasing demand of this propulsion type in the heavyweight ships such as platform supply vessel and cruise ships. The serial hybrid propulsion system segment is projected to register a higher CAGR during the forecast period due to the increasing use of this system in unmanned underwater vehicles (UUVs) .

Serial Segment Corners a 22.9% Share in 2020

In the global Serial segment, USA, Canada, Japan, China and Europe will drive the 5.7% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$603.5 Million in the year 2020 will reach a projected size of US$887.4 Million by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$772.6 Million by the year 2027, while Latin America will expand at a 7.4% CAGR through the analysis period.

Competitors identified in this market include, among others: BAE Systems PLC, Caterpillar, Inc., General Electric Company, Hyundai Heavy Industries Co., Ltd., MAN Diesel & Turbo SE, Mitsubishi Heavy Industries Ltd., Niigata Power Systems Co., Ltd., Rolls-Royce Holdings PLC Siemens AG, and YANMAR Co., Ltd.

By Deadweight Analysis: Increasing use of Naval Vessels will Propel Segment Growth

Based on deadweight, the market is segmented into less than 5K DWT, 5K-10K DWT, and more than 10K DWT. Deadweight tonnage is an accurate measurement of the overall contents of a naval ship, including fuel, crew, passengers, and cargo. The 5K-10K DWT segment is anticipated to project a signicant CAGR during the forecast period, attributed to the ideal deadweight tonnage criteria of 5K-10K DWT for naval vessels, in which a hybrid propulsion system able to operate easily. 5K DWT is a deadweight tonnage capacity of small cargo ships and naval ships. Additionally, more than 10K DWT is a deadweight tonnage capacity of the platform supply vessel, yachts, and cruise liner.

By Ship Type Analysis: Increasing Use of Anchor Handling Tug Supply from China Will Register a Remarkable Growth

In terms of ship type, this market is segmented into anchor handling tug supply vessels, platform supply vessel , yachts, motor ferry, cruise liner, small cargo ships, naval ships, submarines, ROVs, UUVs, and AUVs. The anchor handling tug supply vessels segment is expected to hold the dominant share in the market. This is due to the increasing demand for anchor handling tug supply vessels from the emerging Asian economy such as China and India. Remotely operated underwater vehicles (ROVs), unmanned underwater vehicles (UUV), and autonomous underwater vehicles (AUVs) are operated on lithium battery-based marine hybrid propulsion systems. The adaptability of hybrid marine propulsion for yachts, motor ferry, cruise liner, small cargo ships, naval ships, and submarines is due to the large deviations in the load prole of thrusters.

By Installation Analysis

Increasing Adoption of Marine Hybrid Propulsion Technology in Merchant Ships to Enable Dominance of Segment Based on installation, the market is classied into line t and retrot. The line-t segment dominated the market and is further anticipated to be the fastest growing segment during the forecast period. This growth is owing to the increasing adoption of a hybrid propulsion system in merchant ships. The hybrid propulsion system can be easily installed in the naval vessel and propulsion system. The retrot segment held the largest share during the forecast period. Increase in naval vessel orders and deliveries, economic growth in Asia-Pacic, the need for fuel efficient power rating propulsion technology is augmenting the market.

Regional Insights

The marine hybrid propulsion market size in North America stood at USD 1.01 billion in 2019, attributable to the increasing procurement of oshore support vessels for the U.S. and Canada from the shipbuilding hubs of South Korea and China. The Marine Hybrid Propulsion market in the U.S. is estimated at US$1 Billion in the year 2020. The country currently accounts for a 28.88% share in the global market.

The market in Europe is anticipated to be the largest market during the forecast period owing to the presence of key players in Europe, which includes BAE Systems, General Electric Company, and Rolls-Royce plc. Within Europe, Germany is forecast to grow at approximately 4.5% CAGR while Rest of European market (as defined in the study) will reach US$1.1 Billion by the year 2027.

Asia Pacific is expected to exhibit healthy growth owing to the expanding shipbuilding industry in China and India. China, the world second largest economy, is forecast to reach an estimated market size of US$1.1 Billion in the year 2027 trailing a CAGR of 10.6% through 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 3.8% and 6.2% respectively over the 2020-2027 period.

In addition to this, key market players in Asia-Pacic are increasing funds, which in turn, will boost the market. Rest of the world registers remarkable growth during the forecast period accountable to the increasing spending on small cargo ships in crude oil industry from Latin America and Middle East & Africa.

Diesel-electric, is projected to grow at a 7.3% CAGR to reach US$2.8 Billion by the end of the analysis period. After an early analysis of the business implications of the pandemic and its induced economic crisis, growth in the Parallel segment is readjusted to a revised 6.5% CAGR for the next 7-year period. This segment currently accounts for a 28.9% share of the global Marine Hybrid Propulsion market.

Key Industry Players

Innovative Research Ideology Implemented by Key Market Players to Aid Market Dominance The designing of fuel ecient hybrid propulsion systems and advanced lightweight materials for propulsion systems are the upcoming trends and forecasts in the market. A diversied product portfolio, coupled with the latest technology trends and secondary research methodologies accepted by key players, are the prominent factors boosting the market.

Manufacturers who have focused on this market include Torqeedo based in Germany that subsidizes electric motor research. Another contender is Elco from Athens, New York, which, like Torqueedo, offers both inboard and outboard electric motors. Also, we mustn’t forget the classic Minn Kota trolling motors that have kept anglers emission-free for decades.

Other players in the motor market include the Finnish OceanVolt, Italian Diesel Center, American Electric Yacht, and British Hybrid Marine. California-based Electroprop sells pre-packaged 6 and 21 kW systems that boat builders can drop into their existing engine rooms. Swedish diesel engine giant, Volvo Penta, is promising a 2021 introduction of electric motors installed inline between their diesels and IPS pods, and is working with French catamaran builder, Fountaine Pajot, on a Lucia 40 sailing cat with hybrid power. There are many players all searching for the killer app in marine alternative energy propulsion. It’s likely a few will survive while others are purchased or disappear in an increasingly competitive market.

By the year 2030, the global battery pack for marine hybrid and full electric propulsion market will reach a valuation of USD 600 million (approximately). It will be a notable increase from valuation of about USD 240 million in the year 2019. The compound annual growth rate (CAGR) that the market will witness from 2020 to 2030 will be about 9%. Transparency Market Research notes, “High demand from marine industry to power diesel electric hybrid vehicles is set to contribute massively to the growth of global battery pack for marine hybrid and full electric propulsion market.”

Top players in the marine hybrid propulsion market are ABB Ltd. (Switzerland), BAE Systems (The U.K.), Caterpillar Inc. (The U.S.), General Electric Company (The U.S.), MAN Diesel & Turbo SE (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Rolls-Royce plc (The U.K.), Schottel GmbH (Germany), Siemens AG (Germany), Steyr Motors GmbH (Austria), Torqeedo GmbH (Germany), Wartsila Corporation (Finland).

The Global Battery Pack for Marine Hybrid and Full Electric Propulsion Market is marked by presence of key players such as Corvus Energy, Eco Marine Power, Rolls-Royce plc, Nidec Group, and RELiON Batteries, among others. These are comprehensively profiled in the report prepared by Transparency Market Research. It is worth noting here that the market is consolidated and competition is intense. Currently, players are focused on reducing size of battery and improving performance.

Competitive Landscape

The global marine hybrid propulsion market is dominated by a few major players, such as ABB, Wärtsilä, MAN Energy Solutions, and Rolls-Royce. These players are investing heavily in research and development to develop new technologies for hybrid propulsion systems.

Hybrid Propulsion Technology: Pioneering Green Maritime Propulsion

Hybrid propulsion technology is reshaping the maritime industry, offering a promising solution to reduce emissions and enhance efficiency. This technology combines traditional diesel engines with electric motors and battery banks for sustainable power. Two primary hybrid configurations exist: parallel systems where diesel and electric sources work in tandem, and serial systems with a generator-driven electric motor.

Advancements in battery technology, particularly lithium-ion batteries, have bolstered the viability of electric propulsion. Industry leaders like Torqeedo and BMW have adapted automotive batteries for marine use, resulting in lightweight, longer-lasting, and stable power sources. These innovations have led to the creation of fully integrated inboard electric propulsion systems, exemplified by Torqeedo’s Deep Blue 100i motor, catering to different vessel sizes and applications.

Challenges include initial investment costs and retrofitting issues for existing vessels. However, manufacturers like Katsa and Reintjes are responding with solutions. Katsa’s hybrid power-take-off (PTO) gearbox integrates diesel and electric motors for efficient power transmission, while Reintjes offers electrically driven hybrid systems that prioritize smooth running, reduced noise, and energy efficiency.

As environmental concerns intensify, hybrid propulsion emerges as a beacon of eco-friendliness. This technology aligns with stricter emissions regulations and offers fuel efficiency and operational flexibility. The maritime industry’s shift towards hybrid systems reflects a commitment to a sustainable and responsible future. With ongoing research, advancements in battery technology, and innovative approaches from manufacturers, hybrid propulsion is steering the maritime sector toward a greener horizon.

The Path Forward

As environmental concerns continue to shape the maritime landscape, hybrid propulsion technology is set to play a pivotal role in shaping a more sustainable and efficient future. With ongoing research and development, advancements in battery technology, and innovative approaches from manufacturers, the global marine industry is navigating toward cleaner and more responsible propulsion solutions. The rise of hybrid propulsion systems is not just a trend – it’s a transformative force propelling the maritime sector into a new era of greener operations.

References and Resources also include:

https://www.fortunebusinessinsights.com/industry-reports/marine-hybrid-propulsion-market-100128

https://www.boattrader.com/resources/hybrid-and-electric-boats/

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis