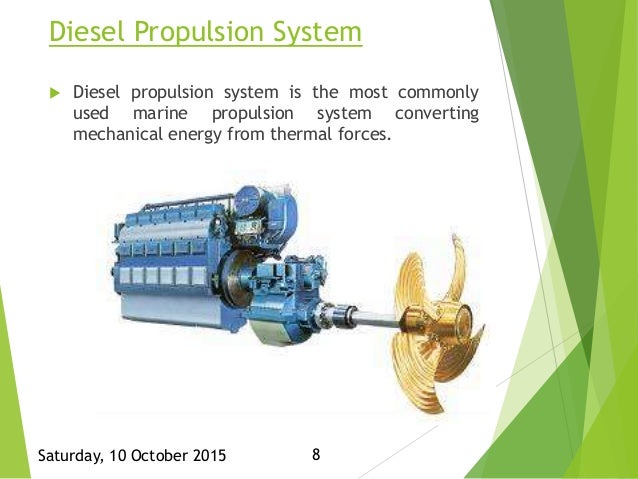

Marine propulsion is the mechanism or system used to generate thrust to move a a naval vessel across water. At present, 90% of the sea-going naval ship are diesel-powered.

There are numerous benefits to electric motor propulsion including that it’s quieter, more efficient at lower speeds and less smelly. It’s also expected to lower overall costs of ownership by reducing or eliminating the needs for oil and transmission fluid changes, filter and impeller replacements and starter problems. There’s less to winterize too. Additionally, unlike diesel or gas engines, electric motors provide full torque instantly so boats get up on plane faster. Aftermarket conversions (which currently make up the lion’s share of the market) can use existing drive shafts and components so there is a cost-savings when re-powering.

A hybrid marine propulsion system is any combination of a combustion engine and an electric motor. Electricity can be produced by one or a combination of the following: a combustion engine generator, a wind generator, a towed water generator or solar panels. A purely electric solution with solar panels is enviable due to its zero carbon footprint and low operating costs and various takes on these systems have been gaining traction on alternative energy vessels. Advances in both energy storage and solar panel technology have reduced costs and physical footprint making solar power propulsion systems more feasible for use on boats.

Hybrid and pure electric propulsion systems have proliferated within the automotive industry, hybrid or electric boats are beginning to gain steam. Still, the marine world is a relatively small niche market that tends to follow rather than lead other industries in terms of innovation. Currently only less than 2 percent of boats today are integrating electric or hybrid propulsion. This slow adaption is partly due to the unique issues of boating. Boats have a different frequency and variance of use than cars and the market has many segments (ferries, sailboats, small high speed planers, large distance cruising yachts, etc.) where boats are used differently, making it hard to build one solution to fit all applications. However, a few companies are trying to change all that.

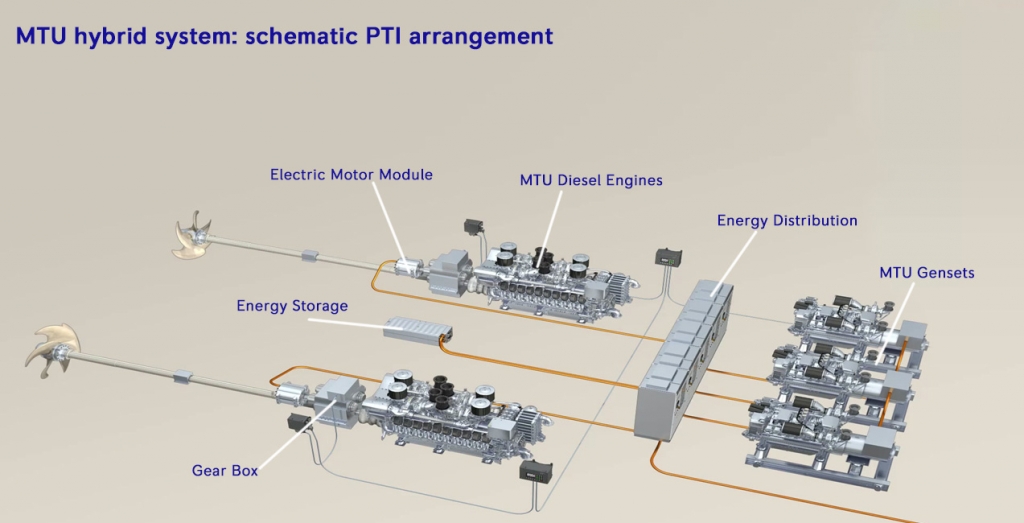

The marine hybrid propulsion is a combination of a battery-powered propulsion system along with alternate fuel such as diesel and liquefied natural gas (LNG) utilized during propulsion of the naval vessels. A hybrid vehicle can achieve propulsion using a fuelled power source for e.g. a diesel engine or through a stored energy source, which is a battery bank and electric motor. Hybrid propulsion systems can be differentiated between configurations, where the diesel engines and the E-motors work in parallel on the propeller. The main applications of marine hybrid propulsion market are in offshore vessels and navy applications. Offshore patrol ships are good examples of ships that are equipped with the hybrid propulsion system. Patrol ships can be operated at low speeds by the electric motor and at a high power demand by the main engine. Moreover, Anchor Handling Tug Supply vessels are good examples of offshore ships with highly flexible power demand and per consequence, different operation modes, and sailing speeds.

The electric propulsion system consists of a prime mover which may be of two types: Diesel driven or Turbine or steam driven both generate mechanical energy and drive generators. The propeller shaft of the ship is connected to large motors, which can be D.C or A.C driven and are known as propulsion motors. Power for propulsion motor is supplied by the ship’s generator and prime mover assembly. Both the systems produce less pollution as compared to conventional marine propulsion system, which involves burning of heavy oil.

Marine hybrid propulsion systems are designed to use two independent drive systems for propulsion: a diesel engine and an electric motor, where electric power is generally stored in batteries or a super capacitor. The system utilizes the unused capacity of the main diesel engine to generate electricity and store it in batteries for later use.

Marine hybrid propulsion systems are gradually emerging as one of the most preferred clean propulsion systems globally and are being used in several vessel categories. One of the major advantages of using hybrid propulsion systems is their clean and efficient mechanism, which significantly lowers emissions as compared to conventional propulsion systems. Features such as silent maneuvering, emission-free operations, and lower degrees of fuel consumption have prompted vessel and towage operators to invest in this technology.

Hybrid-Electric Ferries

Currently, ferries have been recognized as the major ends-user in terms of installation of marine hybrid propulsion systems. Ferry operators, especially in Europe, are anticipated to invest substantial amounts for the installation of hybrid propulsion systems in their respective vessels. Marine hybrid systems utilize diesel, a byproduct of crude oil, for propulsion. Volatility in crude oil prices has resulted in a switch from diesel to LNG. The relatively low price of natural gas and LNG compared to diesel in North America and Europe has attracted investments in LNG bunkering infrastructure in these regions.

Happiness has been retrofitted with a direct-current hybrid-electric microgrid, which now shuttles about 4,500 passengers a day. Since its introduction, dozens of other hybrid-electric and fully electric ferries have been unveiled around the world, and the number is growing year by year. According to the market research firm IDTechEx, the market for electric and hybrid boats will expand to US $12 billion by 2029.

While electrifying a large cargo ship or cruise ship is still impractical given the current state of batteries and electric motors, smaller ferries operating on shorter routes are ideal for electrification. The main difference between Happiness and most of the other electrified ferries is the direct-current microgrid as its heart. Compared with more conventional shipboard systems that use alternating current exclusively, the Taiwanese boat’s DC microgrid offers lower power consumption, lower emissions, better reliability, and more seamless integration with other equipment like batteries and generators.

One big problem with AC power on ships is maintaining the power quality. With AC, the current and voltage are slightly out of phase, but when the two become too far out of phase, it can cause the voltage to sag or spike, which can degrade the equipment over time and also cause the network to shut down if it goes too far. Because a shipboard electrical system is extremely small, compared with, say, a citywide grid, it can suffer from instabilities such as harmonic distortions, in which undesirable higher frequencies develop beyond the fundamental frequency—which in Taiwan’s case is 60 hertz. With DC, there are no waveforms to fall out of sync with each other, so the power quality is higher.

With a DC system, you don’t need a transformer to step voltages up and down, nor do you need rectifiers or inverters to convert between DC and AC. Instead, you can use solid-state power converters, which are much more compact and efficient and give you better control over the voltage and current. So if you’re operating equipment with variable-frequency drives, such as an electric motor driver, a power converter improves the control of the motor. Best of all, a DC power system works very well with power sources like fuel cells, lithium-ion batteries, and supercapacitors, all of which are DC devices. So integrating them into a DC rather than an AC system saves on energy that would otherwise be lost in converting DC to AC and back again.

But to operate a ferry entirely on DC electric would require an enormous bank of batteries, which would be costly and tricky to manage. And DC versions of many types of electrical components and equipment, such as lights and air conditioning, are still not widely available. For all these reasons, designers decided to create a hybrid-electric AC/DC ferry. The main propulsion system and batteries would operate on DC, while loads such as lighting, air conditioning, and deck machinery would operate on AC. The entire system would form a microgrid, with power generation, distribution, storage, and loads comprising a self-contained network.

“Our team started by creating two interconnecting power systems: one operating on AC, the other on DC. On the AC side, the existing diesel generators were connected to a 440-volt AC panel. In addition to powering the lighting, air conditioning, the engine room pump, and deck machinery as they had been doing, the generators would now feed the new DC propulsion system on occasion. The AC system has a total load of 35 kW. On the DC side, we replaced the diesel engines with two synchronous permanent-magnet motors from Danfoss Editron of Denmark, each with a rated power of 130 kW. The new motors were integrated with the original gearbox, main shaft, propeller, and throttle system. We also installed lithium-ion batteries from the Dutch company Super B and power converters from Danfoss. The DC and AC systems are connected by a bidirectional power converter, which allows power to flow between the two systems, converting AC to DC and vice versa.”

The European Union has also supported upgrade of ferries as all vessels traversing through or operating in European waters have to reduce sulfur emissions from 2015. Defense vessels are anticipated to be one of the most prominent end-user segment in terms of future hybrid propulsion installations.

Naval Vessels

Several defense organizations in Europe and North America have started installing hybrid propulsion systems in the respective vessels operated by them. The typical operating profile for naval destroyers and military vessels includes a significant amount of time voyaging at low speed. In such operating modes, electrical propulsion motors can be used to meet the vessel’s power requirement which significantly reduces emissions and saves fuel.

Electric propulsion for Navies

Instead of driving the ship’s propellers directly, diesel engines turn electric generators, which in turn power electric motors that drive the propellers. This arrangement enables diesels to be placed away from the shafts and propellers in sound-insulated compartments. Because the engines are not directly coupled to the shafts, their vibration does not pass along the shaft and thus does not get transmitted to the water as sound. An advantage of the system is that it eliminates the need for gears between the engines and the shaft. By doing so, removes a production bottleneck. The result is an almost silent propulsion system.

Three major advantages of hybrid-electric propulsion for Navy ships include: greater fuel economy, lowered maintenance costs and quieter vessels for advanced warfare operations, said Jamie McMullin, senior director of business development for Leonardo DRS’ naval power systems.

“Our hybrid-electric drive can bring the U.S. Navy real warfighting capability … and then you get all the benefits of fuel economy and less operation on engines and more space in the ship,” he said in an interview. The electric systems’ quiet nature makes it advantageous for anti-submarine warfare, noted Clive Wilgress-Pipe, director of business development for Leonardo DRS’ naval power systems.

Installing the hybrid-electric drive system created by Leonardo DRS onto the forthcoming frigates would come out at essentially a zero net cost to the Navy, Wilgress-Pipe said. “One of the benefits for FFG(X) is that some of the mechanical systems can be eliminated, and that in and of itself would fund the hybrid-electric drive,” he said.

One system that could be removed is the controllable pitch-propeller, McMullin said. “The cost of the hybrid-electric drive is less than that [of the] controllable pitch-propeller, which you can eliminate when you pull a hybrid-electric drive [on board],” he said.

The Navy recently considered retrofitting more than 30 Arleigh Burke-class destroyers with HED. The primary reason given was its superior performance at cruising speeds, the typical operating mode for ships conducting anti-submarine and missile defense missions. The Navy also believed that HED would be a major fuel saver.

While the Burke’s four LM-2500 gas turbines are highly efficient at top speeds, the efficiency decreases at lower speeds, wasting more fuel. Utilizing a preexisting quill drive in the main reduction gear, the HED motor is capable of turning the drive shaft and propelling the ship at speeds less than 13 kts. That speed range would work well with missions like ballistic missile defense or maritime security operations.

HEDs and improved energy storage will be key to meeting the Navy’s growing need for power generation to support the ever-growing demands of future sensors and directed energy weapons. Since retrofitting the FFG(X) would be prohibitively expensive, building in a HED power plant makes sense.

Enhanced quietness also contributes to improved survivability. This is why the U.S. Navy’s stealthy Zumwalt class DDG-1000 and the Columbia-class ballistic missile submarine both employ a HED propulsion system. In addition to the dangers the US. Navy faces from quieter Russian and Chinese submarines. There is also the threat from their improved acoustic sensors that support torpedo and missile strikes.

STADT has signed up for designing a new generation of naval ships utilizing the Stealth AC drive technology for electric propulsion to one of the NATO allied countries. Unique features of this technology is its reliability and long lifetime, its noise free characteristics, compact footprint and low weight, and many other operational advantages. The STADT Lean Propulsion solution can be used in any size of ships due to its scalability. STADT delivered its Stealth Lean Drive technology to SAAB AB a year ago, also for naval project.

One recent analysis suggested that hybrid diesel-electric propulsion can reduce fuel consumption and CO2 emissions by 10% to 25% compared to gas-turbine-electric propulsion. As a result, frigates with HED power plants have significantly greater cruising range than those that don’t. Also, HED causes less wear-and-tear on the main propulsion system. It is quite possible that the long-term savings associated with HED would more than pay for any higher procurement costs associated with such a system.

Electric propulsion for Naval destroyers

The current trend in Navies is moving to electric hybrid gas turbine propulsion plants, again improving efficiency and reducing the need to refuel, while increasing operational availability and performance. The electric propulsion ship by using electric motor is drawing considerable attention because of great advantages such as high efficiency, silent operation, controllability and low life-cycle cost. Especially interior permanent magnet (IPM) motor are considered motor attractive option for wide range operation ability and high torque density.

The success of electrical propulsion in commercial ships and the drive to reduce running cost has prompted significant development programmes to enable electric propulsion for naval destroyers in the UK and US. These development programmes were targeted to increase the power density with advanced technologies, consisting of new permanent magnet and high temperature super conducting motor technologies in order to fit electric propulsion in frigates and meet military requirements.

Major development in naval ship propulsion has been the adoption of integrated electric propulsion (IEP) by the UK Royal Navy (RN) for its Type 45 anti-air warfare destroyers and the forthcoming Queen Elizabeth-class aircraft carriers, and by the US Navy (USN) for the DDG 1000 Zumwalt-class destroyers, the first of which currently is in its pre-commissioning phase.

These development programmes have led to the application of electric propulsion in Royal Navy’s Type 45 destroyer, and Queen Elizabeth aircraft carriers, and in US Navy’s DDG-1000 destroyer. In spite of development programmes for new motor technologies, these naval applications are still all based on the Advanced Induction Motor (AIM) with Pulse Width Modulation (PWM) frequency converter drives. This AIM drive is an advanced development of asynchronous motor technology. These naval applications consist of traditional fixed frequency high voltage AC generator sets with conventional control strategy, despite programmes to develop DC architectures.

Most U.S. allies are all in for HED. The Franco-Italian-designed European multi-purpose frigate, or FREMM, employs HED. It is operating with five different navies: France, Italy, Egypt, Morocco and Greece. Spain’s F110, Germany’s F125 and South Korea’s FFX-II frigate all have some type of HED. Japan’s newest destroyers also have a HED power plant.

To meet designed speed and current weapon system requirements, as well as providing expansion potential for directed energy/laser weapons and an electro-magnetic railgun, the installed power in the 15,600-tonne DDG 1000 totals 80 MW, delivered by two 36 MW Rolls-Royce MT30 and two 3.9 MW Rolls-Royce RR4500 gas turbine generator units. While the original design was to adopt Finmeccanica/DRS Technologies’ permanent magnet motors (PMM) for propulsion, which offer very high torque and power density in a relatively compact unit, although ultimately GE Power Conversion/Converteam Advanced Induction Motors (AIM) were introduced instead to generate the maximum speed of 30 kt.

Leonardo DRS, which is currently building its second generation hybrid-electric propulsion system for the Coast Guard’s new offshore patrol cutter, is touting its technology as the wave of the future. Three major advantages of hybrid-electric propulsion for Navy ships include: greater fuel economy, lowered maintenance costs and quieter vessels for advanced warfare operations, said Jamie McMullin, senior director of business development for Leonardo DRS’ naval power systems.

The U.S. Navy is moving ahead smartly to acquire a new frigate or FFG(X). In 2019, it awarded five contracts for conceptual designs to Austal USA, Lockheed Martin, General Dynamics Bath Iron Works, Fincantieri Marine and Huntington Ingalls. The Navy has articulated a demanding set of requirements. It wants a multi-mission ship that can contribute meaningfully in a high-end combat environment involving anti-submarine (ASW), air and missile defense (AAW), and surface warfare (SUW) missions.

In Sep 2021, south Korea’s navy launched a new 2,800-ton frigate armed with a five-inch cannon, guided missiles and torpedoes at the shipyard of Daewoo Shipbuilding & Marine Engineering. It was the sixth FFX Batch II frigate which is 122 meters long and features a hybrid propulsion system to reduce underwater radiated noise and a towed array passive sonar system.

The FFX Batch II frigate can accommodate a maritime helicopter and carry Hongsangeo (Red Shark) torpedoes and ship-to-ground missiles that can fly up to 200 kilometers (124 miles) and explode with hundreds of shells. The first FFX Batch II frigate capable of sailing at a speed of 30 knots was commissioned in 2018.

To replace an aging fleet of corvettes and frigates, South Korea has launched the FFX program that calls for the construction of six 2,300-ton Incheon-class ships for the first batch, eight 2,800-ton ships for the second batch and six 3,500-ton ships for the third batch. The 129-meter-long Batch III frigate that is scheduled to enter service in 2024 will feature a phased array radar and an electro-optical targeting system and can sail at a speed of 30 knots with 120 personnel on board.

In December 2020, a new MT30 gas turbine designed by Rolls-Royce was selected for the third batch of frigates. Rolls-Royce has already introduced a hybrid propulsion system for Batch II frigates, each powered by a single MT30 gas turbine and electric propulsion motors. The hybrid propulsion system is designed to avoid detection by submarines.

French Navy’s Luciole multi-mission hybrid diesel-electric propulsion barges

The French Cigale-class of « Chalands Multi-Missions » (CMM) consists of self-propelled barges assigned to port service and is used for underwater work, the training of divers, the transport of equipment or pollution control. They are the first surface boats of the French Navy to have hybrid diesel-electric propulsion.

The CMM’s hull is 24 m long, 7 m wide and made of aluminum. It supports a composite superstructure placed at the front, topped with a navigation gangway. The rear is flat and uncluttered, constituting a workspace or storage. The hybrid propulsion system with batteries is a novelty in the French Navy. This engine combines diesel-powered generators and electric batteries. The former operate at maximum speed and the latter at low speed, where diesel engines are less efficient. This installation reduces fuel consumption, polluting and noise emissions, promoting the well-being of sailors during periods of low-speed work.

The CMMs have been built by the H2X shipyard in La Ciotat and maintained in operational condition by Cegelec Défense and Naval Sud-Est. The ports of Toulon and Brest received two units, that of Cherbourg and the Mediterranean school of Saint-Mandrier a single unit. A bargewas planned for the Antilles and a last one for the Human Diving and Under-Sea Intervention Unit (CEPHISMER).

Electric-drive propulsion train for Columbia-Class submarine

The Columbia class is to be equipped with an electric-drive propulsion train, as opposed to the mechanical-drive propulsion train used on other Navy submarines. US Navy has now issued at least one-fourth of the design work and begun further advancing work on systems such as a stealthy “electric drive” propulsion system for the emerging nuclear-armed Columbia-Class ballistic missile submarines by 2021.

In today’s Ohio-class submarines, a reactor plant generates heat which creates steam, Navy officials explained. The steam then turns turbines which produce electricity and also propel the ship forward through “reduction gears” which are able to translate the high-speed energy from a turbine into the shaft RPMs needed to move a boat propeller. Navy developers explain that electric-drive propulsion technology still relies on a nuclear reactor to generate heat and create steam to power turbines. However, the electricity produced is transferred to an electric motor rather than so-called reduction gears to spin the boat’s propellers.

“The electric-drive system is expected to be quieter (i.e., stealthier) than a mechanical-drive system,” a Congressional Research Service report on Columbia-Class submarines from earlier this year states.

Hybrid and Full Electric Marine Propulsion Industry

The global marine hybrid propulsion market was USD 3.05 billion in 2020. It is expected to grow from $4.60 billion in 2022 to $9.99 billion by 2029, at a CAGR of 11.71% in forecast period

Marine hybrid propulsions are primarily used in merchant ships, recreational boats, and

naval ships. The electric propulsion system uses diesel generators and gas turbines. Diesel

generators majorly generate three-phase electricity. It provides electric power motors to

rotate propellers. The electric propulsion technology helps to reduce the unwanted noise

generated by marine engines and removes the need for gearboxes and clutches.

The technology has numerous advantages over the conventional system. It provides high

redundancy and enhanced maneuverability, environmental benefits due to reduced

emissions, increased payload due to the flexible location of machinery components, and

lower fuel consumption. Furthermore, the technology provides improved performance in

harsh ice conditions due to maximum torque at zero-speed, is cost-effective, and provides

more comfort due to reduced noise.

The outbreak of the COVID-19 pandemic has severely impacted the marine industry across the globe. Since February 2020, several countries have implemented lockdown and social distancing measures to curb transmission. As China is the major export hub for numerous intermediate products to Europe and North America, complete lockdown in this country resulted in the halt of supply. These factors are taking a toll on the demand for marine hybrid propulsion systems.

DRIVING FACTORS

Rising Demand for Electric Propulsion Technology from the Shipbuilding Industry to Drive

Market Growth

Some of the key factors propelling market growth are increasing maritime activities and rising concern about environment conservation. However, stringent regulatory measures are the restraining factors for the growth of the market.

Increasing International Seaborne Trade Activities Will Boost Growth

Rising international seaborne trade and increasing demand for ships for maritime activities

drive the marine hybrid propulsion market growth. According to the United Nations

Conference on Trade and Development (UNCTAD), maritime trade volumes expanded by

0.5% in 2019 and reached 11.08 billion tons. In the UNCTAD maritime transport report

2018, the global seaborne trade expanded with 4% growth rate, the highest from 2014-

2018. Additionally, UNCTAD’s Maritime Transport Report 2020 projected that the maritime

trade growth would expand by 4.8% in 2021.

The switch from fuel-based conventional propulsion to the environment-friendly hybrid variety is increasing owing to the latter’s efficiency and cost-effectiveness. Multiple ship operators are utilizing renewable energy including solar energy as a storage option in hybrid propulsion systems. In marine hybrid propulsion systems, stored solar energy is used during peak hours or at night, eliminating the round-the-clock need for conventional marine fuel.

Coupled with Stringent regulations related to minimization of harmful carbon emissions have propelled the demand for hybrid propulsion systems. The growing seaborne trade has resulted in the spillage of marine fuel into the marine ecosystem. Thus, governments of several countries are funding and supporting development and adoption of marine hybrid propulsion systems.

Segments

Based on type, the market is divided into diesel-electric, gas-electric, fully electric, and

others. The diesel-electric segment held the largest share in 2021. It is the technology

where a diesel Internal Combustion Engine (ICE) drives a generator to produce energy for

an electric motor in a naval vessel. The dominance of this segment is due to the fuel-efficient technology of diesel-electric propulsion. It is a highly adopted propulsion system

in naval vessels.

The fully electric segment is projected to be the fastest-growing segment during 2022-

2029. The segment’s growth is due to the increasing environmental advantages from lower

emissions and fuel consumption. It provides enhanced performance in harsh ice

conditions due to maximum torque at zero speed.

The gas-electric segment will witness significant growth due to the growing use of gaselectric propulsion in anchor handling tug supply vessels. The low price of gasses used for gas-electric propulsion, such as CNG and LNG, is projected to increase the demand for gaselectric propulsion systems.

Based on deadweight, the market is segmented into less than 5K DWT, 5K-10K DWT, and

more than 10K DWT. Deadweight tonnage is an accurate measurement of the overall

contents of a naval ship, including fuel, crew, passengers, and cargo.

The 5K-10K DWT segment holds the highest shares in 2021 and continues its domination

during 2022-2029. 5K-10K DWT is the ideal deadweight tonnage that provides the exact

load variation required for the hybrid system to perform at high efficiency, which is

expected to drive the segment’s growth.

The less than 5K DWT segment is projected to show significant growth. The growth is

attributed to the growing demand for installing the hybrid propulsion system in small

vessels such as cruise, small cargo ships, lifeboats, and others.

By the ship type, it is divided into anchor handling tug supply vessels, platform supply vessels, yachts, motor ferry, cruise liner, small cargo ships, naval ships, submarines, ROVs, UUVs, and AUVs. Lastly, by installation, it is bifurcated into line fit and retrofit.

By Operation Analysis

Based on operation, the market is divided into a parallel hybrid propulsion system and

serial hybrid propulsion system. Parallel Hybrid Propulsion Segment Dominated Market Owing to Rising Demand for Heavy Vessels.

The parallel hybrid propulsion system segment held the highest shares in 2021 due to the

growing demand for this system in heavyweight ships such as platform supply vessels and

cruise liner ships. In addition, the weight of the installation is much less for equivalent

endurance. Another advantage is that internal combustion engines can be stopped when

the electric mode is activated.

The serial hybrid propulsion system segment will showcase the highest growth during the

forecast period. The growth is due to the rising use of this system in unmanned

underwater vehicles (UUVs). Prime features are reduced emissions, improved vessel performance, reduced noise levels and vibrations on board, lower maintenance costs related to engines, improved long-term efficiency of the power supply system, and higher redundancy.

By propulsion type, the full electric vessel segment is expected to grow at a significant market share during the forecast period because of its ability to provide more efficiency. On the basis of geography, Asia-Pacific is anticipated to hold considerable market share during the forecast period due to the introduction of various technologically advanced systems.

The rising usage of electric propulsion technology in naval ships, merchant ships, and recreational boats is expected to propel the marine hybrid propulsion market growth in the near future. This technology helps to reduce the need for clutches and gears, as well as lowers the noise created by marine engines. Besides, the technology has the ability to provide improved maneuverability and enhanced performance amid harsh climatic conditions. However, the COVID-19 pandemic has led to a major drop in the global trade, thereby hindering the demand for these hybrid propulsion systems.

More and more countries are accepting Paris Climate Change Agreement and this is leading to a shift towards electric vehicles. Innovation in battery systems is contributing heavily to growth in the market, creating new opportunities for players. Creation of a robust infrastructure, including setting-up of advanced charging stations, will also propel market on to a high growth trajectory. As governments across the globe try to mitigate the harmful impact of pollution, they come up with effective policies; this is set to drive market forward. Growing participation in water sports and increase in demand for marine transportation will be significant growth factors.

Geographically, North America held USD 790.8 million in terms of revenue in 2020. It is expected to remain at the forefront because of the surging procurement of offshore vessel support from the shipbuilding hubs of China and South Korea in Canada and the U.S. In Europe, on the other hand, is expected to show rapid growth on account of the presence of multiple reputed marine hybrid propulsion manufacturers, such as Rolls-Royce plc, BAE Systems, and ABB Ltd.

Merchant ships are mainly used for seaborne trade. Asia Pacific is the largest seaborne

trading region. Asia Pacific’s prominence in the global merchandise trade was 41.0% of the

world’s exports in 2021 and 36.8% of global imports in 2020.

Asian countries, such as South Korea, Singapore, China, and India, have emerged as the

leading countries in the shipbuilding industry. These countries accounted for 90.5% of

global deliveries of naval vessels in 2017.

By the year 2030, the global battery pack for marine hybrid and full electric propulsion market will reach a valuation of USD 600 million (approximately). It will be a notable increase from valuation of about USD 240 million in the year 2019. The compound annual growth rate (CAGR) that the market will witness from 2020 to 2030 will be about 9%. Transparency Market Research notes, “High demand from marine industry to power diesel electric hybrid vehicles is set to contribute massively to the growth of global battery pack for marine hybrid and full electric propulsion market.”

The Global Battery Pack for Marine Hybrid and Full Electric Propulsion Market is marked by presence of key players such as ABB Ltd. (Switzerland), AB Volvo Penta, BAE Systems, Caterpillar Inc. (The U.S.), Corvus Energy, Cummins, Eco Marine Power, Fairbanks Morse Engine, GE (The U.S.), Rolls-Royce plc, MAN Diesel & Turbo (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Masson-Marine SAS, Nidec Group, Niigata Power Systems, RELiON Batteries, Rolls-Royce plc (The U.K.), Schottel GmbH (Germany), Siemens AG (Germany), Steyr Motors (Austria), Torqeedo GmbH (Germany), Wartsila Corporation (Finland) among others. These are comprehensively profiled in the report prepared by Transparency Market Research. It is worth noting here that the market is consolidated and competition is intense. Currently, players are focused on reducing size of battery and improving performance.

Industry News

The fuel-efficient propulsion system is dependent on a highly adaptable mechanism. One

of the key players in this market, Rolls-Royce, is adapting fuel-efficient propulsion

mechanisms, and the company’s Azipull thruster is a perfect example of one such product.

It a is low drag and highly efficient pulling thruster that is designed for up to 24 knots. This

fuel-efficient propeller has excellent maneuverability and low noise & vibration levels. In

addition, the Azipull thruster provides various characteristics such as fuel efficiency and

hydrodynamic efficiency.

GE’s gas turbine and electric drive power and propulsion systems are proven to meet the most demanding needs of world navies. “GE is the only company that offers a full spectrum of gas turbine and electric drive propulsion solutions including mechanical drive, hybrid electric drive (HED) or integrated full electric propulsion (IFEP). Together, GE Aviation-Marine and GE Power Conversion are world leaders, having provided naval power and propulsion systems for 37 navies onboard 715 ships,” says Kris Shepherd, Vice President, General Manager, GE Aviation–Marine, Evendale, Ohio. “To date, GE has supplied the ROK Navy with 186 marine gas turbines for 107 ships. Our longstanding in-country partner Hanwha Aerospace co-manufactures the engine components for the ROK’s naval and industrial gas turbines,” Shepherd added.

For the 8,000-ton ROK Navy’s KDDX destroyer, GE offers proven solutions for the two considered propulsion configurations: HED or IFEP. The HED system would use the 3.4 MW shock tested motor designed for the United Kingdom Royal Navy’s Type 26 frigate. The IFEP system would be nearly identical to the electrical system GE designed for the U.K.’s Type 45 destroyer. Both propulsion systems would use dual GE gas turbines to meet survivability and efficiency needs.

“The IFEP is an attractive solution to satisfy the larger and ever-increasing power demands of weapons and radar systems and when operational flexibility and efficiency are important factors. GE’s IFEP solution uses fourth generation advanced induction motors, shock-proof drives and our generator – coupled to a reliable GE LM2500 gas turbine – to provide a low-risk, fully compliant solution,” says Andy Cooper, U.K. Managing Director of GE Power Conversion. “The KDDX IFEP solution with our electrical system integration expertise is a natural first step as the ROK Navy progresses to a scaled-up IFEP system on the larger LPX II ship,” Cooper stated.

By the end of 2020, Rolls-Royce is planning to bring in to the market a range of completely integrated MTU hybrid propulsion systems for ships, yachts, workboats, ferries and patrol boats. The propulsion systems will have a power range extending from around 1,000kW-4,000kW per powertrain. By this the company aiming to provide significant benefits to customers. The combination of diesel engines and electric motors, in addition to batteries, will provide efficiency, environmental compatibility and the flexibility of the propulsion system.

In November 2021, GE Power Conversion signed a five-year contract worth USD 125 million

with the U.S. Navy to maintain hybrid and electric power and propulsion systems used in

the U.S. Navy Military Sealift Command (MSC) vessels.

In November 2021, BAE Systems launched a next-generation propulsion and power system

for the marine sector. The HybriGen propulsion and power system is a flexible solution

that helps marine operators to reach zero emissions. It also improves vessel range

electrical efficiency, simplifies installation, and increases propulsion power.

Corvus Energy leads project to optimize combined use of hydrogen fuel cells and batteries in vessel propulsion

The project, titled “Optimized Hydrogen Powered Maritime Mobility” (OptHyMob), will improve operations of hydrogen-driven marine vessels in order to reduce costs and extend the lifetime of both the hydrogen fuel cells and the batteries in hybrid configurations.

The lifetime of current fuel cell installations and high cost of hydrogen are barriers for upscaling the hydrogen-driven vessel. By solving this we can accelerate decarbonization of shipping.

The knowledge gained, as well as the models and systems developed through the OptHyMob project, will enable cost-effective use of hybrid fuel cell-battery systems applied for ship propulsion. Through increased efficiency, and extended lifetime of the systems, the total cost of ownership will be reduced. which is essential to the maritime industry’s progress toward zero-emission fuels.

—Svenn Kjetil Haveland, Vice President of Development Projects at Corvus Energy

The power usage and hence the vessel’s energy consumption will vary a lot for different operational modes, such as acceleration and transit, and also depend upon weather conditions and waves etc. In addition, the hydrogen consumption in a fuel cell system will vary depending on how the system is operated.

Simply stated, a fuel cell system prefers a stable load, but the power requirement fluctuates rapidly. To increase the effectiveness and lifetime of the fuel cell system you also need batteries, and it is vital to optimize the continuous balance of power from the fuel cell system and power from the batteries. The project will develop models and systems for real-time recommendations of optimal load distribution that system integrators may utilize in the power management system.

—Svenn Kjetil Haveland

This project will perform its research in close collaboration with and in relation to another Research Council funded KSP project, titled “Energy efficient operation of hydrogen-powered vessels” (HyEff) for short, led by NORCE and involving the same partners.

References and Resources also include:

https://janes.ihs.com/InternationalDefenceReview/Display/FG_2000812-IDR

https://www.greencarcongress.com/2022/09/20220912-corvus.html

https://www.fortunebusinessinsights.com/industry-reports/marine-hybrid-propulsion-market-100128

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis