Related Articles

The Future of Aviation Refueling: AI, Autonomy, and the Next Aerial Revolution

Autonomous tankers and hydrogen-powered systems are reshaping the future of aviation refueling—blending airpower with sustainability.

Air-to-air refueling (AAR) remains a cornerstone of modern military aviation, enabling aircraft to extend their operational range, endurance, and mission flexibility. As global conflicts evolve and airspaces become increasingly contested, , rapid advancements in automation, artificial intelligence (AI), and unmanned systems are reshaping AAR , paving the way for safer, more efficient, and adaptable refueling operations. Today From autonomous tankers to drone-integrated ecosystems, the future of AAR promises to redefine aerial dominance in contested environments. This article explores the transformative trends, challenges, and innovations defining the future of aerial refueling.

The aviation refueling market is evolving rapidly, driven by the need for extended operational ranges, enhanced mission flexibility, and the integration of cutting-edge technologies. The Aviation Fuel Market is projected to grow from USD 200.21 billion in 2024 to USD 325.98 billion by 2030, registering a CAGR of 8.5%. In terms of volume, the market will likely reach 132.80 billion gallons by 2030, from 86.20 billion gallons in 2024, at a CAGR of 7.5%.

Market Overview and Growth Projections

The aviation refueling market is witnessing a robust surge, largely due to increased global demand for extended-range aerial operations. In-flight refueling capabilities allow aircraft to conduct longer missions without needing to return to base, making them invaluable for military and commercial aviation.

Key Drivers

The market’s upward trajectory is underpinned by three primary factors. First, the resurgence of global air travel has created unprecedented demand for efficient refueling infrastructure, particularly at major hubs and regional airports. This growth is fueled by increasing military deployments and the rapid recovery of commercial aviation post-pandemic. Air travel demand has surged to 95% of pre-2019 levels as of late 2023, according to the International Air Transport Association (IATA), while geopolitical tensions have driven nations like the U.S., India, and NATO members to modernize their tanker fleets. These factors, combined with advancements in refueling technology, position the market for sustained expansion.

Second, military modernization programs are accelerating, with the U.S. Air Force’s KC-46 Pegasus tanker program and India’s procurement of Airbus A330 MRTTs highlighting the strategic importance of air-to-air refueling (AAR) capabilities. Rising military demand is one of the primary drivers of this market growth. Military aircraft, especially those engaged in overseas deployments, require the ability to refuel mid-flight to enhance their operational range. This is particularly vital for strategic air operations, including combat missions, reconnaissance, and air patrols. Additionally, technological advancements are playing a significant role, with innovations in refueling systems, such as automated and autonomous refueling technologies, improving the efficiency and safety of air-to-air refueling operations.

Third, the rise of low-cost carriers (LCCs) in emerging economies such as India and Indonesia is pushing airports to adopt faster, more scalable refueling solutions to reduce aircraft turnaround times.

Regional growth is another key factor in this expansion. North America, led by the U.S., remains the dominant region due to significant defense budgets and the presence of major industry players. However, regions like Europe and the Asia-Pacific are rapidly adopting these technologies, driven by growing defense expenditures and modernization of air fleets.

Market Restraints

Despite robust growth, challenges persist. Tanker aircraft like the KC-135 remain vulnerable to advanced threats such as hypersonic missiles, as evidenced by recent conflicts emphasizing the need for stealthier designs. Additionally, rising costs are a critical barrier: installing Multipoint Refueling Systems (MPRS) now exceeds $7–9 million per aircraft, a 20% increase from 2022 due to supply chain disruptions and inflationary pressures. Aging fleets, such as the U.S. Air Force’s KC-135s, also face mounting maintenance expenses, with corrosion and parts obsolescence driving lifecycle costs higher.

Emerging Opportunities

Innovation is unlocking new avenues for growth. Autonomous refueling systems, such as the U.S. Air Force’s Autonomous Aircraft Infrastructure (A3R), have achieved milestones in 2023 with successful UAV trials, paving the way for AI-driven fuel transfer systems. Startups like RefuelAI are leveraging machine learning to optimize refueling rates and reduce human error. Sustainability is another focal point: companies like Garsite have introduced hybrid refuelers that cut emissions by 40%, while Airbus’s hydrogen-powered tanker concept signals a shift toward zero-emission solutions. These advancements align with global decarbonization goals and are attracting investment from both governments and private stakeholders.

Market Segmentation

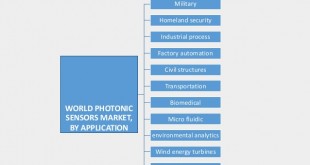

The aviation refueling market is divided into several segments based on product type, end-user, and geography. In terms of product types, the market includes various sizes of refueling systems such as 1,000 gallon, 3,000 gallon, 5,000 gallon, 7,000 gallon, and 10,000 gallon systems, each catering to different aircraft specifications. These systems are crucial in ensuring that the right amount of fuel is provided to meet the specific needs of various aircraft types.

In terms of end-users, the market is primarily segmented into civil and military aircraft. Civil aircraft, which rely on air-to-air refueling systems for long-range operations, are increasingly adopting these technologies. On the other hand, military aircraft, including fighter jets, bombers, and reconnaissance aircraft, rely heavily on air-to-air refueling to extend their operational capabilities during extended missions.

Geographically, North America remains the largest market, driven by the U.S.’s substantial defense budget and technological advancements in the aviation sector. However, regions like Europe and Asia-Pacific are experiencing rapid growth as well, with increasing defense expenditures and modernization efforts pushing the adoption of these systems.

Technological Advancements and Emerging Trends

The aviation refueling industry is not only growing but also evolving, thanks to several technological advancements. One of the most promising innovations in the air-to-air refueling market is the development of autonomous refueling systems. These systems can potentially eliminate human error, improve efficiency, and reduce operational costs. Automated air-to-air refueling (A3R) systems are being designed to integrate both manned and unmanned aircraft in refueling operations.

Lockheed Martin, for example, is working on a project to develop automated refueling technology, which aims to make future uncrewed tanker aircraft capable of refueling other aircraft without human intervention. Additionally, Boeing’s MQ-25 Stingray, an unmanned aerial refueling drone, is set to revolutionize naval aviation logistics. The MQ-25 is designed to extend the range of carrier-based aircraft, making it a key player in future naval operations.

Artificial Intelligence (AI) is also beginning to play a crucial role in enhancing the efficiency and safety of air-to-air refueling operations. The U.S. Air Force is experimenting with AI co-pilots in KC-135 tankers to aid in decision-making and improve operational safety. These advancements indicate a broader shift towards incorporating automation and AI to streamline aerial refueling procedures, improve mission safety, and enhance operational capabilities.

Competitive Landscape

The aviation refueler market is currently shaped by a dynamic blend of established aerospace giants and nimble innovators. Companies like Airbus, Boeing, GE Aviation, and Eaton Corporation collectively command approximately 55% of the global market share, underscoring their long-standing dominance. This concentration reflects their decades of experience in developing complex aerial refueling systems, supported by lucrative and strategic defense contracts, particularly in North America and Europe. However, this dominance is increasingly challenged as agile startups and emerging players enter the space with disruptive technologies, forcing incumbents to ramp up their investments in R&D and pursue strategic alliances to maintain their competitive edge.

Among the market leaders, Airbus continues to fortify its position through its highly successful A330 MRTT (Multi Role Tanker Transport). In 2023, Airbus secured a landmark deal with India for six MRTT units, a move that not only expanded its market footprint but also reinforced its leadership in military aerial refueling. Additionally, Airbus is integrating artificial intelligence into its ARFS (Autonomous Refueling Flight System), which aims to make its tankers compatible with unmanned aerial vehicles (UAVs)—a forward-looking strategy aligned with the rise of autonomous aviation.

Boeing, despite encountering technical and logistical challenges with its KC-46 Pegasus program, remains a vital player in the field. In a notable strategic pivot, Boeing has partnered with Palantir to incorporate blockchain-based cybersecurity features into its refueling platforms, ensuring secure data handling and operational resilience. The company’s MQ-25 Stingray program, which features an unmanned aerial refueling drone for the U.S. Navy, completed successful carrier-based trials in 2024, marking a significant step toward autonomous naval refueling operations.

GE Aviation is taking a different approach by emphasizing environmental sustainability. In collaboration with NASA, GE has developed a hybrid-electric refueling system capable of reducing fuel consumption by 25% during ground operations. Meanwhile, Eaton Corporation continues to lead in fluid power and fuel transfer systems, integrating 3D-printed lightweight valves and IoT-enabled pumps into next-generation refueling vehicles—technologies that are increasingly being adopted by commercial refueler manufacturers like Garsite and Westmor Industries.

UK-based Cobham plc recently secured a $200 million contract to upgrade the British Voyager fleet using its advanced probe-and-drogue systems. These upgrades will enhance interoperability with NATO allies and extend the operational lifespan of the fleet. Lockheed Martin, through its Skunk Works division, has also entered the aerial refueling market with a stealth-enabled tanker concept designed to evade radar and operate in contested airspaces, highlighting the growing emphasis on survivability. Meanwhile, Thales Group has partnered with Safran to roll out AI-driven predictive maintenance tools that are capable of reducing tanker fleet downtime by up to 30%, enhancing operational readiness.

While traditional players dominate the market in volume and contracts, emerging challengers and startups are carving out specialized niches—particularly in autonomy, UAV compatibility, and sustainable aviation. DynaFuel, an Israeli startup launched in 2024, has introduced AI-powered refueling drones designed specifically for small UAVs and electric vertical takeoff and landing (eVTOL) aircraft. The company’s $50 million Series B funding round, led by Lockheed Martin Ventures, signifies industry confidence in its innovative approach.

Singapore-based RefuelAI, a spin-off from MIT, has developed a machine learning platform that optimizes fuel transfer rates in real-time. This technology is already operational at Changi Airport, where it has helped reduce average refueling times by 18%, exemplifying how software-driven optimization can yield significant operational efficiencies. In the United States, Westmor Industries is partnering with Shell to deploy over 100 hydrogen-compatible refuelers by 2025, aligning with global aviation goals to achieve net-zero emissions by mid-century.

To remain competitive, legacy firms are increasingly pursuing mergers and acquisitions. GE Aviation’s acquisition of EcoTanker, a startup specializing in hybrid-electric refueling solutions, in 2023 highlights this consolidation trend. Additionally, strategic partnerships with energy companies—such as Boeing’s alliance with BP to build infrastructure for sustainable aviation fuels—underline the industry’s pivot toward decarbonization. Regional developments are also reshaping market strategies. Both Airbus and Boeing have established local manufacturing hubs in India and South Korea, respectively, to address rising demand in the Asia-Pacific and to streamline supply chains.

Despite the momentum, startups face considerable hurdles in entering the aerial refueling space. High upfront capital requirements, rigorous certification standards from bodies like the FAA and EASA, and the complexity of integrating refueling systems into broader aviation ecosystems pose significant barriers. However, modular and software-centric solutions, such as DynaFuel’s drone-as-a-service model, offer lower-cost, scalable alternatives that are finding traction in specialized segments, particularly military UAV logistics and urban air mobility platforms.

Looking ahead, the competitive landscape of the aviation refueling market will increasingly hinge on advancements in autonomy and sustainability. Firms that fail to invest in AI-based systems or adopt green technologies risk losing relevance as environmental, social, and governance (ESG) criteria become pivotal in procurement and policy decisions. With global defense budgets on the rise and commercial aviation recovering post-pandemic, the race to define the next generation of refueling solutions is heating up. Innovation, adaptability, and strategic collaboration will be the defining factors that determine who leads this rapidly transforming sector

Challenges and Opportunities

Despite the market’s strong growth prospects, there are some challenges that the aviation refueling industry faces. One of the primary challenges is the high installation and maintenance costs associated with Multipoint Refueling Systems (MPRS). The costs can range from USD 5 to 7 million per aircraft, with thousands of labor hours required for installation and maintenance. Additionally, as tanker aircraft age, maintenance costs rise due to issues such as corrosion and material degradation.

Another challenge is the vulnerability of tanker aircraft to ground-based attacks. Large tanker aircraft, which play a critical role in air-to-air refueling, are slow-moving and large, making them easy targets for enemy fire, especially in contested environments. While countermeasures like flares are employed, the risk remains high, especially in regions where adversarial forces possess advanced air defense systems.

However, the market is also ripe with opportunities. The development of autonomous refueling systems and AI technologies presents significant potential for cost reduction, improved safety, and enhanced operational efficiency. Additionally, the increasing use of unmanned aerial vehicles (UAVs) presents an opportunity for air-to-air refueling systems to be integrated into drone operations. This could open new avenues for refueling capabilities in both military and commercial sectors.

Future Outlook

The post-2027 era will be defined by autonomy and sustainability. Autonomous tankers, such as those under development by the U.S. Defense Advanced Research Projects Agency (DARPA), are expected to enter testing by 2026, offering enhanced safety and operational flexibility. Hydrogen-powered systems, though still in early stages, could revolutionize the market by 2035, aligning with global net-zero targets. Urban Air Mobility (UAM) presents another frontier: as eVTOLs (electric vertical takeoff and landing aircraft) scale, demand for compact, rapid-charging refuelers will surge, creating niche opportunities for agile startups.

Conclusion

The aviation refueling market is positioned for significant growth in the coming years, driven by increasing demand for extended-range operations, technological advancements, and the strategic importance of in-flight refueling in both military and commercial aviation. As autonomous systems and AI continue to evolve, the efficiency, safety, and cost-effectiveness of air-to-air refueling operations will improve, further boosting market demand.

The aviation refueler market is at a pivotal juncture, balancing military imperatives with sustainability mandates. For stakeholders in the aviation and defense sectors, staying ahead of these technological trends is crucial for maintaining a competitive edge. Companies that invest in automation, AI, and next-generation refueling systems will likely emerge as leaders in this dynamic and evolving market. Stakeholders must prioritize investments in autonomous systems, green technologies, and cybersecurity to maintain competitiveness.

The aviation refueler market is at a pivotal juncture, balancing military imperatives with sustainability mandates. Stakeholders must prioritize investments in autonomous systems, green technologies, and cybersecurity to maintain competitiveness. As global airpower dynamics evolve and commercial aviation rebounds, strategic collaboration between governments, OEMs, and innovators will be essential to meet the dual demands of efficiency and environmental stewardship.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis