Small Drones, Big Impact: Market Soars Toward $37.6B by 2033

From precision farming to battlefield AI swarms, small drones are reshaping industries and redefining airspace worldwide.

Market Overview: Size, Growth, and Forecast

The global small drones market, valued at $13.0 billion in 2024, is projected to surge to $37.6 billion by 2033, growing at a 12.6% CAGR. The growth is driven by rapid technological advancements, increasing affordability, expanding use cases across industries, evolving regulatory frameworks, and rising demand for drones in emergency response, disaster management, precision agriculture, and military surveillance. North America currently dominates the market, holding a 32.4% share in 2024, largely due to robust R&D activities and the U.S. military’s substantial $2.1 billion investment in UAV innovation.

Key Growth Drivers

Commercial and Industrial Drivers

Small drones are experiencing rapid adoption across various commercial and industrial sectors. In agriculture, drones equipped with multispectral and thermal sensors enable farmers to monitor crop health, optimize irrigation, and detect diseases early, reducing operational costs by up to 20%. In construction, drones streamline site surveys, track progress, and inspect structural integrity, thus improving efficiency and safety.

Diverse Industry Applications

Small drones have penetrated a wide range of sectors due to their adaptability and efficiency. In agriculture, drones equipped with high-resolution cameras and NDVI sensors assist in yield estimation and targeted pesticide application. In the energy sector, drones inspect wind turbines, solar panels, and transmission lines without the need for costly or hazardous manual labor. In disaster management, drones provide real-time situational awareness during floods, wildfires, and earthquakes, helping emergency responders assess damage and plan rescues. Their utility in accessing hard-to-reach or dangerous areas makes them crucial tools for fire departments, police, and search-and-rescue teams.

In logistics, the rising trend of drone-based last-mile delivery is reducing costs and delivery times, particularly in rural or congested urban areas. Amazon launched its Prime Air delivery service in Phoenix in 2024, and India’s Production Linked Incentive (PLI) scheme is actively encouraging the growth of drone delivery startups.

According to PwC, the global market for drone-powered solutions in infrastructure, agriculture, and transport could exceed USD 127 billion. In emergency response and disaster relief, drones are being deployed to provide real-time aerial imagery during crises

Defense and security

Defense and security remain vital to the market’s upward trajectory. In the defense sector, the increasing use of unmanned aerial vehicles (UAVs) for intelligence, surveillance, and reconnaissance (ISR) is propelling demand, supported by growing investments in advanced military technologies. One significant example being Ukraine’s use of AI-driven drone swarms for battlefield surveillance and reconnaissance.

The U.S. Department of Defense has allocated $2.1 billion for UAV research and development in 2024 alone. Militaries are increasingly relying on micro-drones like Russia’s Vektor Kh-120 (38g) for tactical operations and precision strikes. India, too, is integrating AI-enabled drones into its armored divisions to enhance combat effectiveness and situational awareness on the battlefield.

Technological Advancements

Technological advancements play a central role in driving market expansion. Advancements in microelectronics, battery technology, and artificial intelligence have transformed the capabilities of small drones. Improvements in lithium-polymer batteries have extended flight times, while lighter materials and more powerful processors have enabled small drones to carry sophisticated cameras and sensors.

Battery technology has also seen significant progress. While lithium-ion batteries still dominate with a 72% market share, hydrogen fuel cells are gaining ground. A notable example is HevenDrones’ H2D250, which boasts an impressive 8-hour flight time. Moreover, modular drone designs are being adopted widely; Teledyne FLIR’s Black Recon system exemplifies this by enabling rapid deployment of lightweight micro-drones (350g), cutting data collection time by 52%.

The integration of AI and machine learning has allowed drones to navigate autonomously, recognize objects, and adapt to dynamic environments. AI-powered drones are now capable of performing complex tasks such as obstacle avoidance and real-time data analytics. For instance, the U.S. Department of Agriculture (USDA) employs AI-integrated drones in precision farming, which has led to a 20% increase in crop yields by improving soil and pest analysis.

As per Global Market Insights, the AI-powered drone market is forecasted to reach USD 84 billion by 2030. These technological breakthroughs are enhancing the autonomy, reliability, and applications of drones, making them indispensable tools in industries ranging from entertainment to energy.

Affordability and Accessibility

The reduced cost of production and simplified user interfaces have made small drones more accessible to individuals and small businesses. Entry-level drones are now available at prices below USD 1,000, democratizing access to high-quality aerial imaging and data collection tools. Additionally, compact drones are easy to transport and deploy, even in remote or challenging environments. Industries like construction have reported cost savings of up to 20% and a 52% reduction in data collection time through drone implementation, according to McKinsey & Company. This combination of affordability and functionality has accelerated drone adoption among startups, researchers, and public safety agencies.

Market Segmentation

Market Segmentation by Size and Type

Based on size, the small drones market is segmented into nano drones and micro drones.

Micro drones are the dominant category, holding approximately 65% of the market share in 2024. Their compact dimensions and lightweight build allow them to operate effectively in tight or indoor environments, making them suitable for a range of applications from real estate photography to industrial inspection. Their affordability and versatility have made them popular among both recreational users and professionals. These include models like the Black Hornet 4 PRS, which weighs only 70 grams and is extensively used for covert surveillance and indoor inspections. Nano drones are also gaining traction, especially in applications such as pipeline inspection and urban search-and-rescue operations where maneuverability in confined spaces is critical.

By type, the market is categorized into fixed-wing and rotary-wing drones. Rotary-wing drones, including quadcopters and multirotors, lead the market with around 53.8% share in 2024due to their stability and Vertical Take-Off and Landing (VTOL) capabilities. Their ability to take off vertically, hover, and maneuver in confined spaces makes them ideal for aerial photography, infrastructure inspection, and emergency services. DJI’s Matrice 350 is a popular choice in construction and infrastructure sectors for conducting aerial surveys. Ongoing improvements in propulsion and control systems continue to boost their payload capacity and flight endurance, further increasing their utility.

Meanwhile, fixed-wing drones are favored for their long-range capabilities and are widely used in industrial monitoring applications. A good example is the Parrot ANAFI Ai, which is deployed in sectors such as energy and environmental monitoring.

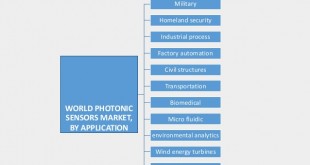

Application Analysis: Military Leads, but Civil Use Expands

The military and defense segment remains the largest application area in 2024, driven by rising global defense budgets and strategic emphasis on unmanned systems. By application, military and defense represent the largest segment with a 30.5% share. UAVs like the Bayraktar TB2 have become indispensable tools in modern warfare, known for their ability to conduct reconnaissance and execute precision strikes. Drones offer armed forces superior ISR capabilities, with many nations adopting them for tactical surveillance, border monitoring, and even combat roles through Unmanned Combat Aerial Vehicles (UCAVs).

In parallel, the civil and commercial segments are experiencing rapid growth due to the expanding use of drones in parcel delivery, infrastructure inspection, urban planning, and public safety. Agriculture is another high-growth segment, projected to expand at a CAGR of 16.2%, especially in the Asia-Pacific region where precision farming technologies are gaining widespread adoption. As civil aviation authorities around the world establish clearer drone regulations, these sectors are expected to witness exponential growth.

Regional Insights

North America continues to lead the global small drones market, supported by a mature technological ecosystem, strong R&D capabilities, and a favorable regulatory environment. The United States accounts for approximately 84.8% of the regional market.

The region is home to over 50,000 registered drones used across logistics, emergency response, and infrastructure inspection. The FAA’s UAS Integration Pilot Program has played a pivotal role in facilitating the deployment of drones for commercial applications. Applications in precision agriculture, infrastructure inspection, and last-mile delivery are gaining momentum. U.S. defense agencies are also investing heavily in small drones for reconnaissance and tactical operations.

In the Asia-Pacific region, rapid industrialization and a strong emphasis on agricultural modernization are propelling drone adoption. China and India, in particular, are leveraging drones for smart farming and public health monitoring.

China continues to drive innovation, recently developing the world’s lightest solar-powered drone, CoulombFly, which weighs only 4.21 grams and is designed for high-efficiency environmental monitoring. China’s domestic drone industry, led by companies like DJI, is also a key global exporter. The governments in these countries are launching initiatives to encourage drone startups, foster innovation, and improve drone-friendly airspace regulations.

Europe benefits from strong regulatory frameworks and public-private partnerships. The European Union Aviation Safety Agency’s (EASA) harmonized rules, combined with funding from Horizon Europe, are accelerating drone adoption in sectors like renewable energy and urban planning. Germany, for instance, has committed €500 million to enhancing border security through the deployment of advanced military UAVs.

In Asia-Pacific, India’s PLI scheme is instrumental in transforming the country into a global drone manufacturing hub. With an ambitious goal of mobilizing $1.7 trillion in infrastructure investments by 2030, India is integrating drones into a wide range of projects. Europe’s small drone market is supported by increasing demand from commercial sectors and initiatives by the European Union to create a unified drone traffic management system (U-space). Meanwhile, Latin America, the Middle East, and Africa are slowly catching up, driven by the need for drones in agricultural and security applications, but face challenges due to infrastructural and regulatory limitations.

In the Middle East and Africa, Saudi Arabia is incorporating drones into its ambitious NEOM city development projects. These UAVs are used for land surveying, construction monitoring, and environmental planning. South Africa, facing severe water scarcity, is employing precision agriculture drones to optimize irrigation and water usage in farming.

Challenges and Restraints

The industry faces several significant challenges. Regulatory hurdles remain a major constraint, particularly in the European Union where Beyond Visual Line of Sight (BVLOS) certification requirements delay the scalability of drone logistics networks. Security concerns are also mounting as terrorist organizations have increasingly adopted Commercial-Off-The-Shelf (COTS) drones. ISIS, for example, has used modified drones to drop grenades, necessitating the development of counter-Unmanned Aircraft System (C-UAS) technologies. Moreover, battery limitations still hinder the broader commercial deployment of delivery drones. Despite technological progress, extended flight times remain elusive for many models.

Competitive Landscape

The competitive landscape is led by major players such as DJI, AeroVironment, and Teledyne FLIR, which collectively hold a 30% share of the global market. These companies are making strategic moves to consolidate their leadership.

The competitive landscape of the global small drones market is marked by the presence of several key players that continue to innovate and expand their capabilities. AeroVironment Inc. remains a dominant force, particularly in the defense and tactical drone segment, offering robust UAV platforms for military applications. Autel Robotics has carved out a niche in the commercial drone sector, focusing on high-performance drones for photography, mapping, and industrial use. Delair, a French UAV specialist, is known for its fixed-wing drones tailored for precision agriculture and infrastructure monitoring.

Defense giants such as Elbit Systems Ltd., Israel Aerospace Industries (IAI), and Lockheed Martin Corporation are significantly investing in UAV technology for reconnaissance, surveillance, and combat operations, contributing to the growing militarization of drone capabilities. Microdrones GmbH leads in the geospatial and surveying markets, integrating LiDAR and photogrammetry for professional-grade applications.

Raytheon Technologies Corporation has strategically enhanced its drone solutions through advanced sensors and counter-UAS technologies, addressing growing concerns around UAV-related threats. SZ DJI Technology Co. Ltd., the undisputed leader in consumer and enterprise drones, maintains a strong market share through continuous innovation and global reach.

Teledyne FLIR LLC focuses on thermal imaging and autonomous drone systems, especially for defense and first responder applications. Textron Inc., through its subsidiary Textron Systems, delivers combat-proven drones for military surveillance missions. Lastly, Thales Group has integrated drone systems into its broader defense and aerospace portfolio, advancing autonomous flight and secure communication technologies.

Together, these companies are shaping a highly competitive and rapidly evolving market, characterized by strategic partnerships, acquisitions, and aggressive R&D to stay ahead in both commercial and military UAV domains.

In 2024, Airbus acquired Aerovel to strengthen its capabilities in maritime surveillance drones. Skydio introduced its X10 drone, specifically designed for first responders. It features advanced AI autonomy, enhanced collision resilience, and improved navigational precision, making it a preferred choice for emergency services.

Future Outlook

The future of the small drones market looks highly promising. AI-powered drone swarms are set to redefine military strategy. The U.S. Army’s Project Convergence, for example, coordinates over 250 drones to establish battlefield superiority through real-time situational awareness and coordinated strikes. Hydrogen fuel cells are projected to power 40% of industrial drones by 2030, offering a sustainable alternative to lithium-based batteries. Urban air mobility is also on the rise, with Japan investing $300 million in drone logistics infrastructure for its emerging smart cities.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis