Antennas are used for a huge range of applications, from mobile phones and “smart” WiFi-connected appliances to GPS and systems that track aircraft and help pilots land safely. Over the years, several distinct types of antennas have come into common use, with designs, frequencies and operating power levels that depend strongly on their purpose. Examples include patch antennas in mobile phones, wire antennas in household radio receivers, and reflector antennas for satellite TV. These systems usually have a few things in common: the antenna itself, which manipulates electromagnetic radiation in the radio and microwave parts of the spectrum; a receiver (if the system receives signals); and a transmitter (if the system transmits).

Antennas are a critical and indispensable component of an aircraft due to their ability to support communication and other systems. There are different types of antennas mounted on an aircraft, general on its belly, which are intended for different purposes. Often termed as aerials by pilots, aircraft antennas assist users in communicating with other people. Mission-specific and large airframes are equipped with multiple radio systems that demand dedicated antennas.

There are various antennas placed on different parts of an aircraft for different purposes. These antennas are operated on different frequencies, so it is important to place accordingly to avoid the interference of the radiation pattern of all these antennas.

Com antennas are usually mounted on either the top or bottom of the aircraft and their only concern is being affected by the shadowing of the fuselage. Each com transmitter has its own antenna, and the antenna is strategically placed mainly because their range and coverage can be negatively affected if positioned incorrectly. For example, the radio feeding the top antenna usually works best for communicating while the plane is still on the ground, while the one feeding the antenna on the bottom of the plane will usually work best when the plane is in the air.

Transmitting less than five watts of power, GPS antennas result in signals that are usually very weak. Because of this, most GPS antennas consist of built-in amplifiers that are designed to boost the signal for the receiver. In addition, the GPS frequency is very high, usually in the gigahertz band, which requires that the GPS antenna to be attached to the very top portion of the fuselage. Communications antennas can cause interference with GPS antennas, which means that the two antennas should be placed as far away from each other as possible.

Almost always found on the vertical tail, nav antennas come in three main types. The cat whisker has several rods jutting out from each side of the stabilizer at 45-degree angles. It is a good antenna to have when you’re flying low because it cannot receive signals from the side. A second type, the dual blade, has antennas on either side of the tail. A third type of nav antenna, the towel bar, is a balanced loop antenna that can easily receive signals from all directions. Towel bar antennas are found on both sides of the tail of the airplane and are often required for area navigation (RNAV) systems.

Long-range navigation, or Loran antennas, usually contain either an amplifier built into their base so that the signal is better or a smaller amplifier located just under the skin. They are meant to be placed either on the top or bottom of the plane, but you must configure the receiver to fit the exact antenna position for them to work properly. Loran systems are very prone to P-static, which results from electrical charge buildup should the plane fly through heavy dust or rain. However, if you bond the airframe structures and antennas properly, this often prevents that from happening.

Radio Altimeters antennas, which look like six-inch-square plates, are placed on the bottom of the aircraft. They are usually either a single- or dual-antenna system, and the radar signal is transmitted straight down and literally bounces off of the ground. Radio altimeters include high frequencies and, therefore, require a secure electrical bond with the skin of the airplane.

UHF Antennas are utilized mostly for distance-measuring equipment (DME) and transponders, UHF aircraft antennas are only around four inches long and are always found on the bottom of the aircraft. They can be used for both DMEs and transponders, and their two main types are blade and spike antennas. Spike antennas should only be used for transponders, while blade antennas work best with DMEs.

Aircraft antennas also include loop antennas, which are shaped like loops. They are also called directional antennas because they can actually determine which direction a signal is coming from. They consist of two or three separate coils that make them look like a flattened bagel, and each signal is received between the coils at various strengths. These are the types of antennas that lightning detection systems usually use. They tend to hold oil and water and, therefore, a good seal job is always recommended to prevent water buildup and to make the antennas last longer.

Marker beacon antennas have to be on the bottom of the aircraft because to receive any signal, the antennas have to be almost directly over the transmitting ground station. There are many different types of marker beacon antennas, with the most common ones resembling little canoes that are roughly 10 inches long. They are both simple and reliable.

Satellite Communication Antennas

An aeronautical channel model for satellite communications needs to consider two main contributions:

• a strong line of sight (LOS) component that is present all the time (except during maneuvers where the satellite signal might be blocked by the aircraft body) affected by ionospheric and tropospheric effects, and possibly by specular and/or diffuse scattering from the aircraft;

• a surface (ground, sea, ice, snow) scattering component which arrive with a certain delay, phase and attenuated power with respect to the LOS component.

Issues related to the installed antenna on the aircraft platform are of three kinds:

• modifications of the antenna pattern in some directions (due to masking effects, reflected or diffracted waves, creeping waves …): this is mainly a narrowband effect which impacts the link budget. A modified antenna pattern has to be used taking into account the position of the antenna and the geometry of the platform.

• additional multipaths on the platform : this is a wideband effect modifying the channel impulse response (CIR).

• specific case of helicopter platforms : additional modulation of the antenna pattern and additional multipaths are caused by the passing of the blades around the antenna. This is both a narrowband and wideband effect. Performance of navigation and communication systems mounted on a rotorcraft is affected by the rotor: periodic blockage and in situ antenna response varying with frequency and time (delay and Doppler effects).

Radar Antenna

A radar antenna at the front of an airplane, helicopter, drone, missile or other flying structure is there to scan its surroundings, identify objects (such as terrain, buildings, cars, ships and airplanes), and then either avoid them or track them. To accomplish this, the beam of the antenna needs to be moved around in a controlled pattern such as a raster scan. The results of this scan and subsequent computer processing will produce a picture of the area around where the antenna is looking.

The major problem with physically scanning the entire antenna in airborne applications is that the available space at the front of a flying object is often small. Allowing extra room for physical movement means the antenna itself must be made smaller – a compromise that leads to worse resolution and lower sensitivity relative to a design that uses all the available space.

Flat-plate arrays Antennas contain small radiating elements such as slotted waveguide, patch or helical wire antennas. These elements are connected to a common transmitter and receiver, producing a coherent beam that can be scanned by moving the plate with motors and push rods. This method uses most of the available aperture of the antenna as a collecting area, while losing only a small amount to allow for the beam movement, and without introducing any distortion of the pattern at high scan angles.

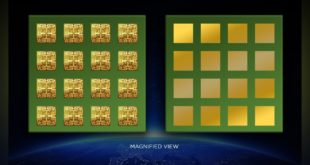

The third way of scanning an antenna beam is to control the beam direction purely electronically, without any moving parts. One such electronically steered antenna is known as a phased array. In an AESA, each element in the array has its own transmitter and receiver. This set-up enables the elements to be controlled independently, while software is then used to combine the signals from all the elements to create a single beam.

From a tracking radar perspective, the interesting thing about the AESA design is that having individual control of each element makes it possible to produce multiple beams in different directions and at different frequencies at the same time. These multiple beams and frequencies are especially beneficial for flying antennas, as they make it more difficult for external sources to interfere with the signal.

The main drawback of electronically steered antennas is that they have a maximum scan range. While it is possible to electronically scan an antenna beam 60° from perpendicular, the beam inevitably degrades as scan angle is increased, and getting to 90° of scan (let alone 180°) is not possible. Practical systems that need wider scanning therefore need some way of addressing this.

When designing a radar system, the trade-offs between electronic and mechanical scanning are complicated. It is certainly not the case that electronically steered arrays have replaced mechanical ones entirely. While mechanically scanned antennas have moving parts that can break, and that need to be maintained and calibrated, the antennas themselves are less complex and cheaper to manufacture than AESAs. The data they produce are also more easily processed, which has kept them in circulation for a long time.

Aircraft Antenna Market

The global aircraft Antenna market size is projected to grow from USD 203 million in 2020 to USD 403 million by 2025, at a CAGR of 14.7% from 2020 to 2025. The market is driven by various factors, such as the growing trend of modernization of aerospace sector and the rising demand for UAVs, globally.

Modernization of air traffic management infrastructure improves the efficiency of the global aviation industry, through connecting multiple aircraft in their airspace. Air traffic management infrastructure consists of air navigation services to handle air traffic more efficiently to reduce flight delays. Aircraft antenna helps to improve the connectivity of the aircraft, from air-to-air and air-to-ground. Due to this, the demand for aircraft antennas in air traffic management is supporting the growth of the market.

Titanium, stainless steel, and aluminum metals are used to build an aircraft antenna. Out of these, aluminum is the most preferred building material for aircraft antennas. This is because of its high strength capacity when exposed to shock & vibration. It is also lightweight with strong corrosion resistance. Therefore, increasing the procurement of 3D printed aluminum antennas helps to contribute to market growth.

Recently, 3D printing technology has been increasingly adopted for the fabrication of 3D electromagnetic complex structures. This method has multiple advantages over conventional fabrication technology. 3D printing technology provides lightweight and low-cost aircraft antennas. The OEMs in this market have opportunities to produce aircraft antenna connectors, aircraft antenna sealants, aircraft antenna doublers, and other crucial components through additive manufacturing technologies.

Restraint: Stringent regulatory norms to ensure safe aircraft operations

Aviation is one of the highly regulated industries across the globe. This is mainly due to the inherent risks associated with failure of flight operations. Thus, companies manufacturing aircraft and aircraft components such as aircraft antennas have to adhere to a multitude of bilateral, national, and international regulations and standards. Different countries across the globe have different regulatory bodies governing safety levels of aircraft operations. In addition, the International Civil Aviation Organization (ICAO) has laid down safety regulations that are to be adhered to by manufacturers of aircraft, aircraft components, and airlines, globally. All aircraft components and systems manufactured have to meet the standards set by various regulatory bodies to ensure safe aircraft operations and reduce risks associated with defective aircraft components.

Aircraft components and systems also have to undergo strict quality checks and rigorous testing to meet the safety standards and reduce the risks associated with the use of defective components. All aircraft components need to undergo a one-time inspection prior to their incorporation in an airplane. For instance, the US Federal Aviation Administration has formulated an Airworthiness Directive (AD) that directs replacement of aircraft components that do not meet safety requirements and design tolerance levels. Hence, it is a challenge for aircraft component manufacturers to adhere to the stringent regulatory norms to deliver quality products.

Opportunity: Rising popularity of eVTOL aircraft

Various transport facilities are being used for intercity travel by passengers to save time. However, intracity travel has become congested, which increases the travel time within a city. In such cases, traditional transportation cannot be used, also private jets that are used by businessman and companies to save time of transportation need to take off from and land at an airport, the availability of which is mostly restricted to one in each city. For intracity travel, VTOL aircraft can be beneficial as they can take off and land at multiple vertiports within a city. With eVTOL aircraft, the ease of travel within the city increases as they are cheaper and less noisy. eVTOL aircraft are part of urban air mobility. For the concept to commercialize, there is a need for technological advancements in terms of battery capacity; building infrastructure such as vertiports and charging pods; and robust regulatory framework. With the advent of eVTOL technology. These eVTOL aircraft also require connectivity and safety antenna as in case of aircraft. The rising popularity of eVTOL aircraft is expected support its adoption in the near future boosting the aircraft antenna market over the forecast period.

Rising Adoption of Multi-Platform Anti-Jam GPS Navigation Antenna (MAGNA) is a Significant Market Trend

Mayflower Communications and BAE Systems have developed MAGNA under the sponsorship of the U.S. Navy to support GPS protection requirements for the sea, air, and ground platforms. MAGNA is a technologically advanced anti-jam GPS navigation antenna. This GPS anti-jam antenna is used in military aircraft during battlefield operations. Magna helps to support the transmission & reception of Iridium communications signals. These signals provide greater than 90 dB J/S anti-jam protection to the aircraft. Therefore, increasing the adoption of anti-jam antennas in military aircraft would propel the demand for aircraft antennas

Segments

The aircraft antenna segment has been categorized into fixed wing and rotary wing.

The fixed-wing segment is further segregated into commercial aircraft, business aircraft, regional jets, general aviation, military aircraft, and UAVs. The fixed-wing segment would showcase the fastest growth during the forecast period. It is due to the increased funding from several governments across the globe. In commercial aircraft such as Boeing 767, Airbus A320, several aircraft antennas are used for in-flight broadband communication. The AV‐530 aircraft antenna is majorly used in commercial aircraft for in-flight broadband communication.

Rotary wing segment is expected to grow at the highest CAGR across the forecast period. The high growth of rotary wing segment segment can be attributed to huge investment made from government as well private players across the globe. Also, Rising popularity or eVTOL is also expected to support the growth of rotary wing segment.

In the case of the rotary-wing segment, it is further classified into a military helicopter, civil helicopter, and UAVs. The military helicopter, as well as civil helicopter, uses a technologically advanced global positioning system (GPS) antenna for surveillance & reconnaissance. The

increasing use of GPS antennas in the helicopter industry is supporting the market growth. Furthermore, lucrative growth opportunities in UAVs are estimated to boost market growth throughout the forecast period.

By frequency band, the market segments comprise of very high frequency (VHF) & ultra-high frequency (UHF) band, Ka/Ku/K band, high frequency (HF) band, X band, C band, and others. Amongst these, the very high frequency (VHF) & ultra-high frequency (UHF) band segment is likely to hold the largest market share during the forecast period. It would occur due to the increasing adoption of in-flight wireless communication technology. The UHF segment is projected to grow at a significant rate during the forecast period. It is due to the several applications of the UHF antenna in aircraft.

The UHF antenna is used for in-flight television broadcasting and radio communications between aircraft and earth-based tracking stations. Ultra-high frequency (UHF) are radio frequencies operated in the range between 300 megahertz and 3 gigahertzes. UHF and HF waves are suitable for line-of-sight applications that require high-end accuracy. The X band is microwave radiofrequency. It is used for in-flight radar communication with the earth-based station. C band antenna is majorly used for in-flight radio communication. The Ka/Ku/K band segment is expected to grow at the fastest rate, due to the rapid adoption of 5G in aviation. Early adoption of 5G connectivity in the aviation sector is expected to drive the demand for the Ka/Ku/K band segment during the forecast period.

By application, the market is classified into communication and navigation & surveillance. Amongst these, the navigation & surveillance segment is set to hold the largest market share during the forecast period. This growth is attributed to the increasing use of air traffic control

transponder antennas in several commercial and military aircraft. Additionally, the communication segment is projected to grow at the highest CAGR during the forecast period. SATCOM antenna is the radio communication intermediate between aircraft pilot and ground-based communication centers. Growth in the communication system is attributed to the increasing use of satellite communication (SATCOM) antennas in aircraft.

By End-User Analysis

Supporting the Growth of the Market Based on end-user, the market is classified into original equipment manufacturers (OEMs) and aftermarket. The OEM segment is projected to grow at the highest CAGR during the forecast period due to the increasing number of aircraft deliveries across the globe from the past few decades. The growth of the OEM segment is attributable to the technological advancements in aircraft antennas to perform real-time aircraft operations, as well as improved reliability of the in-flight wireless communication. The growth of the OEM segment is supported by the introduction of UAVs, with superior connectivity and networking capabilities. The aftermarket segment is expected to hold the largest market share during the forecast period. This growth is attributed to the development of air traffic telecommunication infrastructures and up-gradation programs from airlines.

Geographical outlook

The Aircraft Antenna market in the U.S. is estimated at US$163 Million in the year 2021. The country currently accounts for a 37.11% share in the global market. North America is anticipated to hold the largest aircraft antennas market share during the forecast period. This growth is attributed to the rising number of investments in developing technologically advanced aircraft antennas. The increasing use of UHF-enabled military UAVs for border surveillance activities in countries such as the U.S. is also expected to boost the market growth in North America.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. It is due to the high demand for commercial UAVs from countries such as China and Japan. Advancements in data transmission technologies and the design of aircraft antennas are expected to fuel the growth of the market during the forecast period.

China, the world’s second largest economy, is forecast to reach an estimated market size of US$63.5 Million in the year 2026 trailing a CAGR of 7.9% through the analysis period. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 5.6% and 6.2% respectively over the analysis period.

Europe will showcase significant growth during the forecast period. It is due to the increase in aircraft deliveries in the region. Within Europe, Germany is forecast to grow at approximately 6.1% CAGR while Rest of European market (as defined in the study) will reach US$68.9 Million by the end of the analysis period. In France, the increasing use of reconfigurable liquid antennas in the aircraft is projected to propel the growth of the market across Europe.

In the rest of the world, the Middle East & Africa countries such as Israel is the major exporter of military UAVs for the defense sector across the globe. South Africa adopted military UAVs to carry out surveillance activities. In the military UAVs, several GPS antennas are used for a surveillance operation. Increasing the use of UAVs for surveillance, search, and rescue operation in Africa help to grow the market.

Industry

The global aircraft Antenna market is dominated by a few globally established players such as Antcom Corporation, Azimut Benetti S.p.A., L3Harris Technologies, Inc.US), Honeywell International Inc. (US), The Boeing Company (US), Collins Aerospace (US), Cobham Limited (UK), McMurdo Limited, TECOM Investment FZ‐LLC.

These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and South America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect aircraft antenna production and services by 7–10% globally in 2020.

In July 2021, Icelandair announced that they are ready roll out Viasat in-flight connectivity (IFC) service across its fleet of 737 MAX-9 aircraft, following a supplemental type certificate (STC) issued by the European Union Aviation Safety Agency (EASA) for the aircraft type in June.

In July 2021, Satellite operator Intelsat has delivered Intelsat 2Ku in-flight antenna systems designed for the A321neo aircraft to Airbus. The A321 fitted with 2Ku in-flight antenna will be delivered to Hong Kong’s flagship airline Cathay Pacific for use on commercial flights.

In May 2021, the Antcom Corporation announced that they are set to deliver their high-filtering antennas with interference robustness. These antennas will be equipped with high-filtering amplifiers that reject out-of-band interference, protecting GPS L1 and L2 signals from

potential disruption in a crowded RF spectrum, including 5G communications signals and other interference sources.

In March 2021, Honeywell has signed an agreement to acquire a majority stake in Fiplex Communications. The acquisition will expand the in-building connectivity.

For high-speed data on military aircraft, Boeing Phantom Works created a low-profile electronically guided flat conformal antenna. The Navy’s MQ-25 unmanned mid-air refuelling tanker programme will use this antenna, which is expected to reach production in 2020. The new aircraft programmes are expected to boost antenna makers’ R&D spending as well as their global footprint.

References and Resources also include:

https://www.fortunebusinessinsights.com/aircraft-antennas-market-102533

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis