Advanced Air Mobility Takes Off: The Sky Is the New Highway

eVTOLs and AAM are redefining how we travel, connect, and transport goods in a zero-emission future.

The Advanced Air Mobility (AAM) and electric Vertical Takeoff and Landing (eVTOL) market is rapidly evolving, driven by technological breakthroughs, urbanization pressures, and global sustainability goals. This article explores the market’s growth trajectory, key drivers, emerging trends, regional dynamics, and leading players shaping the future of aerial transportation.

The Vision: A New Era of Air Travel

eVTOL aircraft—electric-powered vehicles capable of taking off and landing vertically—are at the heart of the AAM revolution. These vehicles, ranging from passenger air taxis to cargo drones, are designed to bypass traditional infrastructure constraints like roads and runways. Bain’s report highlights three primary use cases driving demand:

-

Urban Air Mobility (UAM): Short-hop flights between city centers and local airports, slashing commute times in traffic-choked megacities.

-

Regional Connectivity: Efficient intercity travel across busy corridors (e.g., Los Angeles to San Francisco or London to Manchester), reducing multi-hour car or train journeys to under an hour.

-

Remote and Emergency Logistics: Delivering medical supplies, disaster relief, or critical cargo to areas with limited infrastructure.

The appeal lies in eVTOLs’ trifecta of benefits: lower operating costs (thanks to electric propulsion), near-zero emissions, and enhanced safety through advanced autonomy and collision-avoidance systems. Companies like Joby Aviation, Archer Aviation, and Volocopter are already conducting test flights, with commercial operations expected to launch as early as 2025 in cities like Dubai and Los Angeles.

The AAM sector has already attracted over $10 billion in investments, with automakers (e.g., Hyundai, Toyota), aerospace giants (e.g., Boeing, Airbus), and tech firms (e.g., Google, Uber) vying for stakes. By 2040, Bain predicts eVTOLs could account for 15% of intra-city passenger trips in major metros, reducing urban congestion and cutting CO₂ emissions by up to 8 million tons annually. However, success hinges on overcoming societal skepticism, ensuring affordability, and proving safety in real-world conditions.

As Mattia Celli notes, “The sky is no longer the limit—it’s the next frontier for transportation.” For investors, innovators, and policymakers, the race to dominate this transformative market is just beginning.

Challenges on the Horizon

While the opportunities are vast, Bain’s report underscores significant hurdles:

-

Regulatory Hurdles: Certification frameworks for eVTOLs are still evolving. Agencies like the FAA and EASA are racing to establish safety standards, air traffic management systems, and vertiport (vertical airport) guidelines.

-

Infrastructure Gaps: Building vertiports in dense urban areas requires real estate and community buy-in. Startups like Skyports and Urban-Air Port are pioneering modular, multi-level vertiport designs to minimize footprint.

-

Profitability Pressures: High R&D costs and battery limitations (e.g., energy density, charging times) threaten margins. Bain notes that achieving scale and optimizing routes will be critical to viability.

Mattia Celli, a partner at Bain & Company’s Advanced Manufacturing & Services practice, emphasizes the need for seamless integration: “Operators must ensure flights are part of efficient end-to-end solutions—linking ground transport to vertiports and creating user-friendly booking platforms.”

Market Growth and Projections

The global AAM market is experiencing unprecedented expansion, fueled by increasing demand for efficient urban mobility solutions and cargo logistics. The global advanced air mobility market size was valued at USD 11.5 billion in 2024 and is estimated to grow at a CAGR of 20.6% from 2025 to 2034. The rising focus on reducing carbon emissions and combating climate change is a key factor for the growth of the market.

Within this landscape, the eVTOL segment—a critical subset of AAM—is poised to surge from 0.76 billion in 2024 to 17.34 billion by 2035, driven by advancements in battery technology and autonomous systems. Regional growth varies significantly, with North America leading at a 32.4% market share in 2024, while Asia-Pacific emerges as the fastest-growing region due to rapid urbanization and supportive government policies.

Key Market Drivers

Urban Congestion and Traffic Challenges

Urbanization is a primary catalyst for AAM adoption. By 2050, nearly 68% of the global population will reside in cities, exacerbating traffic congestion. eVTOLs offer a solution by transforming multi-hour commutes into 30-minute flights. For example, routes like Los Angeles to San Francisco or London to Manchester could see travel times slashed by 70%, easing pressure on ground infrastructure.

Sustainability and Decarbonization Goals

Environmental concerns are accelerating the shift to electric propulsion. eVTOLs produce zero operational emissions and operate 50% quieter than traditional helicopters, addressing both air and noise pollution. Regulatory frameworks like the European Green Deal prioritize AAM integration, incentivizing manufacturers to align with global net-zero targets.

Technological Innovations

Breakthroughs in battery energy density, autonomous navigation, and lightweight composites are enabling safer, longer-range eVTOL operations. Solid-state batteries, for instance, promise ranges exceeding 350 kilometers, while AI-driven collision-avoidance systems enhance safety. Companies like Beta Technologies are testing multirole eVTOLs capable of transporting both passengers and cargo.

Investment and Public-Private Collaboration

Governments and private entities are pouring billions into AAM infrastructure and R&D. The U.S. has allocated 40million to establish the Tulsa Regional Advanced Mobility Corridor, while China’s Geely Aerofugia and India’s Eve Air Mobility are advancing prototype testing.Venture capital investments exceed 10 billion, with automotive giants like Toyota and Hyundai entering the market through strategic partnerships.

Emerging Market Trends

Autonomous Systems Take Flight

Autonomous eVTOLs are projected to dominate the market, growing at a 27.6% CAGR through 2035. Companies like Wisk Aero are pioneering self-piloting technology, reducing reliance on human operators and lowering operational costs. These systems leverage AI to optimize flight paths and enhance safety, critical for scaling urban air mobility (UAM) services.

Hybrid Propulsion for Versatility

Hybrid eVTOLs, combining electric motors with conventional fuels, are gaining traction for cargo and long-haul applications. Lilium’s hybrid eVTOLs, for example, target regional connectivity with ranges up to 250 kilometers, bridging gaps between urban and remote areas.

Vertiport Infrastructure Expansion

Over 400 vertiports are slated for construction globally by 2030, with costs ranging from $10–20 million per site. Europe’s Air-One in Coventry and Dubai’s VPorts Integrator Center exemplify early-stage infrastructure development, focusing on modular designs to minimize urban footprint.

Cargo and Logistics Revolution

The cargo segment is projected to reach $26.4 billion by 2034, driven by demand for last-mile delivery solutions. Amazon’s Prime Air completed 100 cargo flights in 2023, demonstrating the viability of drone-based logistics for time-sensitive shipments.

Geographical Outlook

North America

North America leads the market, holding 84.8% of regional revenue in 2024. The U.S. is a hub for innovation, with companies like Joby Aviation and Archer Aviation spearheading FAA-certified eVTOL testing. The FAA aims to integrate 1,000+ eVTOLs into national airspace by 2030, supported by initiatives like the Advanced Air Mobility Coordination Council.

Europe

Europe’s market is growing at a 21% CAGR, driven by sustainability mandates. Germany’s Volocopter and France’s Ascendance Flight Technologies are key players, with Paris planning four vertiports by 2026 to support air taxi services during the 2024 Olympics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China targeting a $33.1 billion market by 2034. EHang’s autonomous EH216-S eVTOL is operational in Spain for public safety missions, while India partners with Eve Air Mobility to launch urban flights in Bangalore by 2025.

Middle East

Dubai’s VPorts and Saudi Arabia’s NEOM City are investing heavily in vertiports and pilotless cargo drones, aligning with smart city initiatives to enhance logistics and tourism.

Industry Leaders and Innovators

Joby Aviation

Partnered with Delta Air Lines, Joby completed its first crewed urban test flight in 2024 and aims to launch commercial operations by 2025. Its eVTOL design focuses on low noise and vertical lift efficiency.

Archer Aviation

Collaborating with Stellantis, Archer is scaling production of its Midnight eVTOL, targeting FAA certification by 2025. The aircraft is designed for rapid urban transit, with a range of 160 kilometers.

Volocopter

Germany’s Volocopter plans to debut air taxi services at the 2024 Paris Olympics, backed by a $1.4 billion order from AirAsia. Its VoloCity model emphasizes safety with 18 rotors and redundant systems.

EHang

Dominating the Asian market, EHang’s EH216-S autonomous eVTOL is deployed for aerial logistics and emergency response in Europe, showcasing its versatility in public safety missions.

Beta Technologies

Focused on regional mobility, Beta’s Alia-250 eVTOL collaborates with UPS for cargo delivery, highlighting the potential for hybrid passenger-cargo operations.

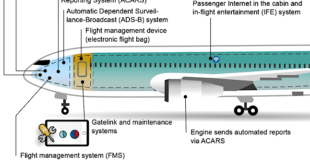

Challenges and Risks

Despite optimism, the sector faces significant hurdles. High R&D costs—exceeding $1 billion for companies like Joby and Archer—threaten profitability without rapid scaling. Regulatory delays, particularly in FAA and EASA certifications, slow commercialization. Cybersecurity risks also loom, with autonomous systems vulnerable to hacking, necessitating robust encryption and international collaboration.

Conclusion

The AAM and eVTOL market represents a transformative shift in global transportation, blending innovation with sustainability. While North America and Europe lead in technological maturity, Asia-Pacific and the Middle East offer untapped growth potential. Success hinges on overcoming regulatory barriers, securing public trust, and advancing battery and autonomy technologies. As vertiports multiply and autonomous systems mature, the sky is set to become the next frontier for efficient, eco-friendly mobility. Stakeholders must prioritize collaboration and innovation to realize the sector’s projected $1 trillion valuation by 2040.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis