Semiconductors are materials that have a conductivity between conductors and insulators. They can be pure elements, silicon or germanium or compounds; gallium, arsenide or cadmium selenide. Semiconductor Chips are the basic building blocks that serve as the heart and brain of all modern electronics and information and communications technology products.

Semiconductors are essential to almost all sectors of the economy including aerospace, automobiles, communications, clean energy, information technology and medical devices etc. The semiconductor industry is the aggregate of companies engaged in the design and fabrication of semiconductors and semiconductor devices, such as transistors and integrated circuits. These semiconductor chips are the drivers for ICT (Information and Communication Technologies) and are used in critical infrastructures such as communication, power transmission, etc., that have implications for national security.

The semiconductor industry and almost every other industry continue to experience supply chain disruption. While the problem is mostly caused by the pandemic and geopolitical tensions, the demand for these materials are still increasing. The semiconductor industry faces the challenges and opportunities of increased product demand in the immediate future. The growth of artificial intelligence (AI) and the Internet of Things (IoT) and the ongoing demands from the smartphone sector and other high-tech industries will place stress on the semiconductor supply chain. The challenge will be further complicated by ongoing international trade disputes, which may drive up the cost of semiconductor materials and interfere with global collaboration within the industry.

The semiconductor industry in India is growing at a rapid rate as compared to the world average, influenced by increasing demand of electronic gadgets & Industrial expansions. India has been a service oriented market. It needs to transform itself into product oriented market. India’s consumption of semiconductors is expected to cross USD 80 billion by 2026 and to USD 110 billion by 2030. India currently imports all chips and the market is estimated to touch $100 billion by 2025 from $24 billion now.

The government incentives and the demand for more chips both locally and internationally are pushing manufacturers to look into setting up hubs in the country itself. India is aiming to become the global hub for semiconductor design, manufacturing and technology development. The Indian Prime Minister also announced at a conference recently that India wants to emerge as a key player in global semiconductor supply chains, urging companies to consider setting up. The push is part of Modi’s flagship “Make in India” project.

The COVID-19 pandemic and the Ukraine war have forced India to accelerate the Atmanirbhar or “Make in India” Mission. Recently manufacturing in China has been facing one of its biggest disruptions since the pandemic started. China’s continued lockdown on major tech hubs and cities due to the COVID-19 pandemic is clearly impacting global deliveries. Therefore there is no choice for India but to become self-reliant for India because the global supply chain can snap for any reason, including geopolitical.

Even America and Europe are not an exception to this urgency. Overdependence on China, Taiwan, and Vietnam for manufacturing is forcing even America to return to the chip manufacturing field, regardless of cost. As the world continues to experience supply chain disruptions from China, India is now emerging as a strong alternative for manufacturers hoping to avoid these problems.

However, the semiconductor sector continues to be a highly capital-intensive industry, with only a few companies able to effectively compete in the field. According to DigiTimes estimates, it costs around US$2.4 billion (NT$66.8 billion) to construct a 12-inch wafer plant that produces 90nm chips with a monthly production capacity of 50,000 wafers. The price tag jumps to US$6 billion for a 28nm fab and US$16 billion for a 5nm plant. The high cost of entry has meant a small number of companies increasingly control larger shares of the overall chip market.

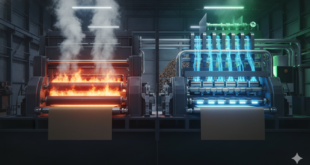

The chip making industry is a highly ultra-pure water-intensive industry, requires an extremely stable power supply, a lot of land and a highly skilled workforce. It is said that a chip manufacturing unit uses no less than two million gallons of water a day. A report states that nearly 10 gallons of water are required to make a single computer chip. The world is witnessing the production of millions of chips, while water availability is dwindling. A decade ago, Intel used nine billion gallons of water in California, the Silicon Valley of America.

The central part of a fab is the clean room, an area where the environment is controlled to eliminate all dust, since even a single speck can ruin a microcircuit, which has features much smaller than dust. The clean room must also be dampened against vibration and kept within narrow bands of temperature and humidity. Controlling temperature and humidity is critical for minimizing static electricity. The clean room contains the steppers for photolithography, etching, and cleaning, doping and dicing machines. All these devices are extremely precise and thus extremely expensive. Prices for most common pieces of equipment for the processing of 300 mm wafers range from $700,000 to upwards of $4,000,000 each with a few pieces of equipment reaching as high as $50,000,000 each (e.g. steppers). A typical fab will have several hundred equipment items. Complex tools and equipment are required to test quality and move silicon from location to location within the ultra-clean confines of the plant. One has to go for volume, which requires a lot of capital investment, because you need utilities that are critical.

Company setting – up the fabrication plant, has to train the workers in the facility for the sophiscated process evolved in the process, very high cost machinery involved, critical raw material & sensitive finished parts used in the process & addition shop floor requirements of the facility.

The need to streamline the semiconductor-industry supply chain is evident. At present, it can take up to six months to complete production of an integrated circuit, not counting packaging and delivery of chips to the buyer. Semiconductor companies need smoother, more efficient manufacturing processes. Automation offers potential solutions. However, automating semiconductor-manufacturing processes isn’t without its own challenges.

Given the length of time needed to process semiconductor devices, downtime at any point in the manufacturing process represents a financial and material cost. In wafer transportation, human handling would carry with it the risk of human error. Furthermore, human handling would risk contaminating wafers with dust particulate, even in a clean room, which controls airborne particulate concentration. Semiconductor manufacturers use front-opening unified pods (FOUPs), which automated material handling systems (AMHSs) control, to prevent contamination and ensure that each wafer is transported and positioned with precision.

Smart machines help increase facility capabilities while identifying and helping eliminate production bottlenecks. To prevent product reliability issues and yield losses, intelligent automated systems employ fault detection and classification (FDC) systems to identify production abnormalities—outliers in machine parameters and sensing data. Given the narrow margin for error when manufacturing integrated circuits, this feature alone makes automation an important industry tool.

According to a report by Bloomberg, the Indian government has been in talks with the semiconductor giants about setting up local operations. Government announced a incentives plan to lure display and semiconductor companies to set up base in India.

India has a decent chip design talent but it never built up chip fab capacity. The ISRO and the DRDO have their respective fab foundries but they are primarily for their own requirements and are also not as sophisticated as the latest in the world.

India has also launched the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) for manufacturing of electronics components and semiconductors. In 2021, the MeitY also launched the Design Linked Incentive (DLI) Scheme to nurture at least 20 domestic companies involved in semiconductor design and facilitate them to achieve a turnover of more than Rs.1500 Crore in the next 5 years. In December 2021, the centre govt sanctioned ₹76,000 crore (US$ 10 billion) under the Production-Linked Incentive (PLI) scheme to encourage the manufacturing of various semiconductor goods within India. However, the level of fiscal support currently envisioned is minuscule when one considers the scale of investments typically required to set up manufacturing capacities in the various sub-sectors of the semiconductor industry.

As the mobile phone industry looks to manufacture its products in India, semiconductor companies are now also heavily exploring opportunities in the world’s largest republic. Some of the big names that may announce plant and investment plans in the subcontinent include Intel, TSMC, and Global Foundries.

The Apple supplier has moved some of its production to India. In fact, the new iPhone 13 model is currently being produced in India at Foxconn’s contract manufacturing partner. According to data shared by market intelligence firm CyberMedia Research (CMR), close to a million “make in India” iPhones have been shipped in the country.

With the lockdown seemingly ongoing in China and with the growing Chinese crackdown on big tech companies, some manufacturers may just be tempted to take up these offers, especially with the demand for semiconductors only increasing in recent times. Geographically, the country is also well-positioned to handle the heavy logistical demands the semiconductor companies require.

One of the biggest concerns for companies looking to set up their hubs in the subcontinent is the ability of the country to provide them with the necessary resources. This includes a sufficient power supply, water as well as a solid infrastructure. Interestingly, despite these concerns, Bloomberg reported that the country is working hard to gain the confidence of the chipmakers to set up their hubs there.

As such, the supply chain may just move from the east to the south of Asia. While it remains to be seen if any major announcements would be made soon, one thing that is for certain is India is beginning to establish itself as a dominant technology hub in the world. Not only is the country attracting semiconductors and phone makers, but it’s also becoming a booming market for the electric vehicle industry.

The recent signing of a memorandum of understanding to house a semiconductor fabrication plant in Mysuru is a good development in the given circumstances. The International Semiconductor Consortium ISMC Analog Fab has signed an MoU with the Karnataka government to invest Rs 22,000 cr ($3 billion) in a 65nm analogue semiconductor fabrication plant to be located about 5 km away from the Mandakalli airport

References and Resources also include:

https://www.drishtiias.com/loksabha-rajyasabha-discussions/perspective-semiconductor-industry-india

https://electronicsmaker.com/semiconductors-fabrication-in-india-obstacles-challenges

https://irds.ieee.org/topics/new-challenges-facing-semiconductors

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis