Nanotechnology is the field of science and engineering that deals with the design, production, and manipulation of materials and devices at the nanoscale. The nanoscale is defined as the size range between 1 and 100 nanometers, where one nanometer is one billionth of a meter. At this scale, materials and devices exhibit unique properties and behaviors that are different from those at the macro scale.

Nanomaterials are materials that have at least one dimension in the nanoscale range. They can be made of various types of materials, including metals, ceramics, and polymers. Nanomaterials exhibit unique properties, such as high surface area to volume ratio, increased reactivity, and unique optical and electrical properties. These properties make nanomaterials useful in various applications, including electronics, energy, biomedical, and environmental.

Graphene is a type of nanomaterial that is composed of a single layer of carbon atoms arranged in a hexagonal lattice. It is only one atom thick, making it one of the thinnest materials known. Graphene exhibits unique properties, such as high strength, high electrical and thermal conductivity, and transparency. These properties make graphene a promising material for various applications, including electronics, energy, composites, and biomedical.

Graphene is considered a “wonder material” because of its unique combination of properties, and it is one of the most extensively studied nanomaterials. The study of graphene and other nanomaterials is an important area of research in nanotechnology, with the potential to lead to new and improved technologies in a variety of fields

Graphene was first isolated in 2004 by Andre Geim and Konstantin Novoselov at the University of Manchester. They used a method called mechanical exfoliation, in which they used sticky tape to repeatedly peel off layers of graphite until they were left with a single layer of graphene.

Graphene’s unique properties stem from its atomic structure. Each carbon atom in graphene is covalently bonded to three neighboring carbon atoms, forming a network of strong, stable bonds. The remaining fourth electron in each carbon atom is delocalized and can move freely throughout the material, allowing graphene to conduct electricity and heat extremely well.

Graphene is also incredibly strong due to its tightly packed lattice structure. It is approximately 200 times stronger than steel, yet incredibly lightweight and flexible. Additionally, because graphene is only one atom thick, it is transparent, making it a promising material for use in electronic displays and solar cells.

There are many potential applications for graphene, including in electronics, energy storage, sensors, and biomedical devices. However, there are still many challenges to overcome in terms of large-scale production and integration into existing technologies. Nonetheless, researchers are continuing to study and explore the many possibilities of this remarkable material.

Growing Commercialization

The commercialization of graphene is still in its early stages, but there has been significant progress in recent years. To date, the commercialization of graphene has been more of a “material push” rather than a “market pull”; a solution looking for a problem. In this first phase, there were numerous technical and commercial barriers to overcome, which in materials science does not happen overnight. But this is changing and Graphene is entering the growing commercialization phase. Some of the key areas where graphene is being commercialized include:

- Electronics: Graphene is being used to develop high-performance electronic devices, such as transistors, sensors, and touchscreens. Its high electron mobility and fast switching speed make it an ideal material for high-speed electronic applications.

- Energy: Graphene is being used to develop advanced batteries and supercapacitors that have higher energy densities and faster charging rates than traditional batteries. It is also being used to improve the efficiency of solar cells and fuel cells.

- Composites: Graphene is being used as a reinforcing material in composites to improve their strength and durability. It is being used in applications such as aerospace, automotive, and sports equipment.

- Biomedical: Graphene has potential applications in the biomedical field, such as drug delivery, tissue engineering, and biosensors.

- Water purification: Graphene oxide has been shown to be an effective adsorbent for removing contaminants from water, making it a potential solution for water purification.

The commercialization of graphene still faces some challenges, such as the high cost of production and the scalability of production methods. The product is solely made of carbon and can be synthesized by multiple methods. However, the lack of an economically feasible production process to synthesize meaningful quantities of the material has limited the scope for industrial adoption of the product. Scientists across the world are continually striving to develop a cost-effective production process to carry out industrial-scale production of the material.

However, with ongoing research and development, it is expected that the commercialization of graphene will continue to grow in the coming years.

Another challenge in the commercialization of graphene is the lack of standardization in the industry. There are various methods for producing graphene, each with its own advantages and disadvantages, and the quality and properties of the graphene produced can vary significantly. This makes it difficult for companies to compare and evaluate different graphene products, and for customers to ensure that they are getting the right quality and performance for their application.

Despite these challenges, there are already some companies that are successfully commercializing graphene. For example, Graphenea is a leading supplier of high-quality graphene products for research and commercial applications. Haydale Graphene Industries is another company that produces and sells graphene products, such as graphene-enhanced composites and inks. Other companies that are working on commercializing graphene include Versarien, XG Sciences, and Directa Plus.

To know more about graphene please visit: Graphene: The Revolutionary Material with Endless Possibilities

Graphene Market growth

Graphene Market Size was valued at USD 0.1 billion in 2021. The graphene market industry is projected to grow from USD 0.14 billion in 2022 to USD 1.43 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 39.45% during the forecast period (2022 – 2030). Increasing at a constant rate and automotive and transportation industries for volume purposes are the key market drivers enhancing the market growth

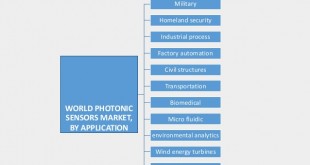

Key potential application areas of graphene include electronics, biomedical technologies, energy storage, composites & coatings, and water & wastewater treatment. The growing focus on miniaturization is one of the primary factors driving graphene research across the world. The product exhibits the potential to revolutionize the semiconductor industry owing to its conductivity and extremely thin nature. Research indicates that graphene-based semiconductor chips are much faster than existing ones made from silicon.

Graphene Market Trends

The electrical conductivity property of the material is expected to contribute to its rising application in light-emitting diodes, touchscreen displays, and electronic transistors, thereby, driving the market. The material can absorb a large quantity of white light, which can be useful for manufacturing photovoltaic cells. Graphene oxide products, which are used as transparent conductive films in many applications including smartphones, are also expected to witness higher penetration over the forecast period.

-

Growing Electronics and Telecommunication Segment to boost the market growth

The creation of products, which addresses the shortcomings of earlier materials, is causing technological advancement in the market. For instance, in 2022, a technology to create batteries using electrodes with thermally stable separators and non-flammable electrolytes was developed by the American company Nanotech Energy. According to the manufacturer, the technology outperforms lithium-ion batteries in terms of cell performance and removes the safety barrier. Therefore, market growth is anticipated to be fueled by this technology’s success.

In addition, graphite may update the smartphone sector by displacing the current touchscreen technology. It is significantly more agile and cheaper than the materials in most contemporary cell phones. Commercial applications include liquid crystal displays (LCDs), organic light-emitting diodes, and touchscreens for smartphones, tablets, desktop computers, and televisions (OLEDs). For instance, Germany’s electrical and digital industry saw revenues of USD 231.89 billion in 2021, an increase of 9.7% from the previous year. The electro and digital industry saw a 3.4% increase in production from December 2020 to December 2021. Compared to the production value in 2020, industrial production increased by 8.8%.

In electrolyte-gated arrangements, it works as an active chemical sensor. Top-gate insulators, which may be made with thicknesses ranging from 1 to 5 nm in an electrolyte with a concentration of a few millimolar, can compete with the best top-gate Field-effect Transistors (FETs) with Atomic Layer Deposition (ALD). The market for indium-tin-oxide (ITO) alternatives in transparent conductors and photoelectric sensors are similar. It is a desirable alternative for creating transparent electrodes in photoconductive sensors and photovoltaic cells due to its high electrical conductivity and transparency, which enhanced the graphene market CAGR across the globe in recent years.

It is ideally suited for electronics applications due to its extraordinarily high thermal and electrical conductivity and lightweight composition. When exposed to an electric field, the electrons in this allotrope of carbon accelerate more quickly than those in semiconductors, such as silicon, which are widely used in electronic devices. These characteristics allow it to develop more effective devices that run more quickly and efficiently than conventional alternatives. Graphite films are one of the strong alternatives for indium tin oxide. As a transparent conductor and electrode in solar cells and OLEDs, indium tin oxide is a commercial commodity frequently utilized in touch displays of smartphones and laptops. Growing consumer demand for touchscreen products and technology is projected to drive market expansion, another factor driving the growth of the graphene market revenue.

Graphene Market Segment InsightsType Insights

The graphene market segmentation, based on type, includes graphene oxide (GO), graphene nanoplatelets (GNP), few-layer, mono-layer & bi-layer graphene, and others. The nanoplatelets (GNP) segment held the majority share in 2021 of the graphene market revenue. These are cutting-edge nanoparticles frequently employed in products, including composites, coatings, conductive inks, and medical devices.

Product Insights

Graphene nanoplatelets emerged as the largest product segment in 2021 with a revenue of USD 53.3 million and accounted for a significant share of the global market in the same year. The product is produced in large volumes owing to their various superior characteristics including high strength and permeability. In addition, increasing consumption of the product in electronic applications is expected to propel product demand over the forecast period.

Graphene nanoplatelets possess major properties such as lightweight, mechanical properties, and superior thermal and electrical conductivities, coupled with low cost and easy manufacturing process. Furthermore, the mass production of the product is also possible. Thus, the aforementioned properties of the product are likely to benefit its demand across applications including electronics, aerospace, medical, and energy storage & generation.

Reduced graphene oxide is the fastest-growing market with a CAGR of 47.8% over the forecast period. The product is highly adopted when a large quantity is required for industrial applications such as energy storage. The reduction process implemented to produce reduced graphene oxide is important, as it enhances the quality

Reduced graphene oxide is increasingly used in the applications such as research, batteries, biomedical, supercapacitors, and printable graphene electronics. In addition, the product is used in field effect transistors (FETs) used as chemical sensors and biosensors. The product is also used as a component in many systems that are designed to detect biologically relevant molecules. Thus, the existence of a wide range of applications of the product is expected to boost the segment’s growth.

Market expansion will be driven by rising demand for lightweight composite materials in the aerospace and automotive sectors due to their strength, surface hardness, and stiffness qualities. Several R&D initiatives are carried out to commercialize GNP production. GO is anticipated to grow considerably throughout the forecast period due to the expanding demand for nanotechnology in the semiconductor and electronics industries. The expanding use of GO in various end-use industries, such as electronics, automotive, aerospace & military, construction, textile, and healthcare, is another important factor predicted to fuel market expansion over the forecast period.

End-Use Industry Insights

The graphene market segmentation, based on the end-use industry, includes automotive, aerospace, pharmaceutical, energy, coatings, electronics, chemical, and others. The aerospace industry segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period 2022-2030. The product is transforming the aerospace sector as it enhances the functionality of the coatings and composites used in producing aircraft, drones, helicopters, and spaceships. It makes it thinner and lighter while improving its mechanical qualities. Due to the product’s strong electrical conductivity and application in building lighter and more damage-tolerant helicopter and airplane structures, de-icing systems are integrated into the wings, increasing fuel efficiency and decreasing emissions throughout an aircraft’s lifetime, impacting the market growth.

Graphene Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North America Graphene market accounted for USD 0.0428 billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. The aerospace and energy industries’ increasing demand and consumers’ high demand for robust, efficient, and lightweight products are expected to contribute to the market’s significant expansion in the North American area. The market revenue would increase even more with the growing use of GO in batteries and solar cells for improved performance.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe’s graphene market accounts for the second-largest market share. The European Research Council (ERC) invested in a Flagship initiative and provided one billion euros to fund the product’s potential and develop technologies. In the history of the European Union, this investment is the largest research project ever launched. Businesses in the area are rapidly providing affordable solutions to enable the material to be produced extensively on a huge scale. Further, the German graphene market held the largest market share, and the UK graphene market was the fastest-growing market in the European region.

The Asia-Pacific Graphene Market is expected to grow at the fastest CAGR from 2022 to 2030. Favorable government policies, funding, and research will all contribute to the expansion of the local market during this time. Additionally, the region’s market is anticipated to be driven by significant manufacturers and customers and the increase in output across several sectors, including the automotive, defense, marine, and aerospace industries. Moreover, China’s graphene market held the largest market share, and the Indian graphene market was the fastest-growing market in the Asia-Pacific region.

Industry

Key Companies in the graphene market include CVD Equipment Corporation, Vorbeck Materials,

Graphene NanoChem, XG Sciences Inc, Angstron Materials Inc, Graphene Laboratories Inc,

BGT Materials Limited Ltd, Graphene Inc, Grafold Inc, Hausale Limited, among others

The graphene market major player such as CVD Equipment Corporation, Vorbeck Materials, Angstron Materials Inc, XG Sciences Inc, BGT Materials Limited Ltd, Grafold Inc, Hausale Limited, and others are working on expanding the market demand by investing in research and development activities.

An American private firm, XG Sciences Inc., uses technologies created at Michigan State University to research and fabricate flakes. XG Sciences creates applications using its xGnP materials. In December 2019, an agreement was signed by Perpetuus Advanced Materials PLC and XG Sciences Inc. to supply it to North American tire makers.

Also, Graphene Laboratories, which Graphene 3D Lab owns, creates and sells functional products. Graphene Supermarket is an online store run by Graphene Labs that sells sophisticated materials and goods. In December 2022, MADE Advance Materials, based in Singapore, and Graphene Laboratories (GLI) formed a strategic partnership. The cooperation between GLI and MADE will be concentrated on joint production and potential intellectual property development.

Graphene Industry Developments

November 2021: NeoGraf Solutions, a leading inventor and manufacturer of graphite, has announced that it has started producing graphite (GNP) materials under the Graf-X brand. Thermoplastic and thermoset applications are the company’s main areas of concentration. According to the business, it can produce about 750 metric tonnes of GNP material annually. Its graphite precursors (GP), which amount to about 1,300 tonnes, are made of graphite and intended to transform graphite materials efficiently. The graphite that NeoGraf produces is made in Lakewood, Ohio.

November 2021: A lithium-sulfur battery for electric vehicles with enhancement has been launched by the California-based business Lyten. The battery has a higher gravimetric energy density than conventional lithium-ion and solid-state technologies. It is commonly known that the corporation has collaborated on military projects with the US government. The LytCell EV product was created to provide three times the energy density of traditional lithium-ion batteries. The Li-S battery lacks nickel, cobalt, and oxygen from metal oxides. The batteries can be produced in prismatic, envelope, and cylindrical shapes.

July 2022: Together, Graphenea and Grapheal developed GraphLAB, a graphite-based tool, to fact-track the investigation on biosensors. A cutting-edge evaluation technique for protein disease and screening detection is GraphLAB.

For instance, in 2022, Nanotech Energy, a U.S.-based company, developed a technology to produce graphene batteries that use electrodes with thermal stable separators as well as non-flammable electrolytes. The company claims that the technology is superior in terms of cell performance and it overcomes the safety barrier faced in lithium-ion batteries

References and Resources also include:

https://www.marketresearchfuture.com/reports/graphene-market-2987

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis