Militaries are relying more on UGVs, UAVs, and other robotic systems to perform critical and dangerous tasks plus serve as intelligent machine partners. They come in the forms of unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) that can function without an operator, with the aid of artificial intelligence (AI) and environmental sensors. The UGV is the land-based counterpart to unmanned aerial vehicles and unmanned underwater vehicles. Unmanned robotics are being actively developed for both civilian and military use to perform a variety of dull, dirty, and dangerous activities.

Unmanned Ground Vehicles (UGVs) are vehicles that can operate on land without a human operator. They are commonly used in military applications for tasks such as reconnaissance, surveillance, and the disposal of explosive ordnance. UGV use by the military has saved many lives. Other applications include oading heavy items, and repairing ground conditions under enemy fire. Two main uses for UGVs in recent decades, as illustrated in Ukraine, have been explosive ordnance disposal (EOD) robots and mine-clearing devices.

UGV use in Recent wars

Unmanned Ground Vehicles (UGVs) have been used in recent wars by various countries, but the specific use cases and the level of technology employed may vary depending on the country and the specific conflict.

For example, during the recent conflict in Syria, the Russian military used UGVs for reconnaissance and surveillance, as well as for the disposal of explosive ordnance. These UGVs were equipped with a variety of sensors and cameras to gather information about the environment, as well as robotic arms to safely dispose of explosive devices.

In the recent conflict in Yemen, the Saudi-led coalition used UGVs for reconnaissance, surveillance, and also for the delivery of supplies to troops in the field.

In the recent conflict in Nagorno-Karabakh, the Azerbaijani army used UGVs for reconnaissance and surveillance, as well as for the disposal of explosive ordnance. The Azerbaijani army has employed various types of UGVs that use different kind of technology and capabilities such as loitering munition (suicide drone), armed drones, as well as smaller reconnaissance drones.

Overall, UGVs have been used in recent wars to reduce the risk to human life, increase situational awareness, and enhance overall mission effectiveness. The use of UGVs in this context is a prime example of how these systems can be used to support military operations in a cost-effective and efficient way.

Military requirements

Military requirements for UGVs typically include:

- Durability: UGVs must be able to withstand harsh environments and rough terrain.

- Mobility: UGVs must be able to move quickly and efficiently across different types of terrain.

- Sensors: UGVs must be equipped with sensors that allow them to gather information about the environment, such as cameras, radar, and LIDAR.

- Autonomy: UGVs must be able to operate independently, with minimal human intervention.

- Communication: UGVs must have the ability to communicate with other vehicles, command centers, and human operators.

- Weaponry: UGVs may also be equipped with weapons, such as machine guns or missile launchers, depending on the mission.

- Safety: UGVs should have safety mechanisms in place to protect human and other assets.

- Interoperability: UGVs should be able to work seamlessly with other systems and platforms to support the overall mission objectives.

Overall, UGVs are designed to reduce the risk to human life, increase situational awareness, and enhance overall mission effectiveness.

Technology requirements

Unmanned Ground Vehicles (UGVs) technology requirements include:

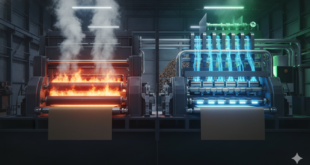

- Power source: UGVs require a reliable power source to operate, such as batteries, fuel cells, or internal combustion engines.

- Control systems: UGVs require sophisticated control systems to navigate, sense their environment, and make decisions. This often includes a combination of software and hardware, such as sensors, processors, and actuators.

- Communication: UGVs need to be able to communicate with other vehicles, command centers, and human operators. This may include wireless communication technologies such as Wi-Fi, Bluetooth, or cellular networks.

- Navigation: UGVs need to be able to navigate their environment, which often includes the use of mapping and localization technologies such as GPS, SLAM (Simultaneous Localization and Mapping), and odometry.

- Perception: UGVs require sensors to perceive their environment, such as cameras, LIDAR, and radar. These sensors are used to detect obstacles, identify targets, and gather data.

- Intelligence: UGVs require some form of artificial intelligence or decision-making capability to interpret sensor data and make decisions. This could include machine learning algorithms, rule-based systems, or a combination of both.

- Human-machine interface (HMI): UGVs require an interface for human operators to interact with and control the vehicle. This could include a remote control, a computer interface, or even a virtual reality headset.

- Safety: UGVs need to have safety mechanisms in place to protect human and other assets. This could include emergency stop buttons, obstacle detection, and fail-safe systems.

- Interoperability: UGVs should be able to work seamlessly with other systems and platforms to support the overall mission objectives. This includes the ability to integrate with other unmanned systems, such as drones or other UGVs, and being able to share data with command and control systems.

Overall, UGVs technology requirements are complex and multifaceted, involving a combination of mechanical, electrical, and software engineering.

Technical Challenges

However, technical challenges still need to be overcome before uncrewed detection systems become more widely used in mine clearance and counter-improvised explosive device tasks. They must be able to search large areas with minimal false alarms, and with the accuracy of skilled operators. While militaries would like to deploy nimble multipurpose vehicles around battlefields, they must overcome natural and manmade obstacles such as minefields.

“Despite advancements in enabling technologies such as autonomy, machine vision and platform mobility, challenges in obstacle avoidance and clearance – particularly in challenging cross-country and forested terrain – nevertheless remain, said Kelvin Wong, a Singapore-based independent defence technology analyst. This is especially so for land combat operations that demand uninterrupted and uncompromised capability lest it result in mission failure and risk to soldiers’ lives, and therefore sets a high bar for reliability.

“Moreover, many UGVs are effectively tele-operated despite being marketed as ‘highly autonomous’, given that an operator is typically controlling it to various degrees. As a result, the lag between an operator – and his/her skills (or lack thereof) – and the vehicle could result in unfavourable outcomes in high-stress or challenging tactical situations.”

Wong listed another obstacle too. “The fielding of UGVs potentially adds to the bandwidth stress of modern combat operations, necessitating a wide-area secure network before these vehicles can effectively be commanded. As such, there’s always a real risk of communications/data link failure between the operator and vehicle, especially in cluttered terrain or in electromagnetically challenged environments (which literally describes the modern battlefield).”

UGV global market

According to GlobalData, the global uncrewed ground vehicle (UGV) market is valued at $476m in 2022 and will grow at a compound annual growth rate (CAGR) of 4.4% to reach a value of $732m by 2032. The cumulative market of the global military UGV market is anticipated to be valued at $6.9bn over the forecast period.

Increasing demand for detecting and defeating roadside bombs, gaining situational awareness, detecting chemical and radiological agents, increasing the standoff distance between soldiers, and potentially dangerous situations are the key factors driving the current UGV market growth. However, restricted battery life is hindering market growth. Apart from drivers and restraints, opportunity in humanitarian relief operation (HRO) and growing demand from civilian applications will create huge opportunities for vendors in the market.

Military UGV Market Segments

The global UGV market has been segmented based on locomotion type, guidance, size, energy source, applications and region. Based on locomotion type, the UGV market has been categorized into wheeled, tracked and legged.

The key segments in the military UGV market are Combat UGV, Logistics UGV, Explosives and Mine Disposal UGV, and Intelligence, Surveillance, and Reconnaissance (ISR) UGV. Combat UGV will lead the military UGV market in the coming years.

Combat UGV: The market for combat UGVs is primarily driven by the need for a vehicle capable of operating in high-risk environments such as terrain and hilly areas, as well as hiding in proximity during combat to provide direct combat support in low-mobility areas.

Explosives and Mine Disposal UGV: Asia-Pacific countries such as India, South Korea, New Zealand, and Australia are procuring various types of explosives and mine disposal UGVs for their armed forces. India is currently planning to procure the mobile autonomous robotic system (MARS) and a future explosive and mine disposal UGV program from local vendors.

Military UGV Market Segmentation by Regions

The key regions in the military UGV market are North America, Asia-Pacific, Europe, Middle East, and Latin America. The military UGV market is expected to be led by North America. US armed forces are procuring UGVs in large quantities across all segments of the market. The Multi-Utility Tactical Transport program is the largest program that is anticipated to deliver logistics UGVs to the US Army by 2034.

The North America region itself, supported by the large-scale investments from the US, is expected to maintain its leading position globally, exhibiting a steady pace of growth over the forecast period with a CAGR of 5.1%.

Meanwhile, the Asia-Pacific region will hold the third largest position globally with a CAGR of 4.4% over the forecast period, primarily driven by the procurement strategies adopted by key economies in the region. Countries such as China, India, Australia, and South Korea have been increasing the deployment of advanced UGVs with their armed forces.

Competitive Landscape

Some of the key companies in the military UGV market are General Dynamics, Pratt Miller, Rostec Corp, QinetiQ, Teledyne Technologies, Torus Robotics Pvt. Ltd., Robotic Research, Ghost Robotics, BAE Systems, Safran SA, Hanwha Corp, and L3Harris Technologies Inc.

Recent news

Teledyne FLIR is a major manufacturer of robotic systems, and in 2021 it received a $70m order for nearly 600 Centaur medium-sized robots under the US Army’s Man Transportable Robot System Increment II programme, bringing total deliveries to all four US military services to some 1,900 Centaurs. A further contract was awarded in mid-2022, highlighting the large scale of many US programmes.

Teledyne FLIR also makes the 166kg Kobra for the US Army’s Common Robotic System – Heavy programme. Importantly, robots are growing in autonomy, target mapping and the ability to work as cross-domain systems. For example, Teledyne FLIR’s R&D has seen an R80D SkyRaider quadrotor UAV flying over an airfield to detect unexploded ordnance, with relevant data then relayed to a UGV for clearance.

Hanwha Defense also developed the 6×6 Unmanned Surveillance Vehicle. Dronebot Warrior, a specialist Republic of Korea Army unit dedicated to uncrewed technologies, completed field trials of the 2t UGV in February 2021.

In 2022, Milrem Robotics delivered one THeMIS to a Ukrainian charity organisation for casevac and resupply missions. To date, 16 countries have acquired the optionally armed THeMIS, half of which are NATO countries. It also forms the foundation of the Integrated Modular Unmanned Ground System (iMUGS) scalable UGV family being developed by a consortium of European companies.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis