Global Digital Battlefield: How AI, 5G, and Space Tech Are Transforming Warfare

From real-time AI decision-making to satellite-powered intelligence, the next decade will redefine military power in the digital domain.

1. Market Overview and Growth Trajectory

The digital battlefield market is entering a period of profound transformation. Valued at $41.22 billion in 2024, it is projected to surge to $142.32 billion by 2034, achieving a compound annual growth rate (CAGR) of 12.4%. This robust expansion reflects the growing integration of advanced technologies such as artificial intelligence (AI), 5G, the Internet of Things (IoT), and geospatial systems into military operations. These technologies enhance decision-making through real-time data fusion, increase situational awareness, and enable multi-domain networked warfare. North America currently dominates with a $16.8 billion share, largely due to sustained investments in defense innovation. However, East Asia is emerging as a major contender, and by 2034, it is expected to command 25% of the global market, driven by rapid technological adoption and modernization programs.

2. Technology Drivers Reshaping Military Operations

The digital battlefield is fueled by several critical technologies. Among them, 5G networks stand out as essential enablers of hyper-connectivity. With the capacity to support over one million connected devices per square kilometer and offer ultra-low latency, 5G facilitates seamless communications between various military assets such as unmanned ground vehicles (UGVs), unmanned aerial vehicles (UAVs), and command centers. The operational impact is significant, with decision latency reduced to milliseconds—particularly crucial for applications like missile defense and surveillance missions where time-sensitive responses are vital.

Artificial Intelligence and big data analytics are playing a pivotal role in transforming defense capabilities. AI is being used for a variety of tasks including predictive maintenance, automated threat detection, and autonomous system navigation. The segment is expected to grow at a CAGR exceeding 20%, fueled by programs such as DARPA’s Advanced Targeting System. China’s efforts are equally aggressive, exemplified by a 2024 AI-powered military communication system developed by the Beijing Institute of Technology. This system is designed to jam enemy signals while securing communications for friendly forces, illustrating the dual-use nature of AI in offense and defense.

Geospatial intelligence (GIS/GPS) technologies are revolutionizing battlefield awareness. Modern GIS-integrated systems now offer real-time mapping, terrain modeling, and dynamic enemy asset tracking. Companies such as Rolta India and Hexagon AB are equipping militaries with advanced geospatial tools, significantly improving mission planning accuracy. These technologies have led to a 40% reduction in camouflage detection errors, thereby enhancing targeting precision and survivability.

The adoption of cloud computing in defense sectors is accelerating at an unprecedented rate. In 2022, the United States allocated $798 million specifically for defense-related cloud services. Cloud infrastructure allows real-time information sharing across theaters of operation, supports remote mission planning, and provides scalability for data-heavy applications. Alongside cloud proliferation, cybersecurity investments are also expanding to safeguard critical assets against rising threats. The 2022 conflict in Ukraine demonstrated the strategic importance of cyber defense, as Ukraine successfully implemented digital countermeasures against Russian attacks, highlighting the necessity of secure cloud-native systems in modern warfare.

3. Regional Analysis: Leaders and Emerging Hotspots

North America, led by the United States, remains the most mature market in the global digital battlefield ecosystem. With a market valuation of $12.1 billion in 2024, this dominance is attributed to vast defense R&D budgets and long-term partnerships with major defense contractors such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman. Recent initiatives, including the formal establishment of the U.S. Space Force and the allocation of $53 million in cyber warfare grants to the Intelligence Collection Flight (ICF), reflect the region’s focus on future warfare capabilities.

In the Asia-Pacific region, several countries are aggressively enhancing their digital defense capabilities. China is registering the fastest growth with a projected CAGR of 13.5%, largely driven by the People’s Liberation Army’s (PLA) digitization efforts and heavy investment in hypersonic missile programs. Japan, responding to regional tensions, has earmarked $2.81 billion in 2024 for cybersecurity initiatives and digital command systems. India, under its “Make in India” initiative, is investing in indigenous UAVs, satellite navigation systems, and AI-based threat detection platforms, aiming to reduce dependence on foreign suppliers.

Europe is making strides through multilateral initiatives such as the European Defence Fund, which facilitates joint research and capability development. The United Kingdom and Germany are particularly active in deploying AI-enhanced systems and secure communication networks. The region is also investing in secure battlefield networks and cyber-defense platforms to protect its forces against increasingly sophisticated digital threats.

4. Platform and Application Trends

Airborne systems represent the most dominant platform segment, commanding $22.11 billion in 2024. This growth is primarily driven by the integration of next-generation technologies in UAVs and fighter aircraft, including Active Electronically Scanned Arrays (AESAs), AI-based navigation, and 5G data links. For instance, Bell’s Nexus VTOL aircraft leverages 5G to enable real-time sensor fusion, effectively minimizing the time between target acquisition and weapon deployment.

Space-based systems are emerging as the most rapidly growing segment, with an expected CAGR of 18.9%. The miniaturization of satellites, particularly CubeSats, is democratizing access to real-time terrain mapping and surveillance. Both the U.S. Space Force and China’s expanding satellite constellations are investing heavily in space-based Intelligence, Surveillance, and Reconnaissance (ISR) capabilities, which are increasingly becoming a cornerstone of digital battlefield operations.

Applications such as cyber warfare, simulation and training, and predictive maintenance are witnessing high adoption rates. Cyber warfare now consumes nearly 45% of digital battlefield investments, with a focus on hardening infrastructure, preventing intrusions, and ensuring secure data exchange. The simulation and training segment is expected to reach $18 billion by 2032, thanks to advancements in virtual and augmented reality training environments that replicate combat scenarios without physical risk. Predictive maintenance systems powered by AI are also gaining traction, reducing mechanical downtime in vehicles and aircraft by as much as 30%, thus improving readiness and operational continuity.

5. Competitive Landscape and Innovations

The digital battlefield market is characterized by intense competition and strategic innovation. Leading companies such as BAE Systems, Lockheed Martin, and Thales are focusing on AI integration, autonomous systems, and secure networking solutions to maintain their leadership. In 2022, Rheinmetall partnered with Helsing to enhance its battlefield software capabilities, signifying the growing role of software and AI in military advantage.

Emerging startups are also making a significant impact. Axon Vision of Israel is providing AI-driven visual processing systems for armored platforms, while U.S.-based Espre Technologies specializes in encrypted wireless communications that offer resilient alternatives to legacy systems. Collaborative innovation is another key trend. Lockheed Martin’s partnership with Red Hat underscores a strategic shift toward open-source software solutions tailored for defense needs. Meanwhile, L3Harris Technologies has been advancing in satellite-based infrared sensing, delivering high-resolution targeting capabilities for all-weather operations.

6. Market Challenges

Despite its rapid evolution, the digital battlefield market faces several critical challenges. The first is the high cost of digital transformation. Upgrading or replacing traditional systems with next-generation technologies often requires more than 20% increases in defense budgets, making it a major hurdle for low- and middle-income countries.

Secondly, cybersecurity vulnerabilities remain a pressing concern. Studies show that up to 60% of military networks are susceptible to Advanced Persistent Threats (APTs), which can compromise missions, leak classified data, and cause irreversible damage.

Another major challenge is system interoperability. Many defense systems still rely on legacy infrastructure that lacks the ability to interface with modern 5G or AI-enabled platforms. This technological gap can delay the deployment of integrated digital battlefield systems by three to five years, reducing combat effectiveness during transitional periods.

7. Future Outlook (2030–2034)

Looking ahead, several high-impact technologies are expected to redefine the digital battlefield between 2030 and 2034. Quantum technologies and hypersonic systems are anticipated to reach operational deployment. The U.S. Defense Advanced Research Projects Agency (DARPA) is advancing quantum battery research that could revolutionize power delivery for high-energy weapons and communication nodes. Meanwhile, China’s development of hypersonic delivery systems points to a future of near-instantaneous strike capability.

Space dominance will play an even larger role, with satellite-based ISR systems projected to constitute 35% of total battlefield operations, enabling persistent, high-fidelity observation over global theaters. AI swarm warfare will become operational, with autonomous drone groups conducting coordinated attacks, surveillance missions, and defensive maneuvers without direct human input. These swarms will likely be integrated into both NATO and PLA force structures.

Finally, cost-effective modular upgrades will help address affordability issues. Innovations such as Rheinmetall’s EVO retrofit kits, which can be installed in under six hours, will allow militaries to digitize existing platforms rapidly and with minimal downtime—an essential capability in fast-moving conflict zones.

Conclusion

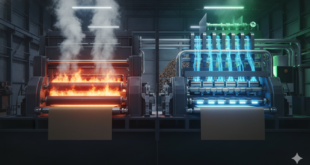

The evolution of the global digital battlefield is reshaping how wars are fought and won. The competitive edge no longer lies solely in firepower, but in the mastery of data-driven decision-making, AI-enhanced awareness, and real-time command and control. The race to integrate 5G, AI, cloud computing, and space-based ISR into cohesive military architectures will determine global defense leaders over the next decade.

While North America and East Asia are front-runners in this space, regions that can overcome cost barriers and improve cybersecurity readiness will also find opportunities to lead. As General David Wilson of the U.S. Army aptly put it, “The shift from fuel to electrons isn’t about sustainability—it’s about survivability.” The battlefield of tomorrow is not just digital—it is intelligent, autonomous, and relentlessly interconnected.

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis