Globalization has opened the doors for trade across the world and it has thus become necessary for ships to be equipped with the latest forms of communication and technology. Communication is vital for the safe navigation and management of ships. Marine communication involves ship-to-ship and ship-to-shore communication. Cell phones are less reliable on the water. Most are not water-resistant, and their range is relatively short due to the proximity of land-based towers and repeaters. Range is further complicated by the fact that the majority of cell antenna/stations are placed and oriented with land-based use in mind, so the distance offshore that a vessel can remain in contact is frequently shorter.

Marine communication was addressed through the use of onboard systems via shore stations and satellites. VHF radio made ship-to-ship communication a reality, and shortly thereafter Digital Selective Calling (DSC) allowed for greater communication capabilities including remote control commands that could transmit and receive distress signals, place urgent safety calls, and put out routine messages. Today, DSC controllers are often integrated with the VHF radio in line with updates regarding SOLAS (Safety of Life at Sea) requirements.

Satellite services, as opposed to terrestrial communication systems, need the help of geostationary satellites for transmitting and receiving signals, where the range of shore stations cannot reach. These marine communication services are provided by INMARSAT (a commercial company) and COSPAS – SARSAT (a multi-national government-funded agency). All of our world’s oceans are covered by HF marine communication services. It is required by the IMO that there are two coast stations per ocean region. Most ships are equipped with satellite terminals for the Ship Security Alerts System (SSAS), as well as for tracking and long-range identification.

A1, A2, A3, and A4

There are a variety of radio communication systems that must be carried onboard ships, the exact requirements vary based upon the area a ship is navigating. These marine navigation tools are there to assist with Search and Rescue operations from Maritime Rescue Co-ordination centers. The goal is always to keep those out at sea as safe as possible.

A1: This represents ships that are around 20 to 30 nautical miles from the coast and are therefore covered by at least one VHF coast radio station, thus allowing for constant DSC alerting. The equipment used in this area includes a VHF and a DSC along with a NAVTEX receiver.

A2: This represents any area that is over 400 nautical miles away from the shore. In practice, it also reaches 100 nautical miles off shore but does not include A1 areas. The equipment used in this area includes a DSC, along with a radio telephone (MF radio range), as well as the equipment needed for A1 areas.

A3: This area excludes A1 and A2 areas, but is within INMARSAT geostationary range, and falls within 70 degrees north and 70 degrees south latitude, this area allows for continuous alerting. The equipment used in this area includes a high-frequency radio and/or INMARSAT, along with all equipment required for A1 and A2 areas.

A4: This accounts for all areas located outside of A1-A3. Generally speaking, this includes the Polar Region North and South of 70 degree of latitude. The equipment used in this area includes all of the previously mentioned equipment along with HF radio service.

Marine Communication trends

Unlike the fast and reliable wireless data services on land, maritime has inherent limitations, including low throughput of legacy analog VHF radio systems, regulatory compliance concerns, and the IMO’s 2021 cybersecurity mandates. Implementing new network-centric communications systems also faces challenges caused by lack of infrastructure, interoperability, spectrum, interference, and the diverse ocean environment.

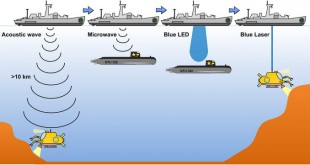

Once entrenched in analog radio traditions, maritime communications are now on the brink of digital transformation. Significant advancements have accelerated the digital shift as commercial marine companies fight to stay competitive. The need for more robust communications technologies are primarily being driven by the big data requirements of smart ships such as unmanned boats, remote-controlled tugs, oceanographic exploration, research and training vessels. In recent years, technologies that connect ships to shore to convey real-time data have advanced significantly.

Next-generation solutions are being developed to handle large volumes of information for intelligence-gathering, live video streaming, etc., as well as the internet-of-things (IoT) to support sensors for real-time cargo tracking, predictive maintenance, routing optimization, vessel performance, digital fleet management, and the like.

The escalating demand for maritime digital services has prompted many industry collaborations to improve connectivity, deliver high-speed data rates and extended coverage. Wireless service providers are expanding infrastructure for cellular, voice, data, text, Wi-Fi and IoT at sea. Recently deployed commercial maritime broadband services, along with existing equipment upgrades, are providing voice services and internet connectivity for IoT, crew welfare, and critical communications. Maritime wireless mesh networks (MWMNs) are also on the near horizon, while artificial intelligence (AI) based predictive positioning system trials have demonstrated excellent potential for vastly improved situational awareness.

The current marine communication operates through VSAT support and legacy voice and data communication. 5G is expected to open up infinite possibilities in maritime communication. The emergence of 5G based communication satellite systems gradually taking their place in the maritime sector, 5G based communication systems will improve high-quality voice and data communications and cybersecurity will be available at a lower price point.

The 5G will also strengthen connectivity and cybersecurity, for shipping companies and vessels as well. Furthermore, maritime 5G will also facilitate the adoption of autonomous vessels with low latency connectivity for remote operation and hasten the use of Internet-of-Things sensors during search-and-rescue for real-time communications and accurate positioning.

Cyber Security

One of the key factors hampering growth and adoption of marine communications is the insecure mode of data transmission. Since communication systems totally rely on wireless systems for the transmission of information, a number of new attacks on wireless transmission of information are evolving in order to misguide ships.

Attacks such as denial of service prevent the accurate information about the position and speed of a ship from being received at the destination. Also, these days, attackers modify the information of ships in order to capture them by navigating them into hostile and attacker controlled sea space. As a result, insecure transmission of information may hamper the market growth for marine communication systems.

Viasat displays Cloud-based communication capabilities in naval exercise

Viasat has demonstrated tactical Cloud-based communication capabilities to enable advanced battlespace applications during a naval technology exercise in the US. The company displayed the abilities at the Naval Integration in Contested Environments (NICE) Advanced Naval Technology Exercise (ANTX) held at Camp Lejeune, North Carolina.

The event called on industry stakeholders to demonstrate new technologies that can be used by the US Navy and US Marine Corps in support of Expeditionary Advanced Base Operations (EABO) and Littoral Operations in Contested Environments (LOCE). Viasat used its technologies to increase network capacity and communication resilience in contested environments to enhance situation awareness.

The scope of the demonstration included enabling secure ship-to-shore communications in a littoral environment and swift deployment and management of communication nodes at all echelons. Additionally, the company used Office of Naval Research ENDOR Future Naval Capability (FNC) and Viasat NetAgility to enable Electronic Warfare Operations across distributed systems.

It also implemented an automated Primary, Alternate, Contingency, and Emergency (PACE) plan to boost resiliency and management across all network nodes. Viasat Government Systems president Craig Miller said: “The US Navy and Marine Corps understand the importance of exploring technological innovations that can support critical operations in difficult contested environments.

Marine Communication Market

The global marine communication market is expected to surpass US$ 8.6 billion in 2031, according to a latest study by market research firm Future Market Insights (FMI). Growing need for high-quality, secure and reliable communication between shores and ships has increased the demand for marine communication systems and its solutions.

Moreover, as demand for global freight increases, maritime trade volumes are set to triple to 2050. Thus, the increasing ocean trade activities across several countries of the world has increased the demand for marine communication systems on merchant ships and cargo vessels.

Between 2016 and 2020, sales of marine communication grew at a CAGR of 7.3%. Increasing adoption of satellite-based equipment has fueled the demand for marine communications systems. By product, marine radio devices are estimated to hold a largest market share of 25.2% in 2020, owing to huge adoption of recreational boating in several countries of the world opens new possibilities for VHF radio equipment manufactures since boaters must use the finest channel when communicating on VHF radio.

Satellite communication enables the crew onboard ships to be able to connect with other ships and teams to keep them updated with the current situations on-board in real-time, which helps reducing errors and thereby increasing efficiency. The segment is witnessing the high growth with a CAGR of 11% and is estimated to reach USD 1,214.5 Mn by 2031.

Various vendors are developing advance satellite systems to reduce the time gaps and cover a wider geographical location. For instance, Inmarsat a global satellite communication provider, offers a geostationary system that has four operational satellites. One each is mounted over the Pacific and Indian Oceans and a further two cover the Atlantic Ocean for faster and reliable land and marine communication.

Regional Outlook

Until 2020, marine communication value across the United States experienced a Y-o-Y growth of over 9.1% to reach US$ 835.7 Mn. The market is set to further aggrandize at a CAGR of nearly 8.4% through 2031. FMI has projected U.S. to remain one of the most lucrative markets throughout the course of the forecast period, owing to continuous developments in satellite-based communication systems. According to estimates, the marine communication shipment in U.S. has increased by 4% due to rise in maritime tourism and increase in U.S. seaborne trade.

The U.K. marine communication market is estimated to reach a valuation of 228.7 Mn by the end of 2031 by registering a CAGR of 9%. The UK has strong international standing as a center for design, engineering, marine equipment and research, coupled with its position as the world’s leading maritime financial, professional and business services hub. Also, U.K. has a geographical comparative advantage when it comes to Arctic shipping. In coming years, U.K. is expected to see increase in demand for maritime communication systems and infrastructure, from the development of remotely operated vessels to the need for increased satellite coverage of remote areas like the Arctic.

Chinese government is continuously focusing on development of advanced satellite communication systems to ensure secure and reliable communication in land and maritime industries. For instance, Amid COVID-19, in July 2020, China has successfully launched its APSTAR-6D telecommunication satellite. The satellite can be used for maritime communications, aviation airborne communications, land vehicle communications, and fixed satellite broadband Internet access.

Moreover, the South China Sea is a prominent shipping passage with $5.3 trillion worth of trade cruising through its waters every year. That’s nearly one-third of all global maritime trade. As the second-largest economy in the world with over 60 percent of its trade in value traveling by sea, China’s economic security is closely tied to South China Sea.

India is estimated to register a high growth with a CAGR of 10.9% during the forecast period owing to rise in India’s Navy defense spending along with the government’s initiative towards development of quality broadband services to the maritime sector would drive the market growth in India.

Industry Players

Prominent marine communication providers in its report: Icom Inc, Inmarsat, Furuno Electric Co., Ltd.,Garmin Ltd., FLIR Systems, Inc., Cobham SATCOM, Navico, Jotron, Intellian Technologies, Bochi Corporation, Avatec Marine, HZH Marine Group Co., Ltd., and Matsutec

References and Resource also include:

https://www.futuremarketinsights.com/reports/marine-communication-market

https://www.workboat.com/viewpoints/commercial-marine-communications-a-digital-shift

International Defense Security & Technology Your trusted Source for News, Research and Analysis

International Defense Security & Technology Your trusted Source for News, Research and Analysis